Answered step by step

Verified Expert Solution

Question

1 Approved Answer

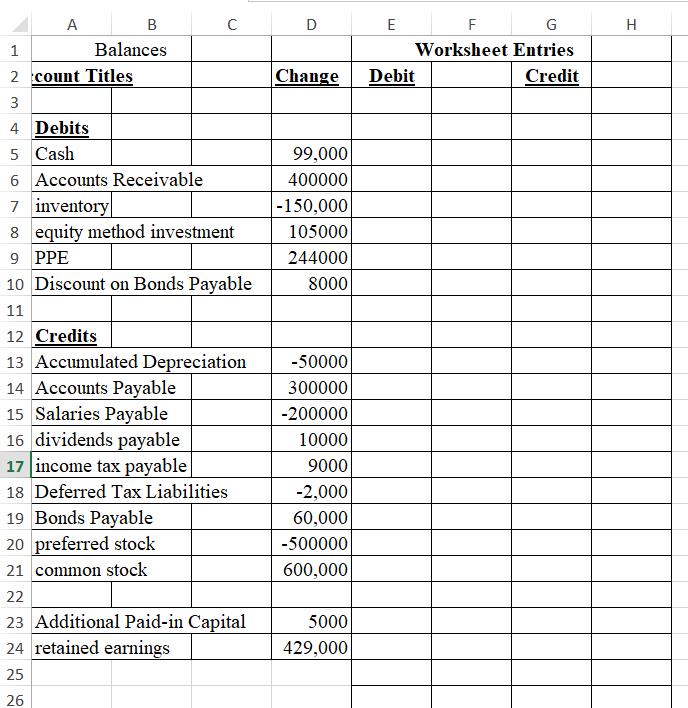

B C D E A 1 Balances 2 count Titles 3 4 Debits 5 Cash Change Debit 99,000 6 Accounts Receivable 400000 7 inventory

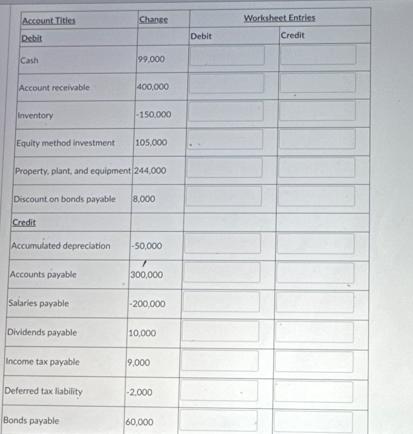

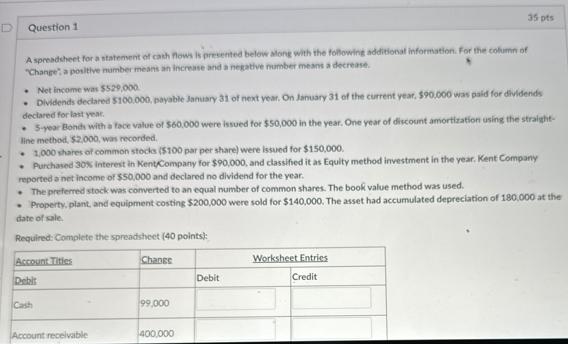

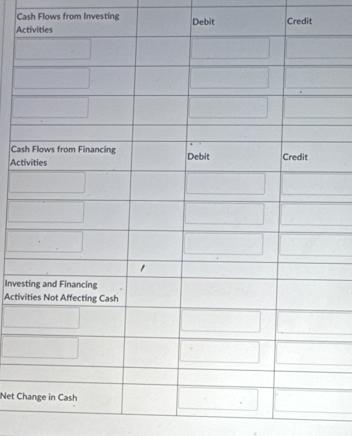

B C D E A 1 Balances 2 count Titles 3 4 Debits 5 Cash Change Debit 99,000 6 Accounts Receivable 400000 7 inventory |-150,000 8 equity method investment 105000 9 PPE 244000 10 Discount on Bonds Payable 11 8000 12 Credits 13 Accumulated Depreciation -50000 14 Accounts Payable 300000 15 Salaries Payable -200000 16 dividends payable 10000 17 income tax payable 9000 18 Deferred Tax Liabilities -2,000 19 Bonds Payable 60,000 20 preferred stock -500000 21 common stock 600,000 22 23 Additional Paid-in Capital 5000 24 retained earnings 429,000 25 26 F G H Worksheet Entries Credit Account Titles Change Debit Debit Cash 99.000 Account receivable 400,000 Inventory -150,000 Equity method investment 105,000 Property, plant, and equipment 244,000 Discount on bonds payable 8,000 Credit Accumulated depreciation -50,000 Accounts payable 300,000 Salaries payable -200,000 Dividends payable 10,000 Income tax payable 9,000 Deferred tax liability -2,000 Bonds payable 60,000 Worksheet Entries Credit Question 1 A spreadsheet for a statement of cash flows is presented below along with the following additional information. For the column of "Change" a positive number means an increase and a negative number means a decrease. Net income was $529,000 35 pts Dividends declared $100,000, payable January 31 of next year. On January 31 of the current year, $90,000 was paid for dividends declared for last year. 5-year Bonds with a face value of $60,000 were issued for $50,000 in the year. One year of discount amortization using the straight- line method, $2,000, was recorded. 1,000 shares of common stocks ($100 par per share) were issued for $150,000. Purchased 30% interest in Kent/Company for $90,000, and classified it as Equity method investment in the year. Kent Company reported a net income of $50,000 and declared no dividend for the year. The preferred stock was converted to an equal number of common shares. The book value method was used. Property, plant, and equipment costing $200,000 were sold for $140,000. The asset had accumulated depreciation of 180,000 at the date of sale Required: Complete the spreadsheet (40 points): Account Titles Debit Cash Change Worksheet Entries Debit Credit 99,000 Account receivable 400,000 Cash Flows from Investing Activities Debit Credit Cash Flows from Financing Activities Investing and Financing Activities Not Affecting Cash Net Change in Cash Debit Credit Cash Flows from Financing Activities Debit Credit Investing and Financing Activities Not Affecting Cash Net Change in Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started