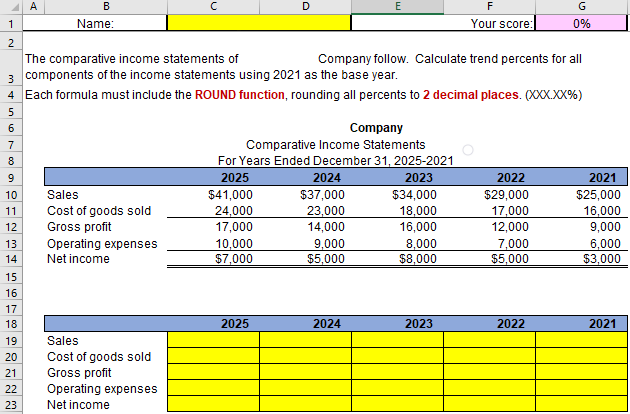

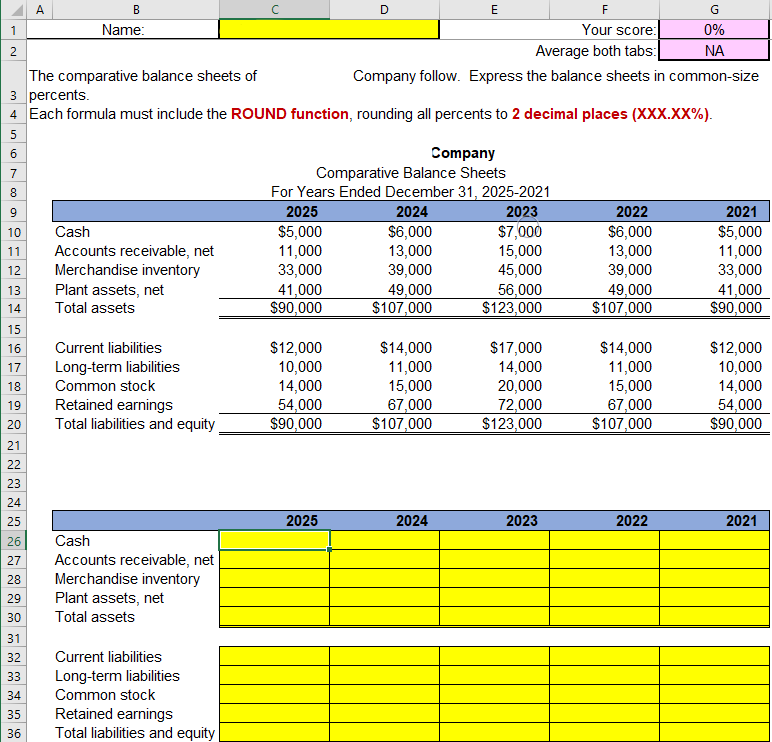

B C D E F 1 Name: Your score: 0% 2 The comparative income statements of Company follow. Calculate trend percents for all 3 components of the income statements using 2021 as the base year. 4 Each formula must include the ROUND function, rounding all percents to 2 decimal places. (XXX.XX%) 5 6 Company 7 Comparative Income Statements 8 For Years Ended December 31, 2025-2021 9 2025 2024 2023 2022 2021 10 Sales $41,000 $37,000 $34,000 $29,000 $25,000 11 Cost of goods sold 24,000 23,000 18,000 17,000 16,000 12 Gross profit 17,000 14,000 16,000 12,000 9,000 13 Operating expenses 10,000 9,000 8,000 7,000 6.000 14 Net income $7,000 $5,000 $8,000 $5,000 $3,000 15 16 17 18 2025 2024 2023 2022 2021 19 20 21 22 23 Sales Cost of goods sold Gross profit Operating expenses Net income D E 1 0 1 7 9 B F G Name: Your score: 0% 2 Average both tabs: NA The comparative balance sheets of Company follow. Express the balance sheets in common-size 3 percents. 4 Each formula must include the ROUND function, rounding all percents to 2 decimal places (XXX.XX%). Company Comparative Balance Sheets 8 For Years Ended December 31, 2025-2021 2025 2024 2023 2022 2021 10 Cash $5,000 $6,000 $7,000 $6,000 $5,000 Accounts receivable, net 11,000 13,000 15,000 13,000 11,000 Merchandise inventory 33,000 39,000 45,000 39,000 33,000 13 Plant assets, net 41,000 49,000 56,000 49,000 41,000 Total assets $90,000 $107,000 $123,000 $107,000 $90,000 15 16 Current liabilities $12,000 $14,000 $17,000 $14,000 $12,000 17 Long-term liabilities 10,000 11,000 14,000 11,000 10,000 18 Common stock 14,000 15,000 20,000 15,000 14,000 Retained earnings 54,000 67,000 72,000 67,000 54,000 20 Total liabilities and equity $90,000 $107.000 $123,000 $107.000 $90,000 21 22 23 11 12 14 19 24 25 2025 2024 2023 2022 2021 26 27 28 Cash Accounts receivable, net Merchandise inventory Plant assets, net Total assets 29 30 31 32 33 34 Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and equity 35 36