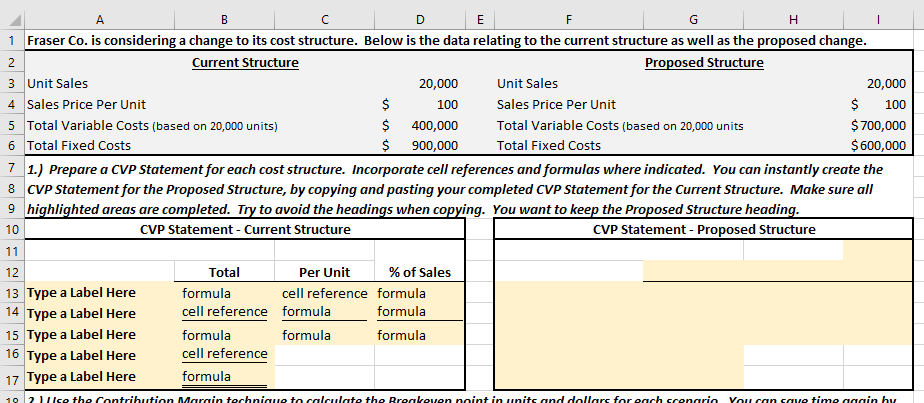

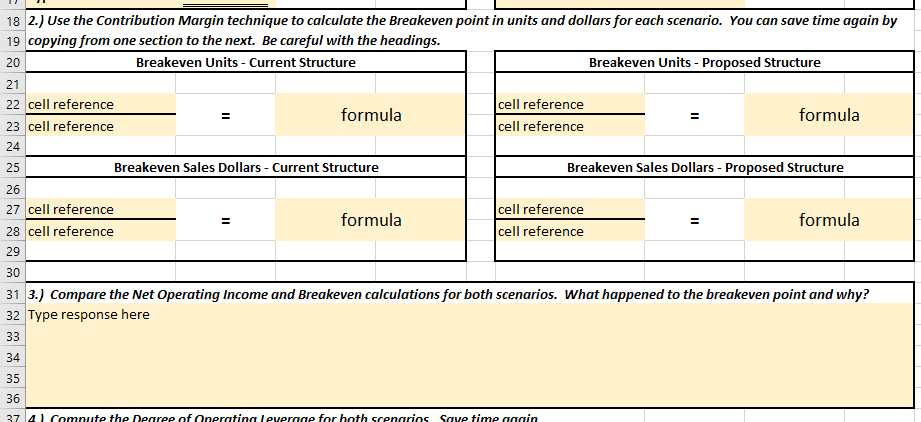

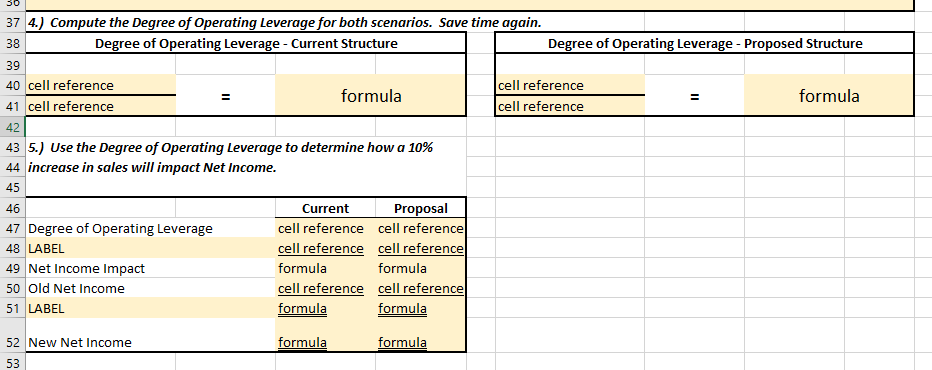

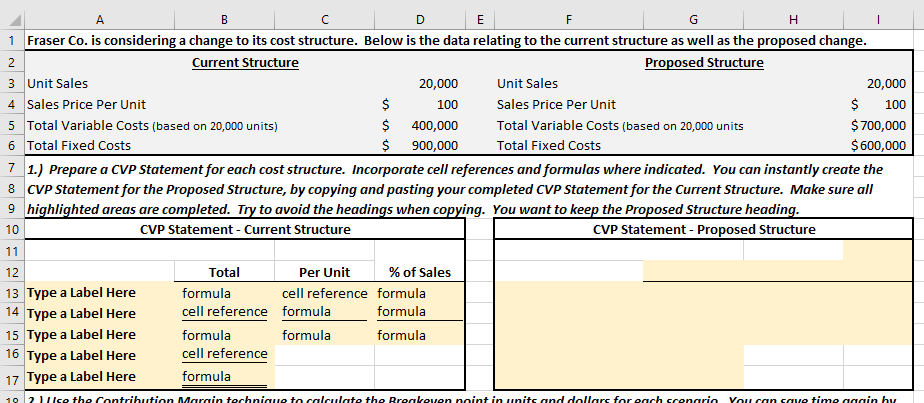

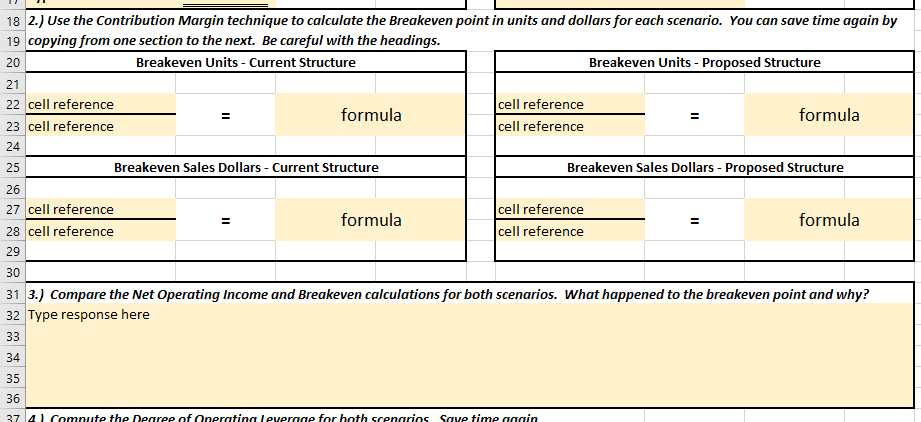

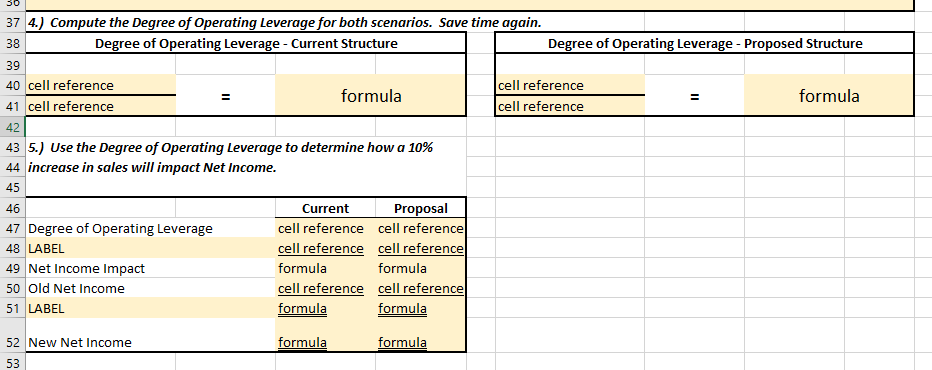

B C D E F G 1 Fraser Co. is considering a change to its cost structure. Below is the data relating to the current structure as well as the proposed change. 2 Current Structure Proposed Structure 3 Unit Sales 20,000 Unit Sales 20,000 4 Sales Price Per Unit $ 100 Sales Price Per Unit $ 100 5 Total Variable Costs (based on 20,000 units) $ 400,000 Total Variable Costs (based on 20,000 units $ 700,000 6 Total Fixed Costs $ 900,000 Total Fixed Costs $600,000 7 1.) Prepare a CVP Statement for each cost structure. Incorporate cell references and formulas where indicated. You can instantly create the 8 CVP Statement for the Proposed Structure, by copying and pasting your completed CVP Statement for the Current Structure. Make sure all 9 highlighted areas are completed. Try to avoid the headings when copying. You want to keep the Proposed Structure heading. CVP Statement - Current Structure CVP Statement - Proposed Structure 10 13 Type a Label Here 14 Type a Label Here 15 Type a Label Here 16 Type a Label Here 17 Type a Label Here Total formula cell reference formula cell reference formula Per Unit % of Sales cell reference formula formula formula formula formula 10 2 lice the contribution Marain technique to calculate the Broakoven naint in units and dollars for each scenario You can save time again hu 18 2.) Use the Contribution Margin technique to calculate the Breakeven point in units and dollars for each scenario. You can save time again by 19 copying from one section to the next. Be careful with the headings. Breakeven Units - Current Structure Breakeven Units - Proposed Structure 22 cell reference 23 cell reference formula cell reference cell reference formula 25 Breakeven Sales Dollars - Current Structure Breakeven Sales Dollars - Proposed Structure formula cell reference 28 cell reference 29 cell reference cell reference formula 31 3.) Compare the Net Operating Income and Breakeven calculations for both scenarios. What happened to the breakeven point and why? 32 Type response here 37 4 Comnute the nearee of Oneratina leverage for hoth scenarios Save time again 37 4.) Compute the Degree of Operating Leverage for both scenarios. Save time again. Degree of Operating Leverage - Current Structure Degree of Operating Leverage - Proposed Structure 40 cell reference 41 cell reference formula cell reference cell reference formula 43 5.) Use the Degree of Operating Leverage to determine how a 10% 44 increase in sales will impact Net Income. 46 47 Degree of Operating Leverage 48 LABEL 49 Net Income Impact 50 Old Net Income 51 LABEL Current Proposal cell reference cell reference cell reference cell reference formula formula cell reference cell reference formula formula formula formula 52 New Net Income 53