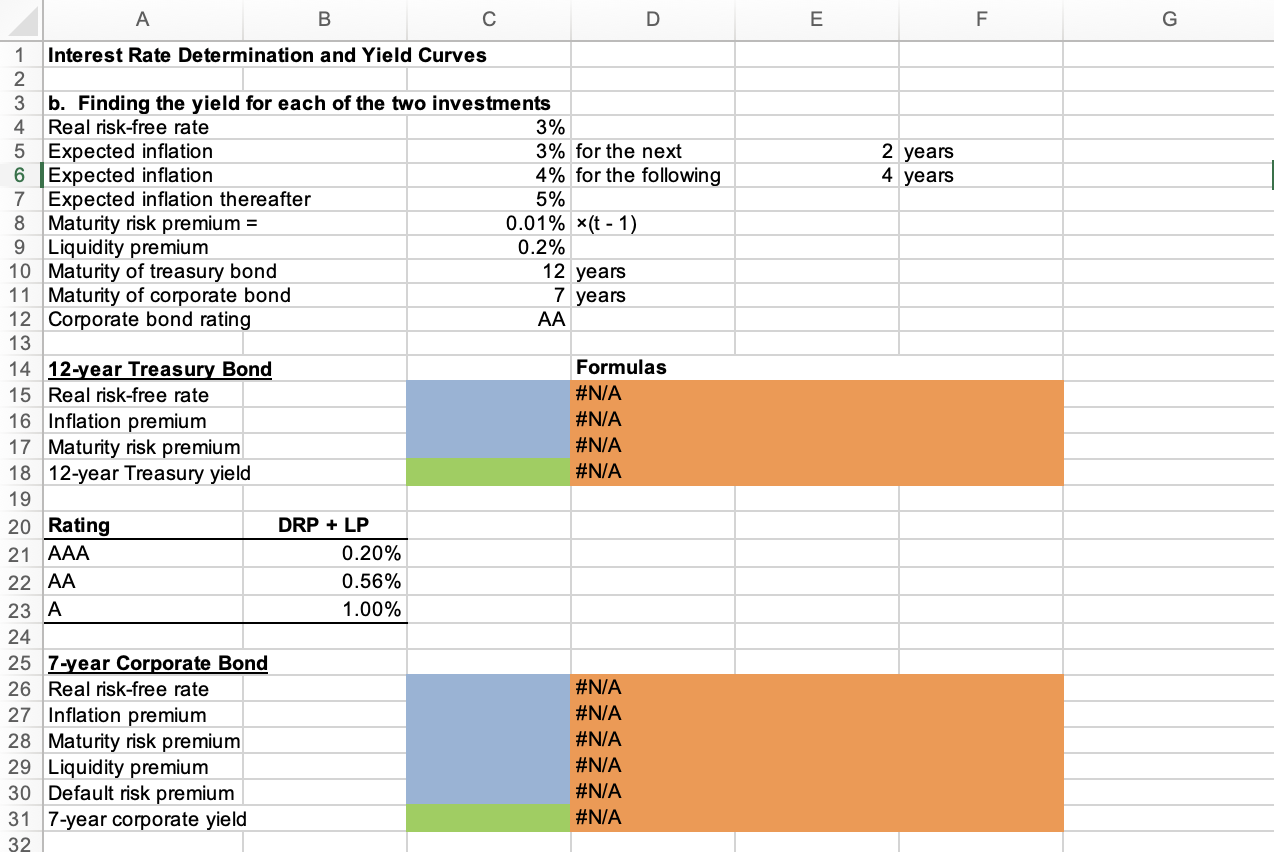

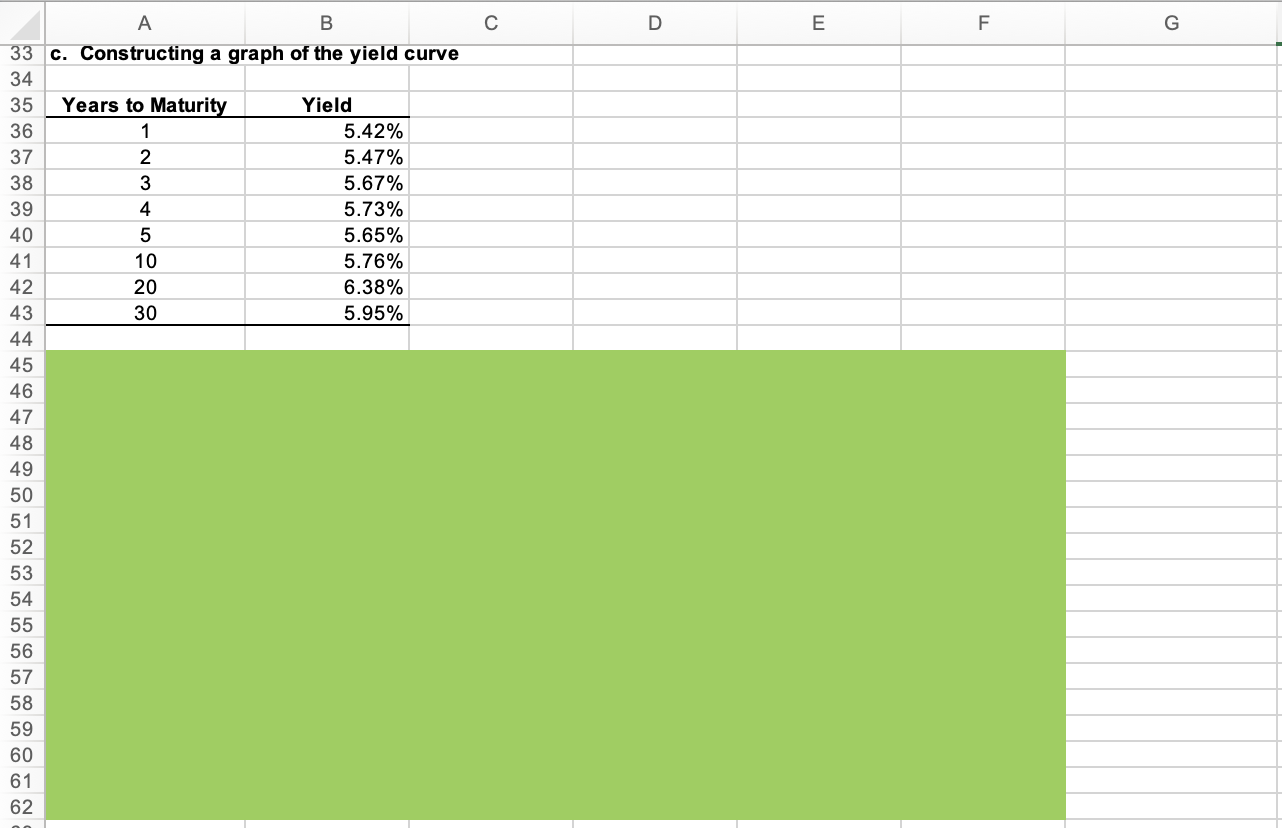

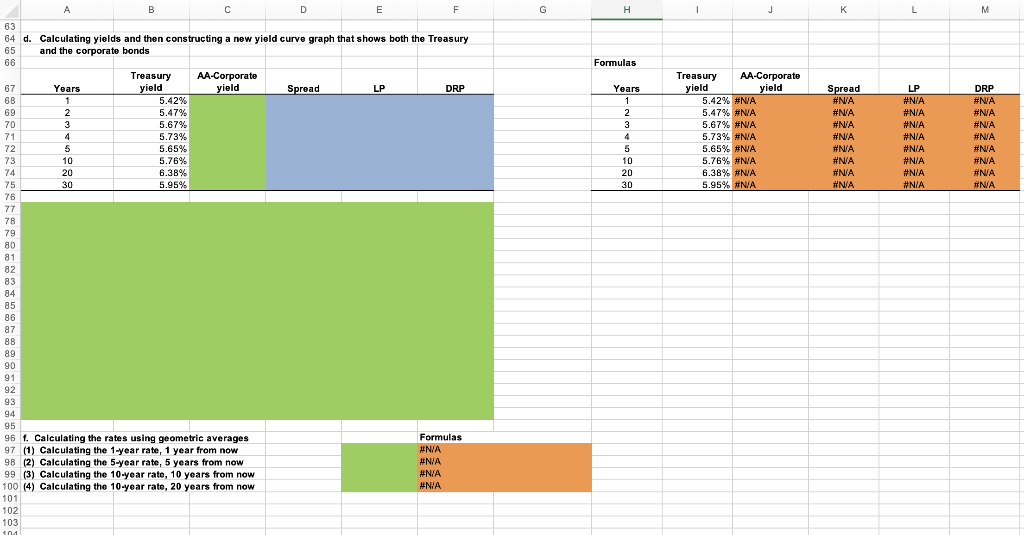

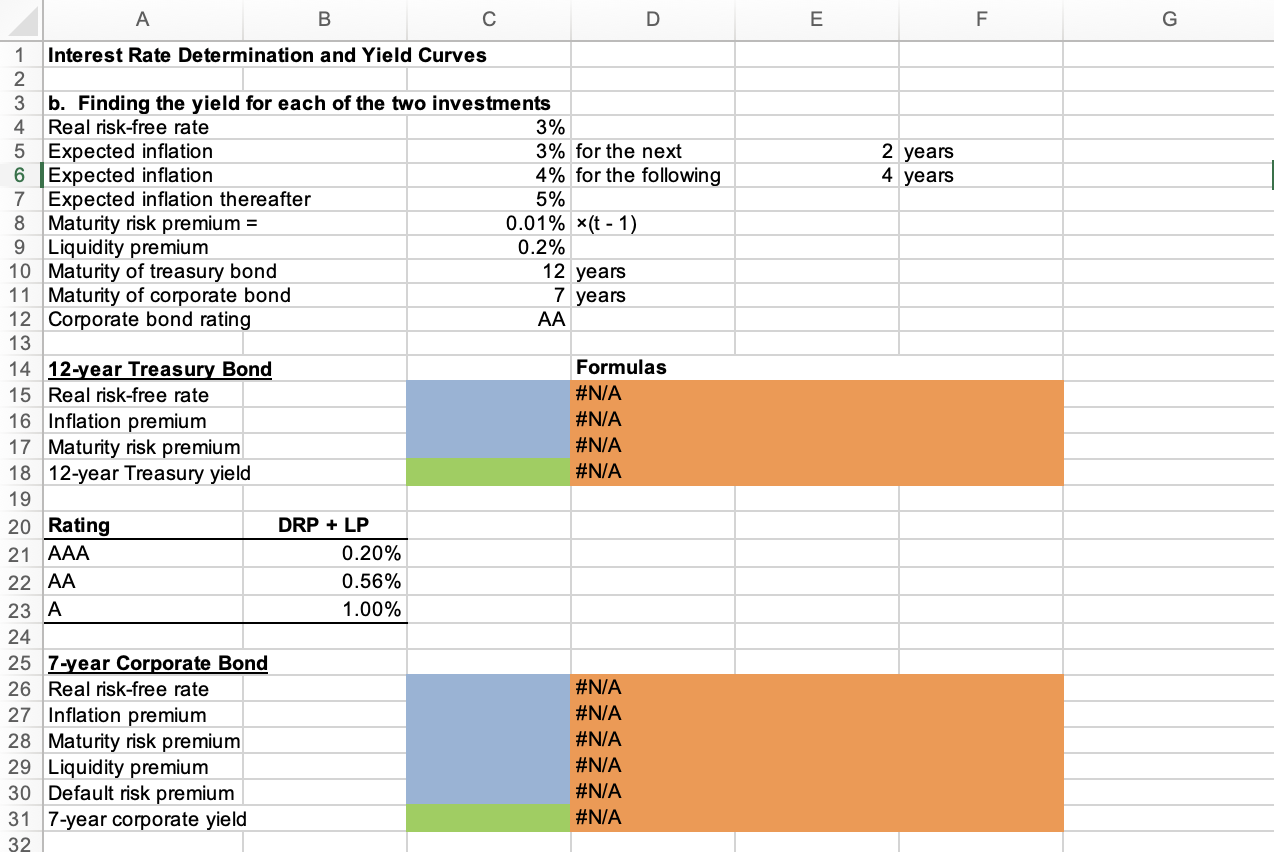

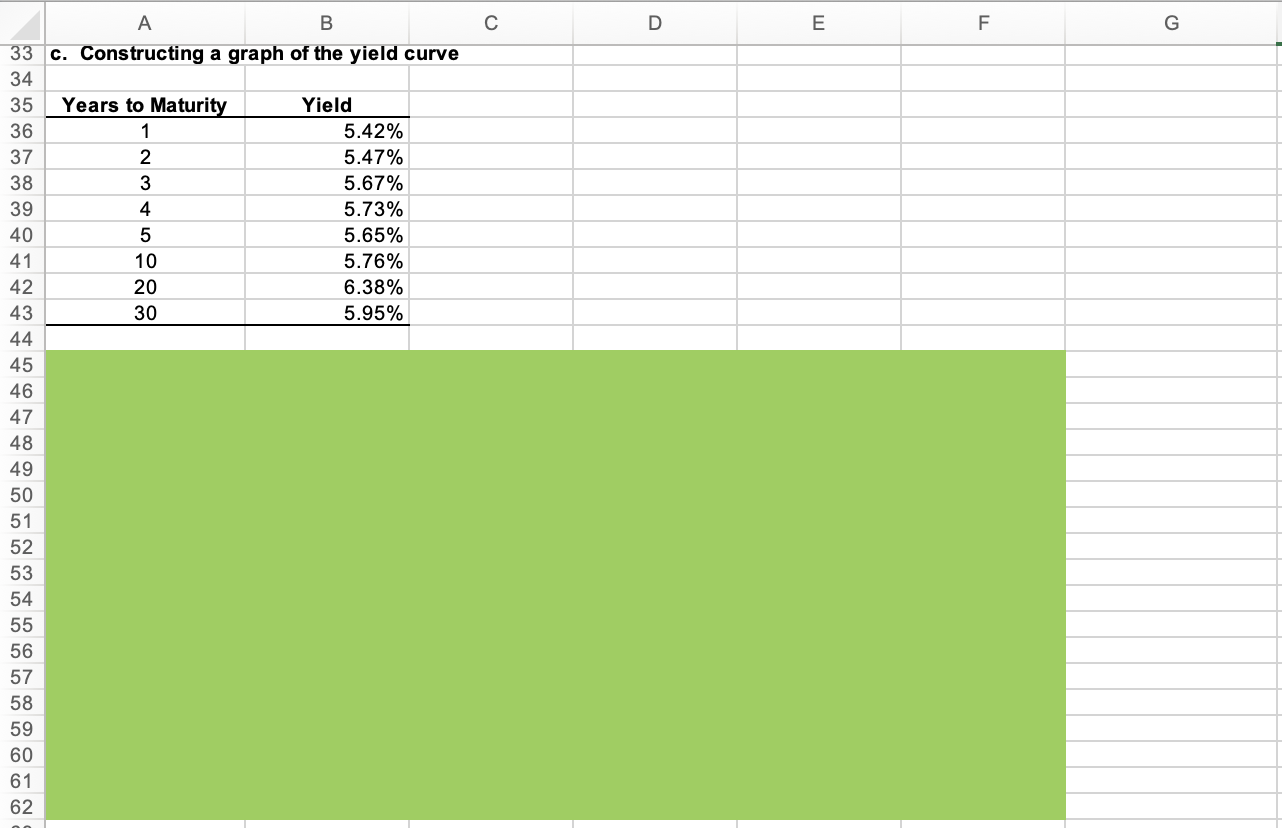

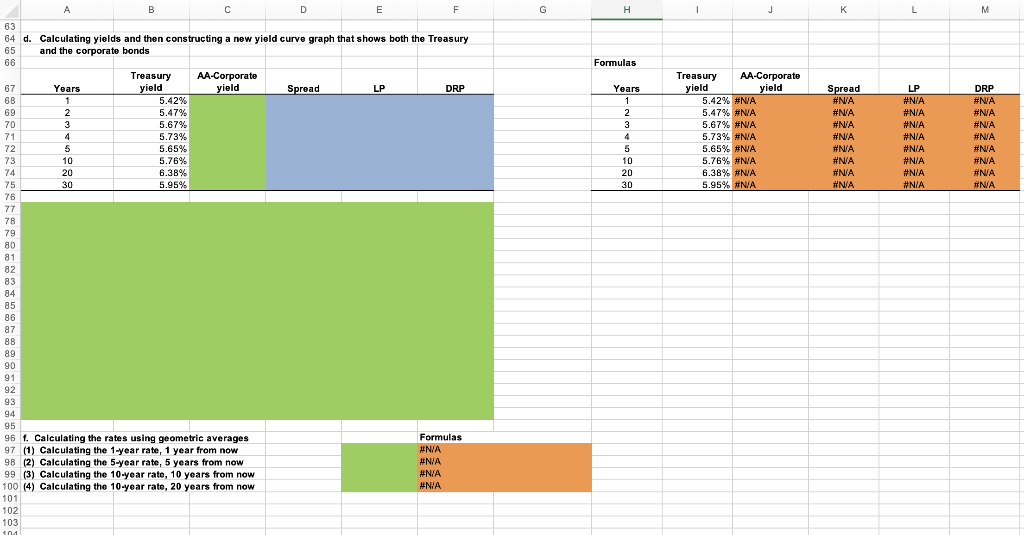

B C D E F G 2 years 4 years 12 years 7 years 1 Interest Rate Determination and Yield Curves 2 3 b. Finding the yield for each of the two investments 4 Real risk-free rate 3% 5 Expected inflation 3% for the next 6 Expected inflation 4% for the following 7 Expected inflation thereafter 5% 8 Maturity risk premium = 0.01% (t-1) 9 Liquidity premium 0.2% 10 Maturity of treasury bond 11 Maturity of corporate bond 12 Corporate bond rating 13 14 12-year Treasury Bond Formulas 15 Real risk-free rate #N/A 16 Inflation premium #N/A 17 Maturity risk premium #N/A 18 12-year Treasury yield #N/A 19 20 Rating DRP + LP 21 AAA 0.20% 22 AA 0.56% 23 A 1.00% 24 25 7-year Corporate Bond 26 Real risk-free rate #N/A 27 Inflation premium #N/A 28 Maturity risk premium #N/A 29 Liquidity premium #N/A 30 Default risk premium #N/A 31 7-year corporate yield #N/A 32 c D E F G A B 33 c. Constructing a graph of the yield curve 34 35 Years to Maturity Yield 36 1 5.42% 37 2 5.47% 38 3 5.67% 39 4 5.73% 40 5 5.65% 41 10 5.76% 42 20 6.38% 43 30 5.95% 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 G H J L M Formulas Years 1 1 2 3 4 5 10 20 30 Treasury AA-Corporate yield yield 5.42% #NA 5.47% #NA 5.67% #N/A 5.73% #N/A 5.65% #N/A 5.76% #N/A 6.38% #N/A 5.95% #N/A Spread #NA #N/A #NA #NA #N/A #N/A #NA #N/A LP #N/A #N/A #N/A #NIA #N/A #NIA #NIA #N/A DRP #NA #NA #NA #NA #NA #NA #N/A #N/A A B D E F 63 64 d. Calculating yields and then constructing a new yield curve graph that shows both the Treasury 65 and the corporate bonds 66 Treasury AA-Corporate 67 Years yield yield Spread LP DRP 6B 1 5.42% 69 2 5.47% 70 3 5.67% 71 4 5.73% 72 5 5.65% 73 10 5.76% 74 20 6.38% 75 30 5.95% 76 77 78 79 80 81 82 83 84 85 86 87 8B 89 90 91 92 93 94 95 96 f. Calculating the rates using geometric averages Formulas 97 (1) Calculating the 1-year rate, 1 year from now #N/A N 98 (2) Calculating the 5-year rate, 5 years from now #N/A 99 (3) Calculating the 10-year rate, 10 years from now #N/A #N/ 100 (4) Calculating the 10-year rate, 20 years from now #N/A 101 102 103 10 B C D E F G 2 years 4 years 12 years 7 years 1 Interest Rate Determination and Yield Curves 2 3 b. Finding the yield for each of the two investments 4 Real risk-free rate 3% 5 Expected inflation 3% for the next 6 Expected inflation 4% for the following 7 Expected inflation thereafter 5% 8 Maturity risk premium = 0.01% (t-1) 9 Liquidity premium 0.2% 10 Maturity of treasury bond 11 Maturity of corporate bond 12 Corporate bond rating 13 14 12-year Treasury Bond Formulas 15 Real risk-free rate #N/A 16 Inflation premium #N/A 17 Maturity risk premium #N/A 18 12-year Treasury yield #N/A 19 20 Rating DRP + LP 21 AAA 0.20% 22 AA 0.56% 23 A 1.00% 24 25 7-year Corporate Bond 26 Real risk-free rate #N/A 27 Inflation premium #N/A 28 Maturity risk premium #N/A 29 Liquidity premium #N/A 30 Default risk premium #N/A 31 7-year corporate yield #N/A 32 c D E F G A B 33 c. Constructing a graph of the yield curve 34 35 Years to Maturity Yield 36 1 5.42% 37 2 5.47% 38 3 5.67% 39 4 5.73% 40 5 5.65% 41 10 5.76% 42 20 6.38% 43 30 5.95% 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 G H J L M Formulas Years 1 1 2 3 4 5 10 20 30 Treasury AA-Corporate yield yield 5.42% #NA 5.47% #NA 5.67% #N/A 5.73% #N/A 5.65% #N/A 5.76% #N/A 6.38% #N/A 5.95% #N/A Spread #NA #N/A #NA #NA #N/A #N/A #NA #N/A LP #N/A #N/A #N/A #NIA #N/A #NIA #NIA #N/A DRP #NA #NA #NA #NA #NA #NA #N/A #N/A A B D E F 63 64 d. Calculating yields and then constructing a new yield curve graph that shows both the Treasury 65 and the corporate bonds 66 Treasury AA-Corporate 67 Years yield yield Spread LP DRP 6B 1 5.42% 69 2 5.47% 70 3 5.67% 71 4 5.73% 72 5 5.65% 73 10 5.76% 74 20 6.38% 75 30 5.95% 76 77 78 79 80 81 82 83 84 85 86 87 8B 89 90 91 92 93 94 95 96 f. Calculating the rates using geometric averages Formulas 97 (1) Calculating the 1-year rate, 1 year from now #N/A N 98 (2) Calculating the 5-year rate, 5 years from now #N/A 99 (3) Calculating the 10-year rate, 10 years from now #N/A #N/ 100 (4) Calculating the 10-year rate, 20 years from now #N/A 101 102 103 10