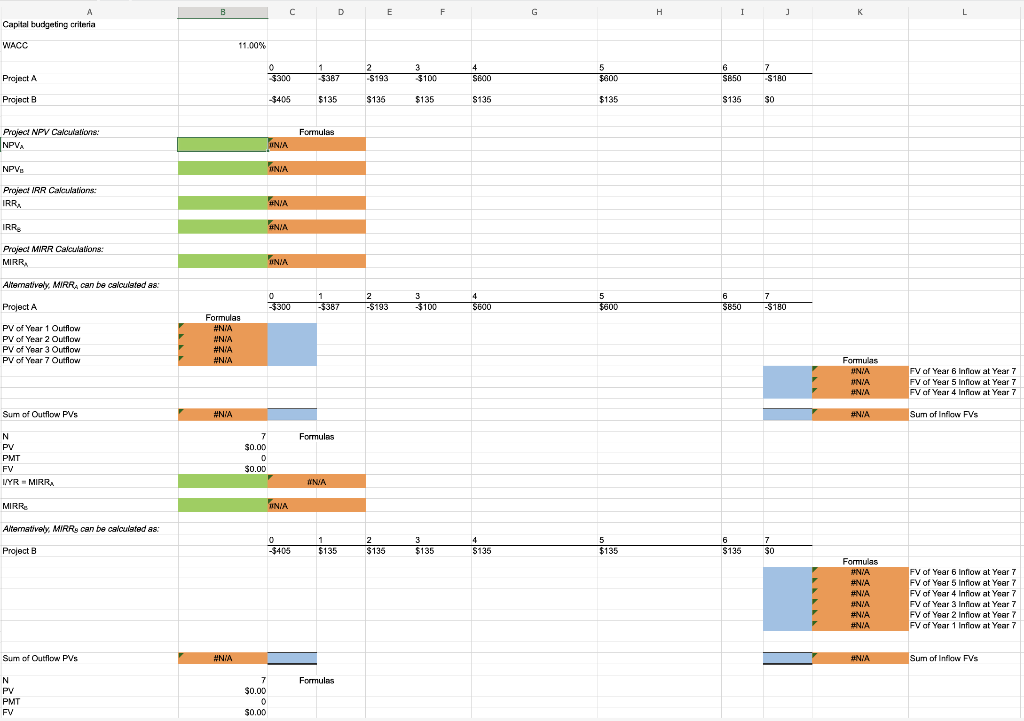

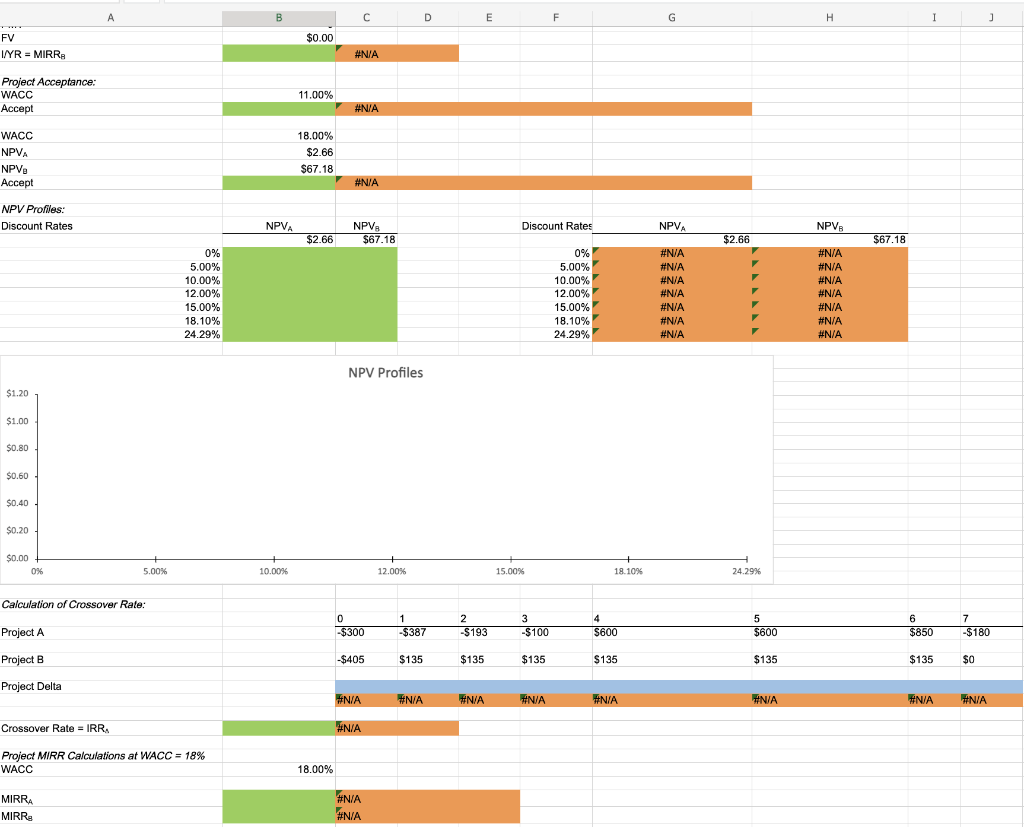

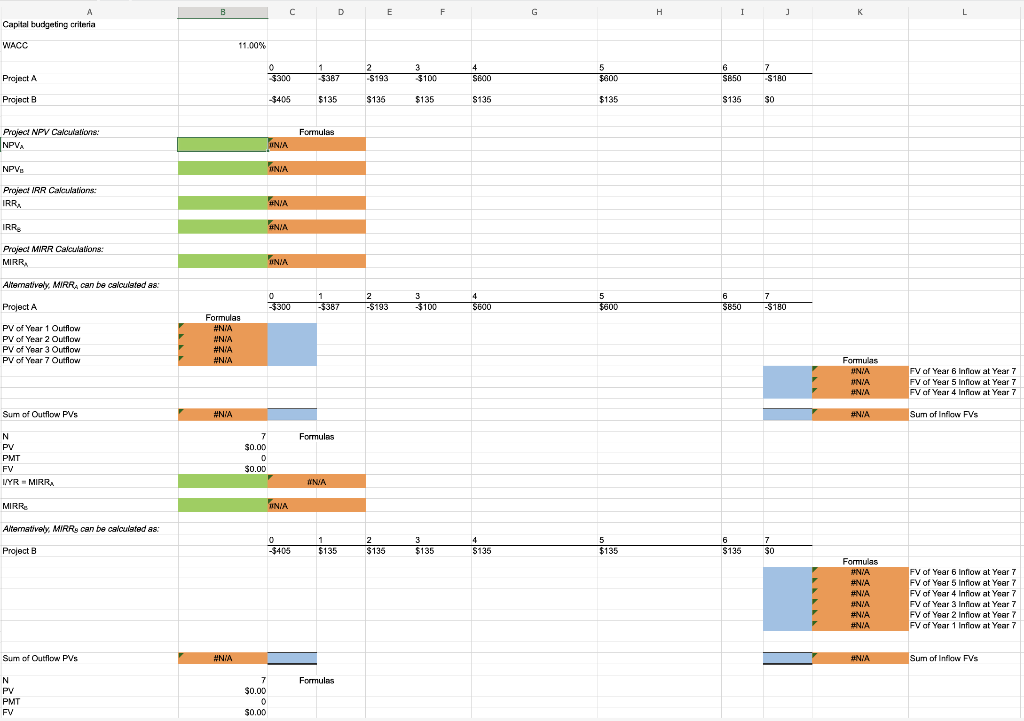

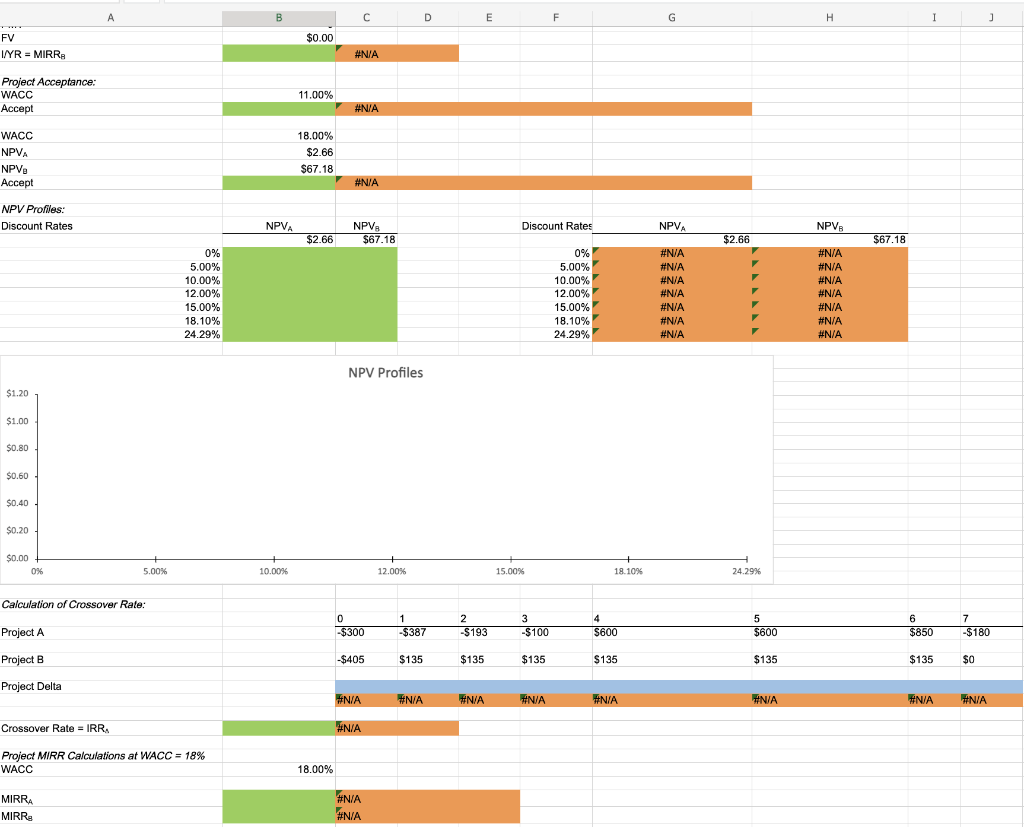

B C D E F G H j K Capital budgeting criteria WACC 11.00% 0 $300 1 $387 2 -S193 3 $100 $ 4 S800 5 $600 6 S850 7 -S 180 Project A Project B -$405 $135 $135 $135 $135 $135 $135 SO Formulas Project NPV Calculation NPVA DNIA NPVE UNIA Project IRR Calculations: IRRA NIA IRR. ANIA Project MIRR Calculations: MIRRA UNIA Alternativy MIRRA can be calculated as 6 7 0 3300 Project A 1 -$387 2 -$193 3 3100 4 SU0O 5 3600 $850 $180 PV of Year 1 Outflow PV of Year 2 Outflow PV of Year 3 Outflow PV of Year 7 Outflow Formulas #NIA WNIA #N/A #NIA Formulas UNIA WNIA #NIA FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 Sum of Outflow PVs #NIA #N/A Sum of Inflow FVs Formulas N PV PMT FV I/YR - MIRRA 7 $0.00 $ 0 $0.00 #N/A MIRR WNIA Alternatively, MIRR, can be calculated as 4 0 $405 1 $135 3 $135 $135 $ Project B 5 $135 $ $135 6 $135 7 $0 $ Formulas #NIA #N/A #N/A UNIA #N/A #NIA FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 FV of Year 3 Inflaw at Year 7 FV of Year 2 inflow at Year 7 FV of Year 1 Inflow at Year 7 Sum of Outflow PVS #NIA #NIA Sum of Inflow FVS Formulas N PV PMT FV 7 $0.00 0 $0.00 A B D D E F G G H I ] $0.00 FV I/YR - MIRRA #N/A Project Acceptance: WACC Accept 11.00% #N/A WACC NPVA NPV Accept 18.00% $2.66 $67.18 #N/A NPV Profiles: Discount Rates NPVA Discount Rates NPVA NPVA $2.66 NPVA $67.18 $2.66 $67.18 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.29% 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.29% #A #N/A #N/A #N/A #N/A #N/A #N/A #N/A # #N/A NA #N/A #N/A #N/A #N/A #N/A NA #N/A NPV Profiles $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 1 $0.00 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.29% Calculation of Crossover Rate: 0 $300 Project A 1 -$387 2 -$193 3 -$100 4 S600 5 $600 6 $850 7 -$180 Project B $405 $135 $135 $135 $135 $135 $135 $0 Project Delta NA #N/A #N/A #N/A N/A #N/A #N/A #N/A #N/A Crossover Rate = IRR. #N/A Project MIRR Calculations at WACC = 18% WACC 18.00% MIRRA MIRR #N/A #N/A B C D E F G H j K Capital budgeting criteria WACC 11.00% 0 $300 1 $387 2 -S193 3 $100 $ 4 S800 5 $600 6 S850 7 -S 180 Project A Project B -$405 $135 $135 $135 $135 $135 $135 SO Formulas Project NPV Calculation NPVA DNIA NPVE UNIA Project IRR Calculations: IRRA NIA IRR. ANIA Project MIRR Calculations: MIRRA UNIA Alternativy MIRRA can be calculated as 6 7 0 3300 Project A 1 -$387 2 -$193 3 3100 4 SU0O 5 3600 $850 $180 PV of Year 1 Outflow PV of Year 2 Outflow PV of Year 3 Outflow PV of Year 7 Outflow Formulas #NIA WNIA #N/A #NIA Formulas UNIA WNIA #NIA FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 Sum of Outflow PVs #NIA #N/A Sum of Inflow FVs Formulas N PV PMT FV I/YR - MIRRA 7 $0.00 $ 0 $0.00 #N/A MIRR WNIA Alternatively, MIRR, can be calculated as 4 0 $405 1 $135 3 $135 $135 $ Project B 5 $135 $ $135 6 $135 7 $0 $ Formulas #NIA #N/A #N/A UNIA #N/A #NIA FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 FV of Year 3 Inflaw at Year 7 FV of Year 2 inflow at Year 7 FV of Year 1 Inflow at Year 7 Sum of Outflow PVS #NIA #NIA Sum of Inflow FVS Formulas N PV PMT FV 7 $0.00 0 $0.00 A B D D E F G G H I ] $0.00 FV I/YR - MIRRA #N/A Project Acceptance: WACC Accept 11.00% #N/A WACC NPVA NPV Accept 18.00% $2.66 $67.18 #N/A NPV Profiles: Discount Rates NPVA Discount Rates NPVA NPVA $2.66 NPVA $67.18 $2.66 $67.18 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.29% 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.29% #A #N/A #N/A #N/A #N/A #N/A #N/A #N/A # #N/A NA #N/A #N/A #N/A #N/A #N/A NA #N/A NPV Profiles $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 1 $0.00 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.29% Calculation of Crossover Rate: 0 $300 Project A 1 -$387 2 -$193 3 -$100 4 S600 5 $600 6 $850 7 -$180 Project B $405 $135 $135 $135 $135 $135 $135 $0 Project Delta NA #N/A #N/A #N/A N/A #N/A #N/A #N/A #N/A Crossover Rate = IRR. #N/A Project MIRR Calculations at WACC = 18% WACC 18.00% MIRRA MIRR #N/A #N/A