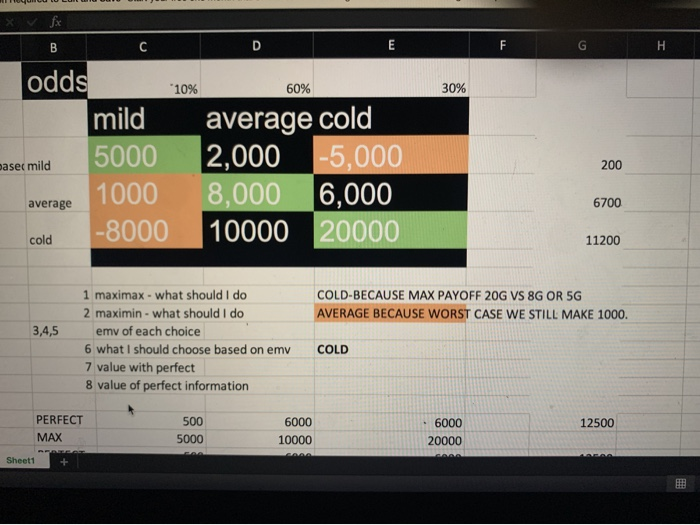

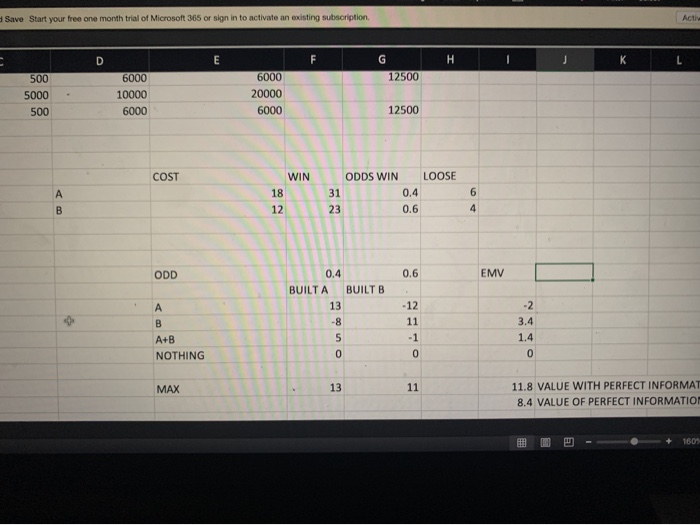

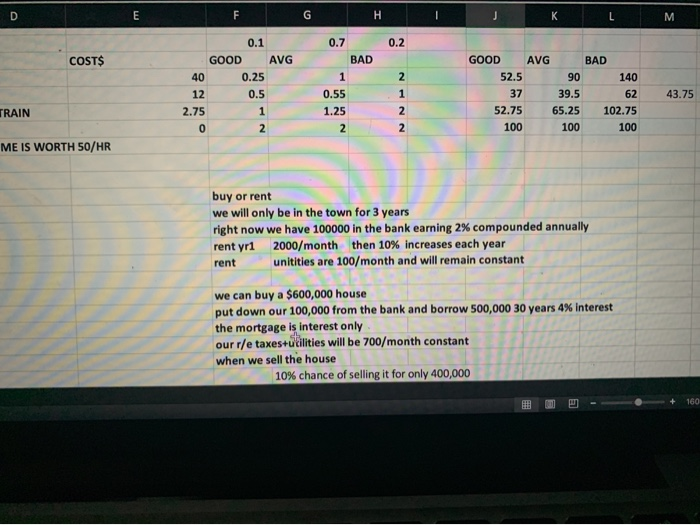

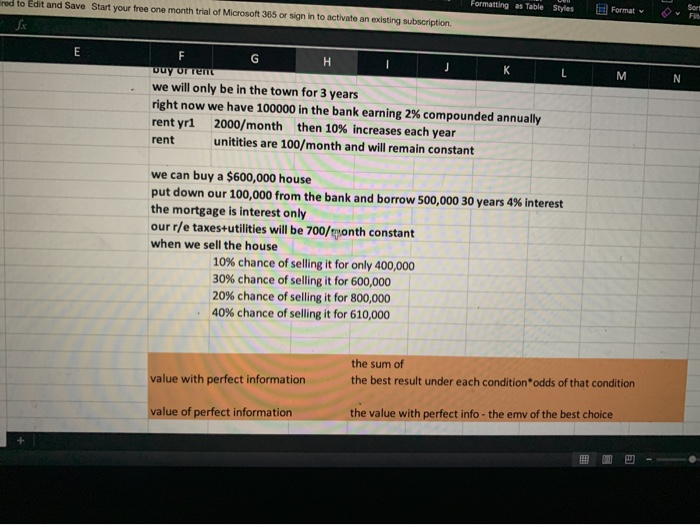

B C D E F H 10% 60% 30% odds mild base mild 5000 1000 average cold -8000 200 average cold 2,000 -5,000 8,000 6,000 10000 20000 6700 11200 COLD-BECAUSE MAX PAYOFF 20G VS 8G OR 5G AVERAGE BECAUSE WORST CASE WE STILL MAKE 1000. 3,4,5 1 maximax - what should I do 2 maximin - what should I do emy of each choice 6 what I should choose based on emv 7 value with perfect 8 value of perfect information COLD PERFECT MAX 12500 500 5000 6000 10000 GWA 6000 20000 Sheet1 BIE Save Start your free one month trial of Microsoft 365 or sign in to activate an existing subscription Active D E G H K 12500 500 5000 500 6000 10000 6000 6000 20000 6000 12500 COST WIN 18 12 ODDS WIN 31 23 LOOSE 0.4 0.6 6 4 B ODD 0.6 EMV 0.4 BUILT A BUILTB 13 A B -8 -12 11 -1 0 -2 3.4 1.4 A+B NOTHING 5 0 0 MAX 13 11 11.8 VALUE WITH PERFECT INFORMAT 8.4 VALUE OF PERFECT INFORMATION 1609 D E F G H K L M 0.2 COST$ 0.1 GOOD AVG 40 0.25 12 0.5 2.75 1 0 2 0.7 BAD 1 0.55 1.25 2 GOOD AVG BAD 52.5 90 140 37 39.5 62 52.75 65.25 102.75 100 100 100 2 1 2 2 43.75 TRAIN ME IS WORTH 50/HR buy or rent we will only be in the town for 3 years right now we have 100000 in the bank earning 2% compounded annually rent yr1 2000/month then 10% increases each year unitities are 100/month and will remain constant rent we can buy a $600,000 house put down our 100,000 from the bank and borrow 500,000 30 years 4% interest the mortgage is interest only our r/e taxes+utilities will be 700/month constant when we sell the house 10% chance of selling it for only 400,000 Hi 160 red to Edit and Save Start your free one month trial of Microsoft 365 or Sign in to activate an existing subscription. Formatting as Table Styles Format v Son F E M N F H K buy or rent we will only be in the town for 3 years right now we have 100000 in the bank earning 2% compounded annually rent yr1 2000/month then 10% increases each year rent unitities are 100/month and will remain constant we can buy a $600,000 house put down our 100,000 from the bank and borrow 500,000 30 years 4% interest the mortgage is interest only our r/e taxes+utilities will be 700/month constant when we sell the house 10% chance of selling it for only 400,000 30% chance of selling it for 600,000 20% chance of selling it for 800,000 40% chance of selling it for 610,000 value with perfect information the sum of the best result under each condition odds of that condition value of perfect information the value with perfect info- the emy of the best choice B C D E F H 10% 60% 30% odds mild base mild 5000 1000 average cold -8000 200 average cold 2,000 -5,000 8,000 6,000 10000 20000 6700 11200 COLD-BECAUSE MAX PAYOFF 20G VS 8G OR 5G AVERAGE BECAUSE WORST CASE WE STILL MAKE 1000. 3,4,5 1 maximax - what should I do 2 maximin - what should I do emy of each choice 6 what I should choose based on emv 7 value with perfect 8 value of perfect information COLD PERFECT MAX 12500 500 5000 6000 10000 GWA 6000 20000 Sheet1 BIE Save Start your free one month trial of Microsoft 365 or sign in to activate an existing subscription Active D E G H K 12500 500 5000 500 6000 10000 6000 6000 20000 6000 12500 COST WIN 18 12 ODDS WIN 31 23 LOOSE 0.4 0.6 6 4 B ODD 0.6 EMV 0.4 BUILT A BUILTB 13 A B -8 -12 11 -1 0 -2 3.4 1.4 A+B NOTHING 5 0 0 MAX 13 11 11.8 VALUE WITH PERFECT INFORMAT 8.4 VALUE OF PERFECT INFORMATION 1609 D E F G H K L M 0.2 COST$ 0.1 GOOD AVG 40 0.25 12 0.5 2.75 1 0 2 0.7 BAD 1 0.55 1.25 2 GOOD AVG BAD 52.5 90 140 37 39.5 62 52.75 65.25 102.75 100 100 100 2 1 2 2 43.75 TRAIN ME IS WORTH 50/HR buy or rent we will only be in the town for 3 years right now we have 100000 in the bank earning 2% compounded annually rent yr1 2000/month then 10% increases each year unitities are 100/month and will remain constant rent we can buy a $600,000 house put down our 100,000 from the bank and borrow 500,000 30 years 4% interest the mortgage is interest only our r/e taxes+utilities will be 700/month constant when we sell the house 10% chance of selling it for only 400,000 Hi 160 red to Edit and Save Start your free one month trial of Microsoft 365 or Sign in to activate an existing subscription. Formatting as Table Styles Format v Son F E M N F H K buy or rent we will only be in the town for 3 years right now we have 100000 in the bank earning 2% compounded annually rent yr1 2000/month then 10% increases each year rent unitities are 100/month and will remain constant we can buy a $600,000 house put down our 100,000 from the bank and borrow 500,000 30 years 4% interest the mortgage is interest only our r/e taxes+utilities will be 700/month constant when we sell the house 10% chance of selling it for only 400,000 30% chance of selling it for 600,000 20% chance of selling it for 800,000 40% chance of selling it for 610,000 value with perfect information the sum of the best result under each condition odds of that condition value of perfect information the value with perfect info- the emy of the best choice