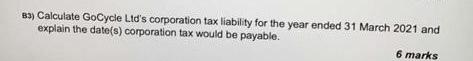

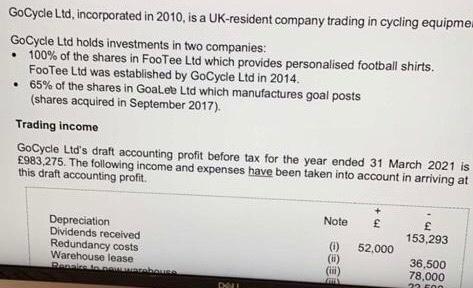

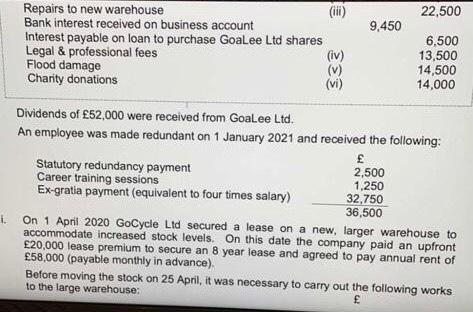

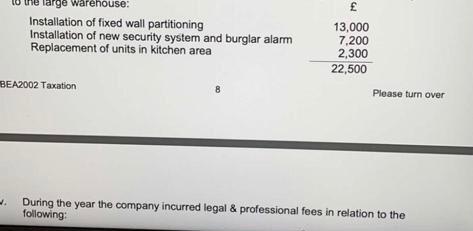

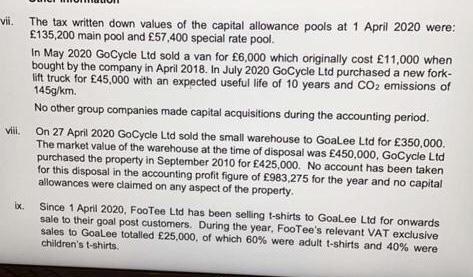

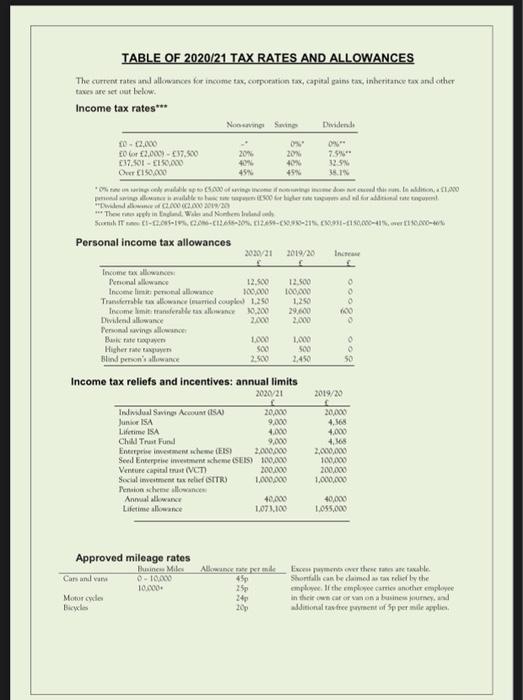

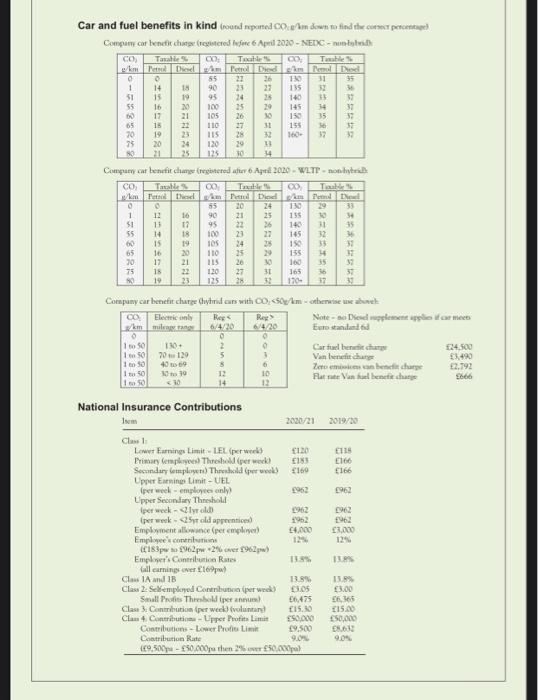

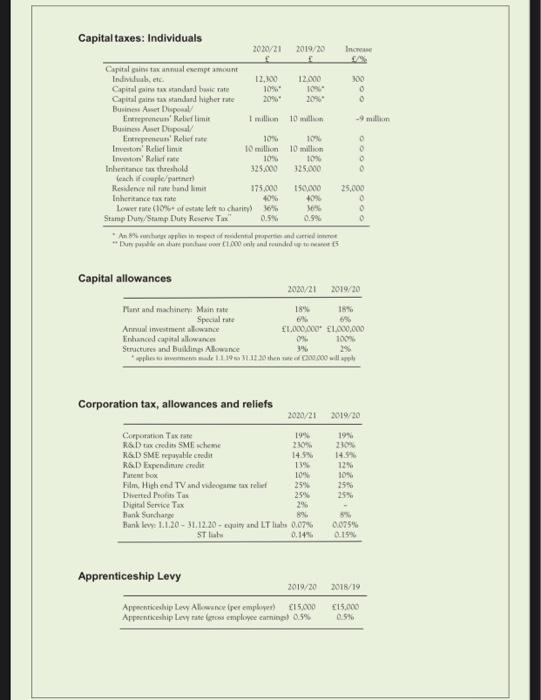

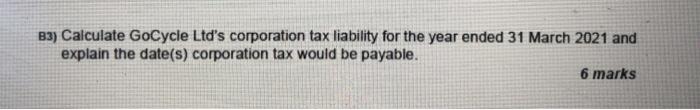

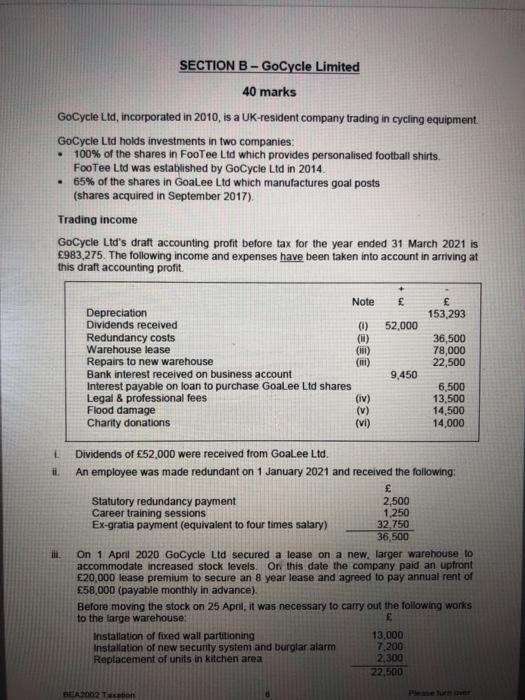

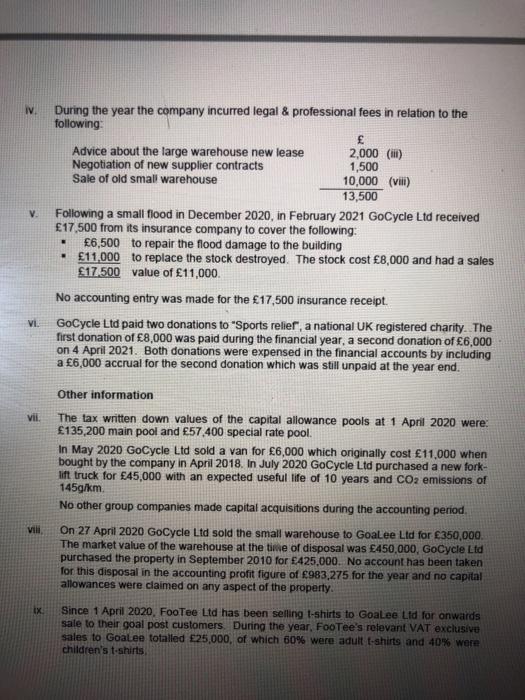

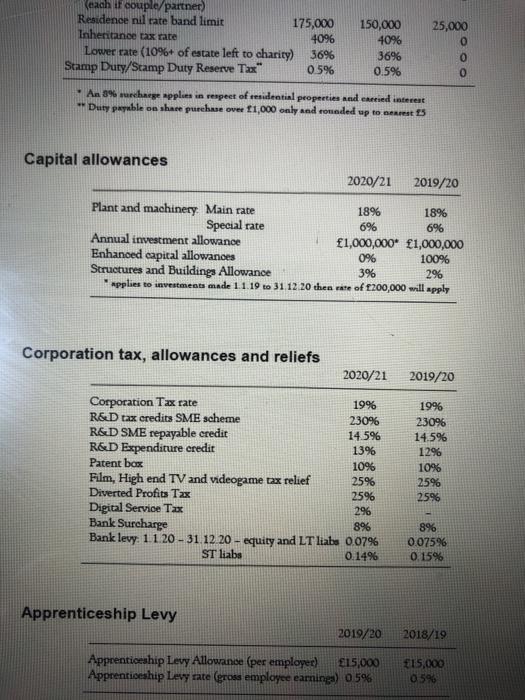

B) Calculate GoCycle Lid's corporation tax liability for the year ended 31 March 2021 and explain the date(s) corporation tax would be payable. 6 marks GoCycle Ltd, incorporated in 2010, is a UK-resident company trading in cycling equipme GoCycle Ltd holds investments in two companies 100% of the shares in FooTee Ltd which provides personalised football shirts. FooTee Ltd was established by GoCycle Ltd in 2014. 65% of the shares in Goalee Ltd which manufactures goal posts (shares acquired in September 2017). Trading income GoCycle Ltd's draft accounting profit before tax for the year ended 31 March 2021 is 983,275. The following income and expenses have been taken into account in arriving at this draft accounting profit Note Depreciation Dividends received Redundancy costs Warehouse lease Rencos 153,293 52.000 (1) () (ii) 36,500 78,000 CA 22,500 9,450 Repairs to new warehouse (ii) Bank interest received on business account Interest payable on loan to purchase Goalee Ltd shares Legal & professional fees (iv) Flood damage Charity donations 6,500 13,500 14,500 14,000 Dividends of 52,000 were received from Goalee Ltd. An employee was made redundant on 1 January 2021 and received the following: Statutory redundancy payment 2,500 Career training sessions 1,250 Ex-gratia payment (equivalent to four times salary) 32,750 36,500 1 On 1 April 2020 GoCycle Ltd secured a lease on a new, larger warehouse to accommodate increased stock levels. On this date the company paid an upfront 20,000 lease premium to secure an 8 year lease and agreed to pay annual rent of 58,000 (payable monthly in advance). Before moving the stock on 25 April, it was necessary to carry out the following works to the large warehouse: f the large warehouse: Installation of fixed wall partitioning Installation of new security system and burglar alarm Replacement of units in kitchen area 13,000 7,200 2,300 22,500 Please turn over BEA2002 Taxation 8 - During the year the company incurred legal & professional fees in relation to the following: Advice about the large warehouse new lease 2,000 (1) Negotiation of new supplier contracts 1,500 Sale of old small warehouse 10,000 (viii) 13,500 V. Following a small flood in December 2020, in February 2021 GoCycle Ltd received 17,500 from its insurance company to cover the following: 6,500 to repair the flood damage to the building 11.000 to replace the stock destroyed. The stock cost 8,000 and had a sales 17,500 value of 11,000. No accounting entry was made for the 17,500 insurance receipt. vi. GoCycle Lid paid two donations to "Sports relief, a national UK registered charity. The first donation of 8,000 was paid during the financial year, a second donation of 6,000 on 4 April 2021. Both donations were expensed in the financial accounts by including a 6,000 accrual for the second donation which was still unpaid at the year end. vii. The tax written down values of the capital allowance pools at 1 April 2020 were: 135,200 main pool and 57,400 special rate pool. In May 2020 GoCycle Lid sold a van for 6,000 which originally cost 11,000 when bought by the company in April 2018. In July 2020 GoCycle Ltd purchased a new fork- lift truck for 45,000 with an expected useful life of 10 years and CO2 emissions of 145g/km. No other group companies made capital acquisitions during the accounting period. viii. On 27 April 2020 GoCycle Lid sold the small warehouse to Goalee Ltd for 350,000. The market value of the warehouse at the time of disposal was 450,000, GoCycle Ltd purchased the property in September 2010 for 425,000. No account has been taken for this disposal in the accounting profit figure of 983,275 for the year and no capital allowances were claimed on any aspect of the property. x Since 1 April 2020, FooTee Ltd has been selling t-shirts to Goal.ee Ltd for onwards sale to their goal post customers. During the year, FooTee's relevant VAT exclusive sales to Goalee totalled 25.000, of which 60% were adult t-shirts and 40% were children's t-shirts TABLE OF 2020/21 TAX RATES AND ALLOWANCES The current rates and allowances for income tax, corporation twcapital gains tax, inheritance tax and other tre set out below Income tax rates*** Noosaving Sean Dividende 0-02.000 ON E0 BH 2,097,400 20% 20 7.5 (37.501 - 150.000 40 2. Owr 150.000 45 own we province de ce le aldon 1.200 lenalitial . www.200.000 2019/20 *** The Wales and SIT-C.-19.-20. 21-08-2-1500-4.00 Personal income tax allowances 2020/21 2019/20 Ince Income tax ac Palawan 12.500 12.500 Income limit personal allowance 100.000 100.000 o Tremble lanserted coupled 1.250 1.250 Income mire te away 10.200 29.000 100 Duvidance 2.000 2.000 Pernal sing alone Bukan 100 1.000 Higherren 500 500 0 Blind person's awance 2.500 2450 Income tax reliefs and incentives: annual limits 2020/21 2019/20 Individual Swings Account (ISA 20,000 20,000 June ISA 9.000 4,164 Lifetime ISA 4.000 4.000 Chi Trust Fund 9.000 4,165 Enterprise en chew (ES) 2,000,000 2,000,000 Seed Enterprise investment scheme SELS) 100.000 100.000 Venture Capital (VT) 200.000 200.000 Social netta SITR) 1.000.000 1,000,000 Tension scheme allowance Annual away 40,000 40,000 Lifetime alone 1.07.100 1.055.000 Approved mileage rates Flumine Mile Cars anilor 0-10.000 10.000 Motorcycles Alkan 45 25p 24 20p Excerymenter the rates we table Shontall can be daimoltax dief by the ple. If the employee carries another employee in their em car or an on a business found additional tas tree mentuf Supermeapple Car and fuel benefits in kind round neported Carbon dawn o find the correct percentage) Company cor benefiche (retred I 6 April 2020 - NEXC- 00 km Ticked Till Did 0 55 27 1 31 35 1 14 TH 90 13 135 3 51 15 19 95 24 25 140 55 16 100 25 29 145 37 17 21 105 26 150 35 32 15 27 110 27 31 155 57 19 115 28 52 20 24 25 10 14 SRA Company car benefit cum registered ur 6 April 2020-WLTP-nony CO Tale 00 T Tak km Ta tid med Dad Female De 55 20 24 IN 29 33 1 11 16 90 21 25 155 94 51 17 22 26 31 55 14 18 100 2 22 145 32 15 19 105 24 25 10 33 16 20 110 25 2 155 17 21 115 0 160 35 75 15 33 120 27 31 365 36 19 23 125 28 12 170- 1 ARE Company car benefit charpe Chycars with 20,