Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. Calculate the business income apportioned to State X. d. Determine the tax liability for State X for the entire group. Required information [The following

b. Calculate the business income apportioned to State X.

d. Determine the tax liability for State X for the entire group.

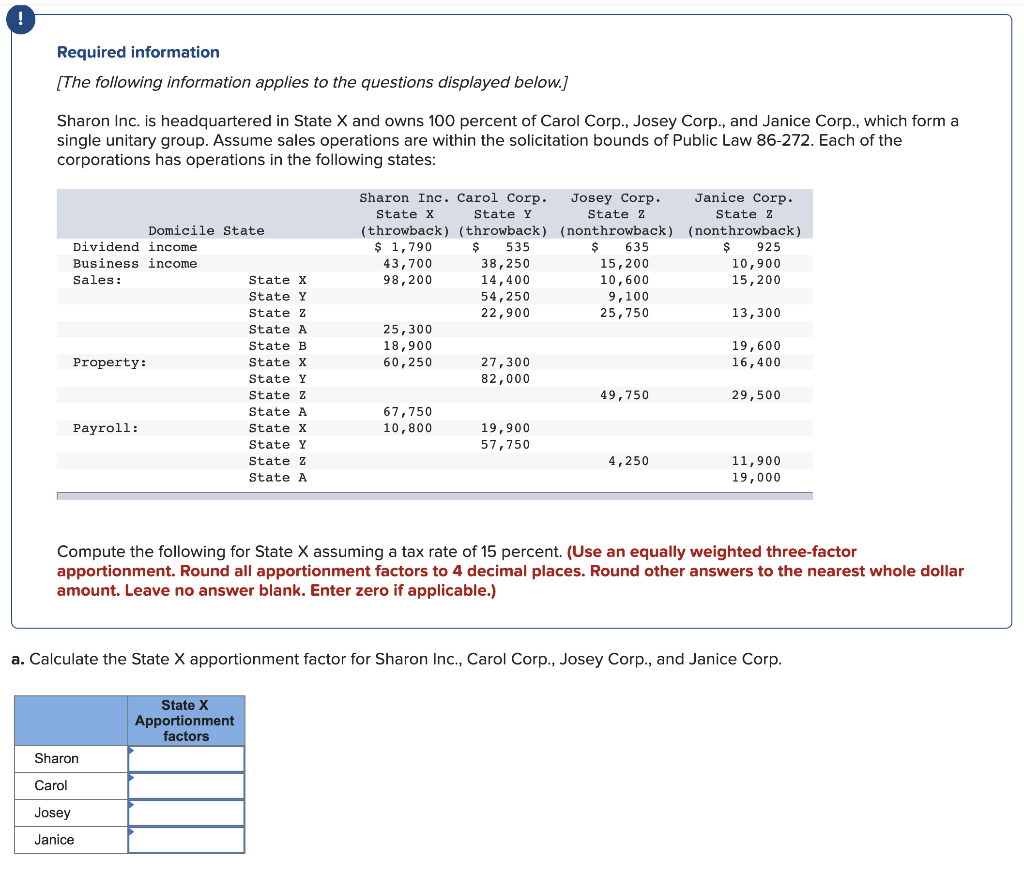

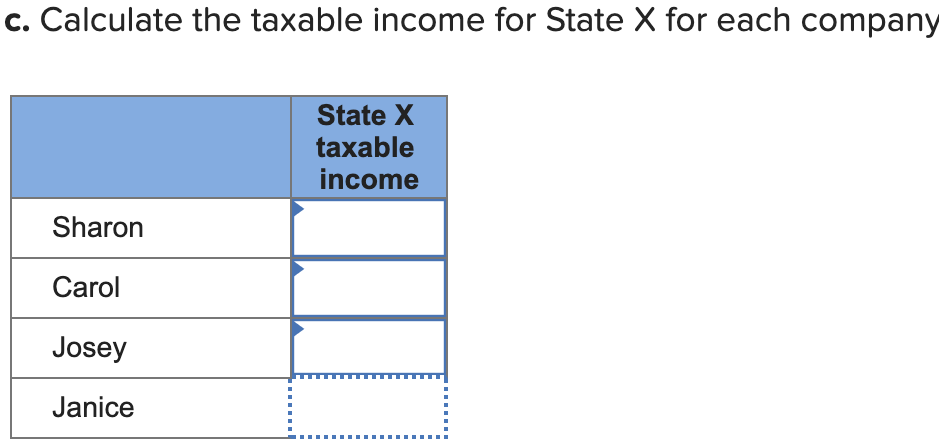

Required information [The following information applies to the questions displayed below.) Sharon Inc. is headquartered in State X and owns 100 percent of Carol Corp., Josey Corp., and Janice Corp., which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: 10,600 Domicile State Dividend income Business income Sales: State x State Y State z State A State B Property: x sustav State Y State z State A Payroll: State x State Y State z State A Sharon Inc. Carol Corp. Josey Corp. Janice Corp. State x State Y State z State Z (throwback) (throwback) (nonthrowback) (nonthrowback) $ 1,790 $ 535 $ 635 $ 925 43,700 38,250 15,200 10,900 98,200 14,400 15,200 54,250 9,100 22,900 25,750 13,300 25,300 18,900 19,600 60,250 27,300 16,400 82,000 49,750 29,500 67,750 10,800 19,900 57,750 4,250 11,900 19,000 State Compute the following for State X assuming a tax rate of 15 percent. (Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) a. Calculate the State X apportionment factor for Sharon Inc., Carol Corp., Josey Corp., and Janice Corp. State X Apportionment factors Sharon Carol Josey Janice c. Calculate the taxable income for State X for each company State X taxable income Sharon Carol Josey JaniceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started