Answered step by step

Verified Expert Solution

Question

1 Approved Answer

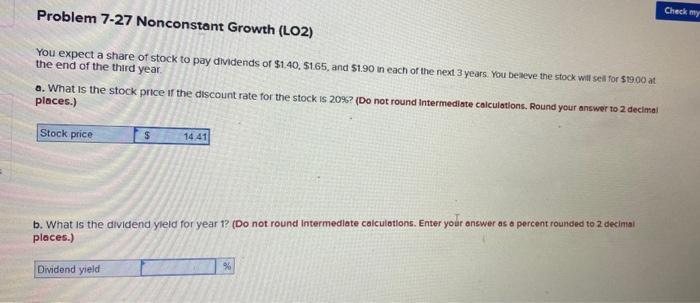

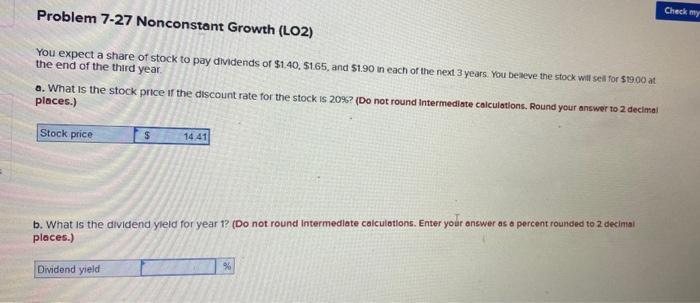

B? Check my Problem 7-27 Nonconstant Growth (LO2) You expect a share of stock to pay dividends of $1.40, 5165, and $1.90 in each of

B?

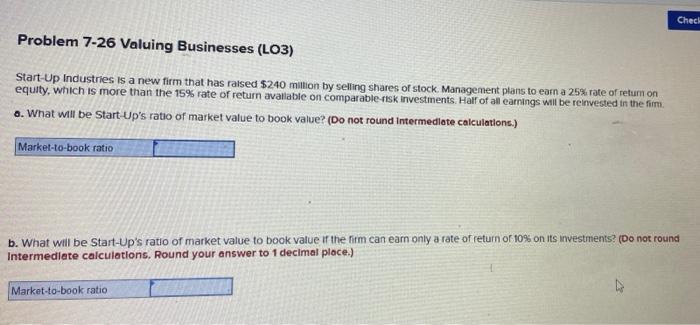

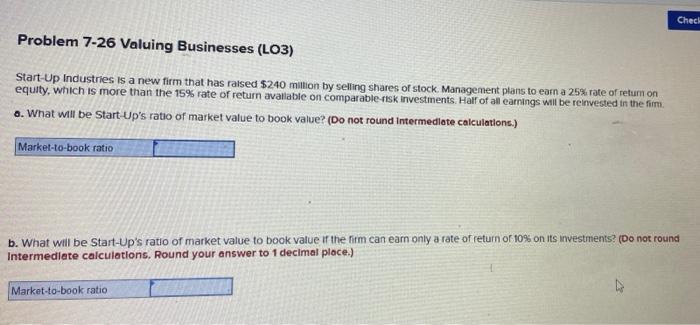

Check my Problem 7-27 Nonconstant Growth (LO2) You expect a share of stock to pay dividends of $1.40, 5165, and $1.90 in each of the next 3 years. You beseve the stock will sell for $19.00 at the end of the third year. a. What is the stock price if the discount rate for the stock is 20%? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Stock price $ 14 41 b. What is the dividend yield for year 1? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Dividend yield % Chech Problem 7-26 Valuing Businesses (L03) Start-Up Industries is a new firm that has raised $240 million by selling shares of stock. Management plans to earn a 25% rate of return on equity, which is more than the 15% rate of return available on comparable risk investments. Half of all earnings will be reinvested in the fim. a. What will be Start-Up's ratio of market value to book value? (Do not round Intermediate calculations.) Market-to-book ratio b. What will be Start-Up's ratio of market value to book value if the firm can earn only a rate of return of 10% on its investments? (Do not round Intermediate calculations. Round your answer to 1 decimal ploce.) Market-to-book ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started