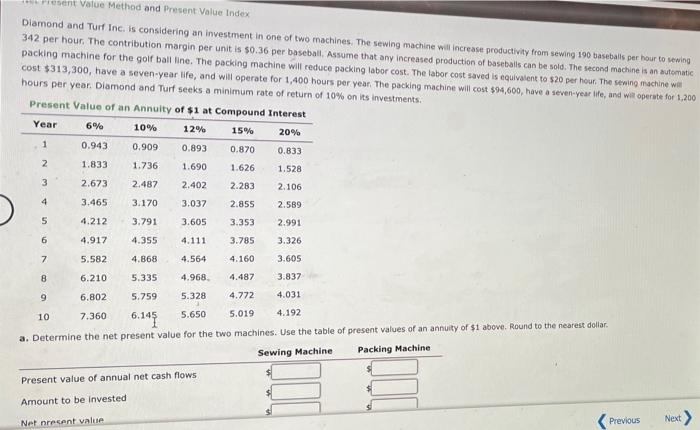

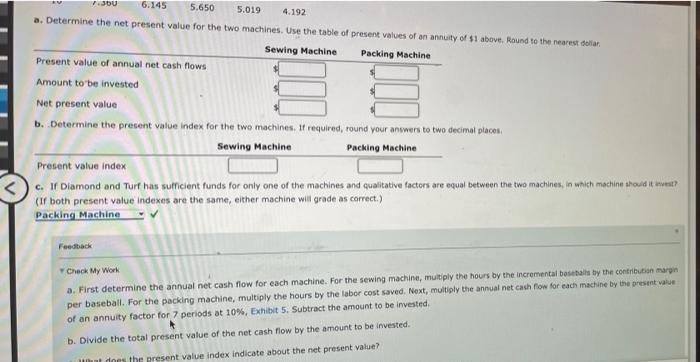

Present Value Method and Present Value Index Diamond and Turf Inc. is considering an investment in one of two machines. The sewing machine will increase productivity from sewing 190 baseballs per hour to sewing 342 per hour. The contribution margin per unit is $0.36 per baseball, Assume that any increased production of baseballs can be sold. The second machine is an automatic packing machine for the golf ball line. The packing machine will reduce packing labor cost. The labor cost saved is equivalent to $20 per hour The sewing machine wa cost $313,300, have a seven-year life, and will operate for 1,400 hours per year. The packing machine will cost $94,600, have a seven-year life, and will operate for 1.200 hours per year. Diamond and Turf seeks a minimum rate of return of 10% on its investments, Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 5.650 5.019 4.192 6.145 a. Determine the net present value for the two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar Sewing Machine Packing Machine Present value of annual net cash flows Amount to be invested Net recent value 1 Previous Next 1.360 6.145 5.650 5.019 4.192 a. Determine the net present value for the two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar Sewing Machine Packing Machine Present value of annual net cash flows Amount to be invested Net present value b. Determine the present value index for the two machines. It required, round your answers to two decimal places Sewing Machine Packing Machine Present value index c. If Diamond and Turf has sufficient funds for only one of the machines and qualitative factors are equal between the two machines, in which machine should it anwest? (If both present value indexes are the same, either machine will grade as correct.) Packing Machine Feedback Check My Work a. First determine the annual net cash flow for each machine. For the sewing machine, multiply the hours by the incremental botas by the contribution margin per baseball. For the packing machine, multiply the hours by the labor cost saved. Next, multiply the annual net cash flow for each machine by the presente of an annuity factor for 7 periods at 10%, Exhibit 5. Subtract the amount to be invested, b. Divide the total present value of the net cash flow by the amount to be invested. What does the present value index indicate about the net present value