Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. Clamentine Berhad had undergone an aggressive financial strategy, the growth rate of dividend is expected to grow rapidly over the next three years at

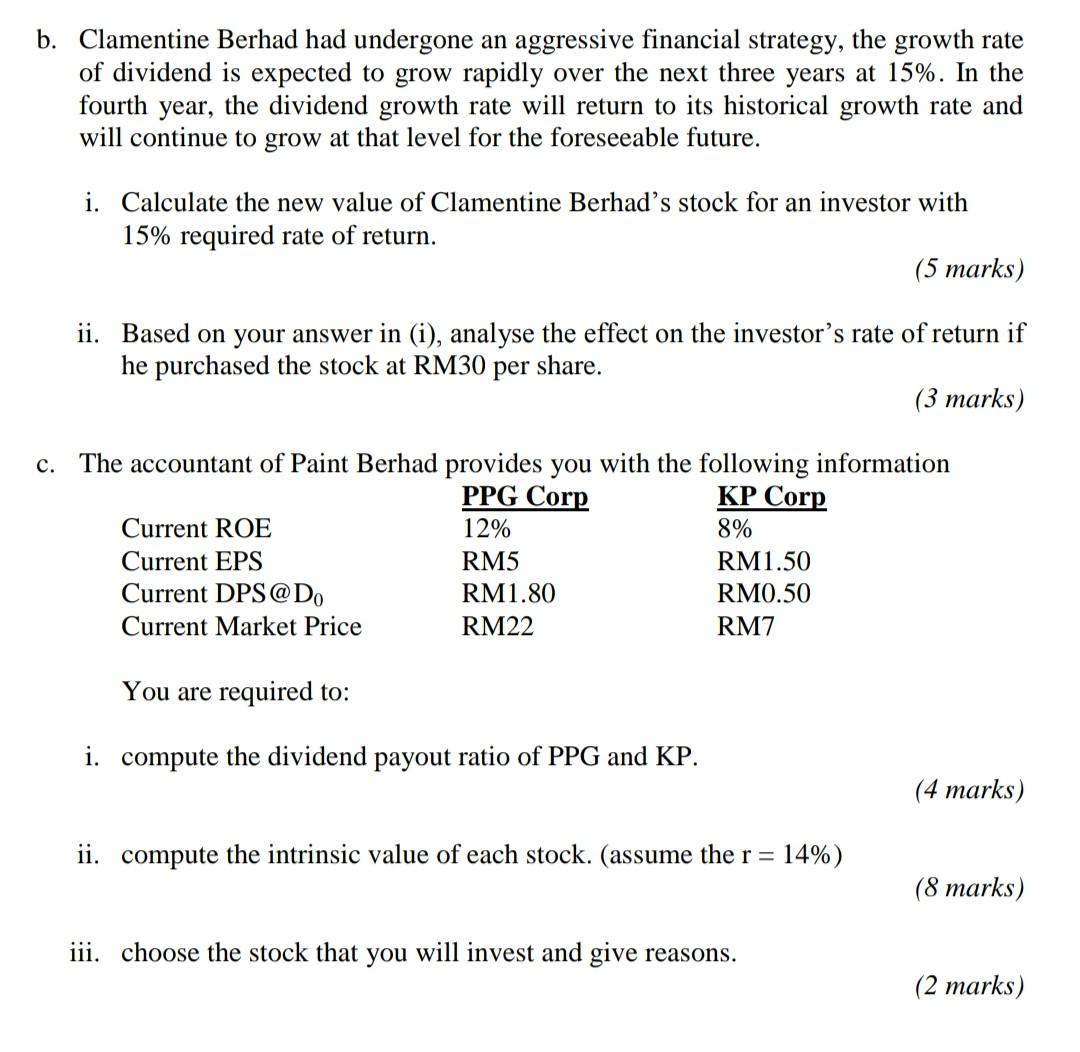

b. Clamentine Berhad had undergone an aggressive financial strategy, the growth rate of dividend is expected to grow rapidly over the next three years at 15%. In the fourth year, the dividend growth rate will return to its historical growth rate and will continue to grow at that level for the foreseeable future. i. Calculate the new value of Clamentine Berhad's stock for an investor with 15% required rate of return. (5 marks) ii. Based on your answer in (i), analyse the effect on the investor's rate of return if he purchased the stock at RM30 per share. (3 marks) c. accountant of Paint Berhad provides you with the following information PPG Corp KP Corp Current ROE 12% 8% Current EPS RM5 RM1.50 Current DPS@Do RM1.80 RM0.50 Current Market Price RM22 RM7 You are required to: i. compute the dividend payout ratio of PPG and KP. (4 marks) ii. compute the intrinsic value of each stock. (assume the r = 14%) (8 marks) iii. choose the stock that you will invest and give reasons. (2 marks) b. Clamentine Berhad had undergone an aggressive financial strategy, the growth rate of dividend is expected to grow rapidly over the next three years at 15%. In the fourth year, the dividend growth rate will return to its historical growth rate and will continue to grow at that level for the foreseeable future. i. Calculate the new value of Clamentine Berhad's stock for an investor with 15% required rate of return. (5 marks) ii. Based on your answer in (i), analyse the effect on the investor's rate of return if he purchased the stock at RM30 per share. (3 marks) c. accountant of Paint Berhad provides you with the following information PPG Corp KP Corp Current ROE 12% 8% Current EPS RM5 RM1.50 Current DPS@Do RM1.80 RM0.50 Current Market Price RM22 RM7 You are required to: i. compute the dividend payout ratio of PPG and KP. (4 marks) ii. compute the intrinsic value of each stock. (assume the r = 14%) (8 marks) iii. choose the stock that you will invest and give reasons. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started