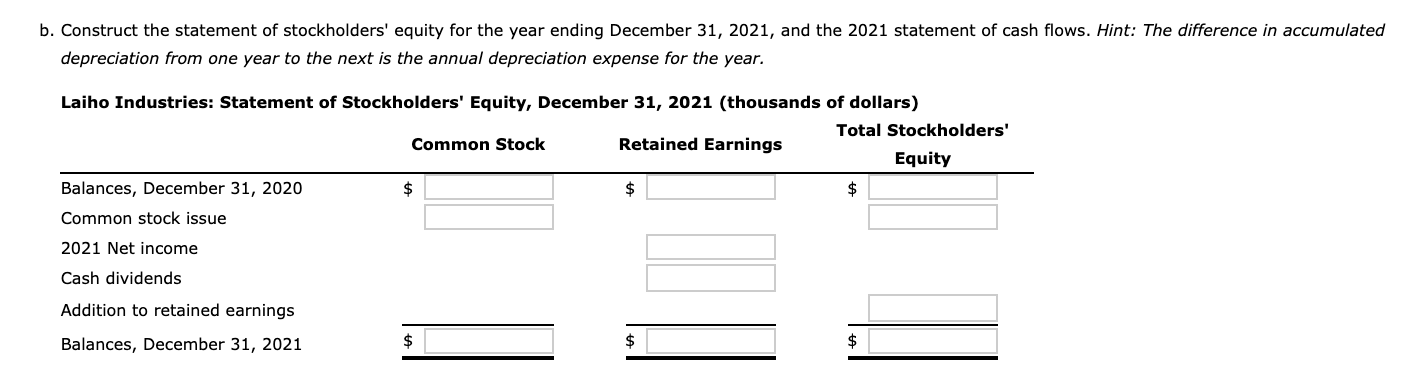

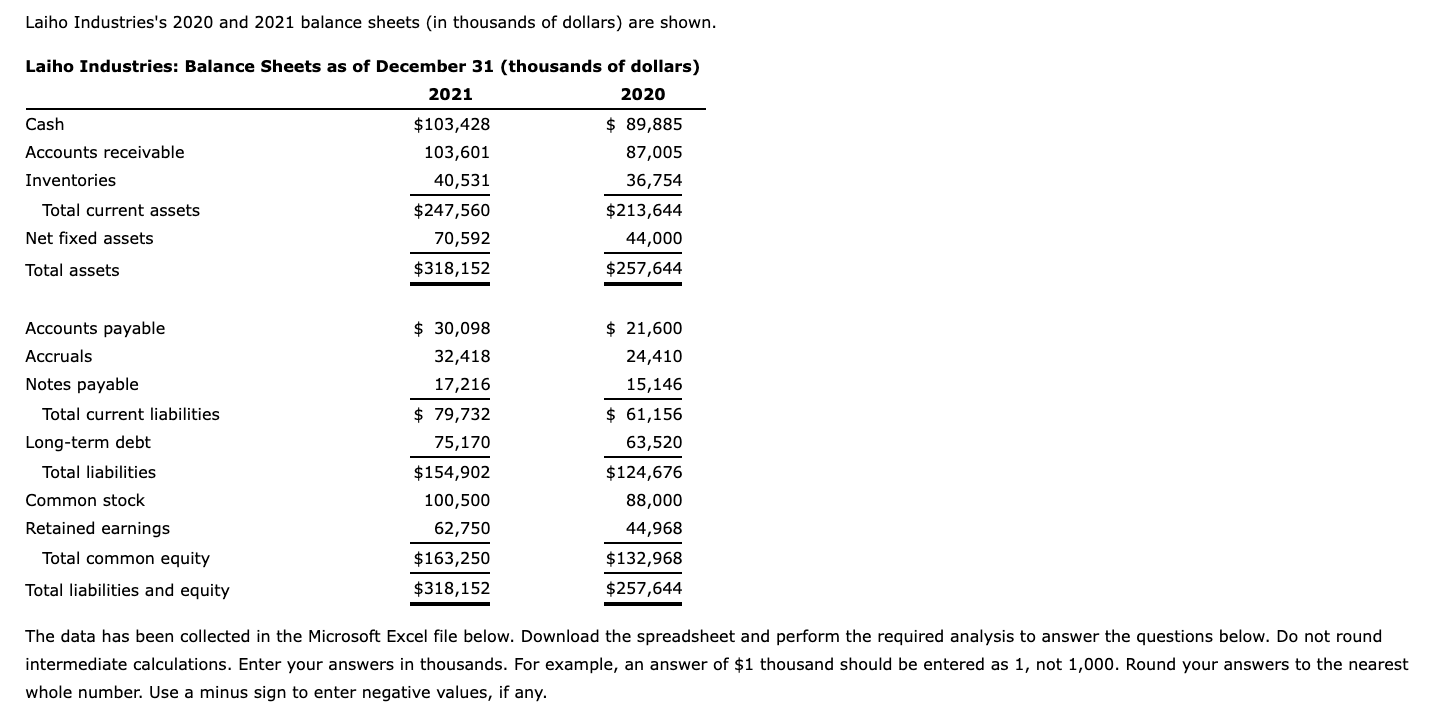

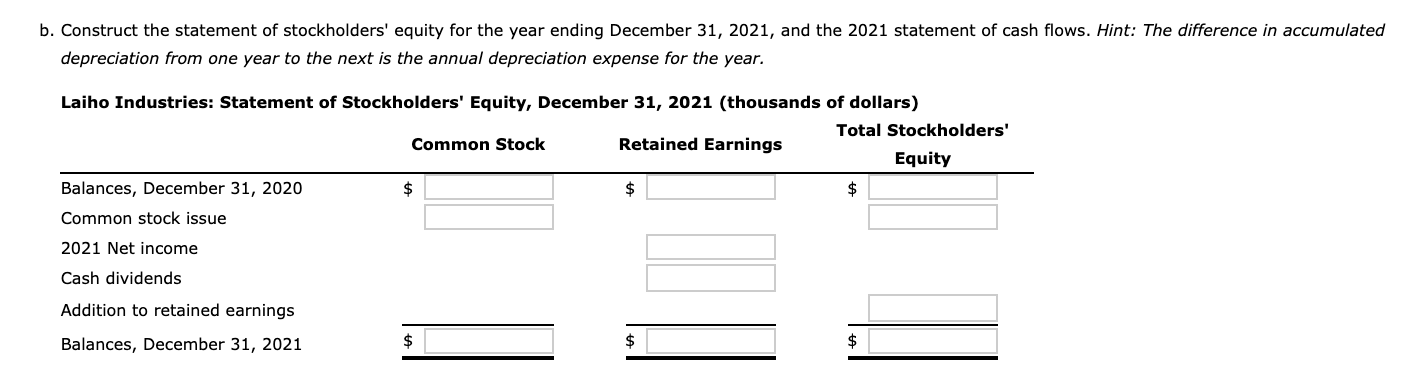

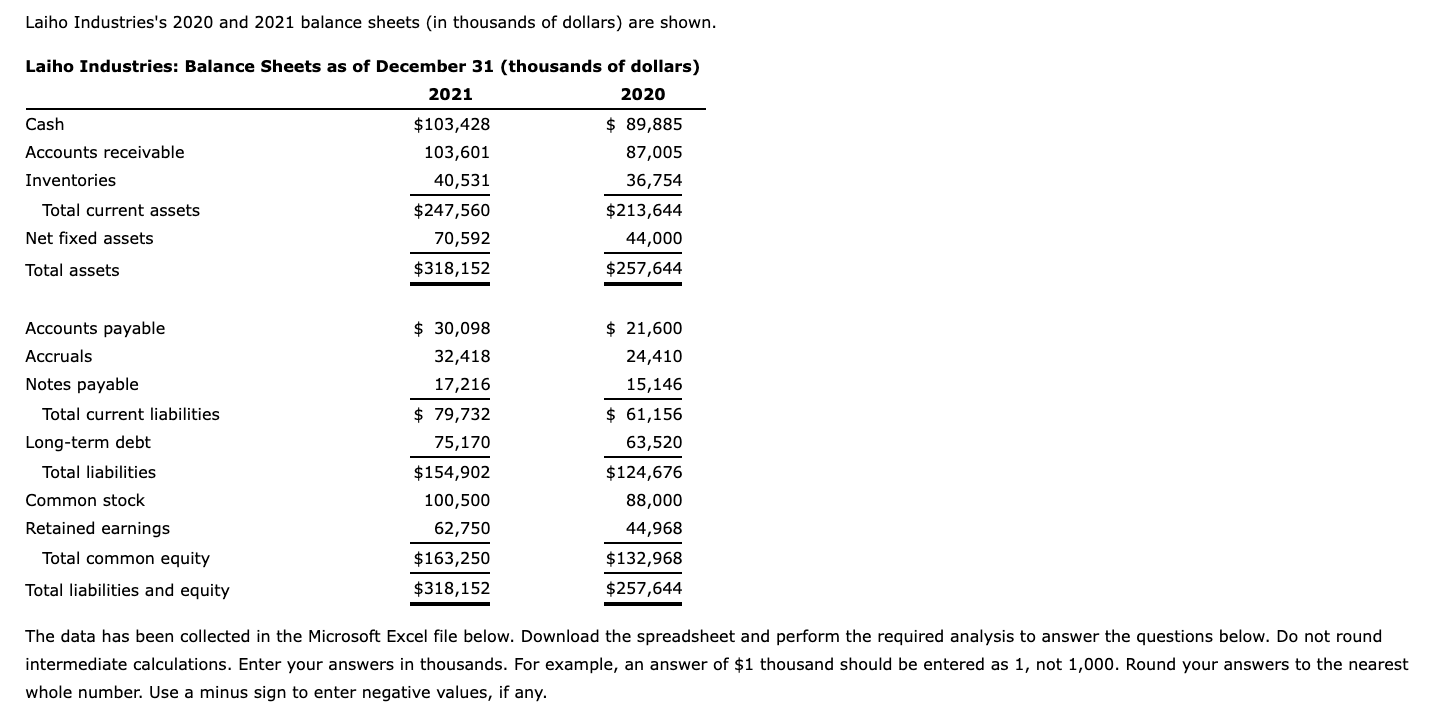

b. Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows. Hint: The difference in accumulated depreciation from one year to the next is the annual depreciation expense for the year. Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 (thousands of dollars) Total Stockholders' Common Stock Retained Earnings Equity Balances, December 31, 2020 $ $ $ Common stock issue 2021 Net income Cash dividends Addition to retained earnings Balances, December 31, 2021 $ $ Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. Laiho Industries: Balance Sheets as of December 31 (thousands of dollars) 2021 2020 Cash $103,428 $ 89,885 Accounts receivable 103,601 87,005 Inventories 40,531 36,754 Total current assets $247,560 $213,644 Net fixed assets 70,592 44,000 Total assets $318,152 $257,644 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 30,098 32,418 17,216 $ 79,732 75,170 $154,902 100,500 62,750 $163,250 $318,152 $ 21,600 24,410 15,146 $ 61,156 63,520 $ 124,676 88,000 44,968 $132,968 $257,644 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $1 thousand should be entered as 1, not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any. b. Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows. Hint: The difference in accumulated depreciation from one year to the next is the annual depreciation expense for the year. Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 (thousands of dollars) Total Stockholders' Common Stock Retained Earnings Equity Balances, December 31, 2020 $ $ $ Common stock issue 2021 Net income Cash dividends Addition to retained earnings Balances, December 31, 2021 $ $ Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. Laiho Industries: Balance Sheets as of December 31 (thousands of dollars) 2021 2020 Cash $103,428 $ 89,885 Accounts receivable 103,601 87,005 Inventories 40,531 36,754 Total current assets $247,560 $213,644 Net fixed assets 70,592 44,000 Total assets $318,152 $257,644 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 30,098 32,418 17,216 $ 79,732 75,170 $154,902 100,500 62,750 $163,250 $318,152 $ 21,600 24,410 15,146 $ 61,156 63,520 $ 124,676 88,000 44,968 $132,968 $257,644 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $1 thousand should be entered as 1, not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any