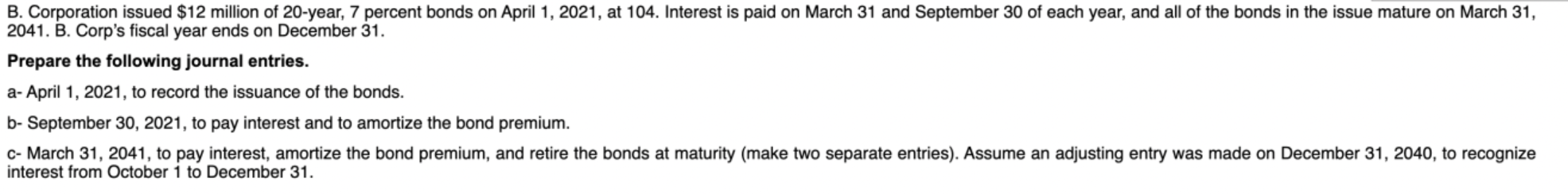

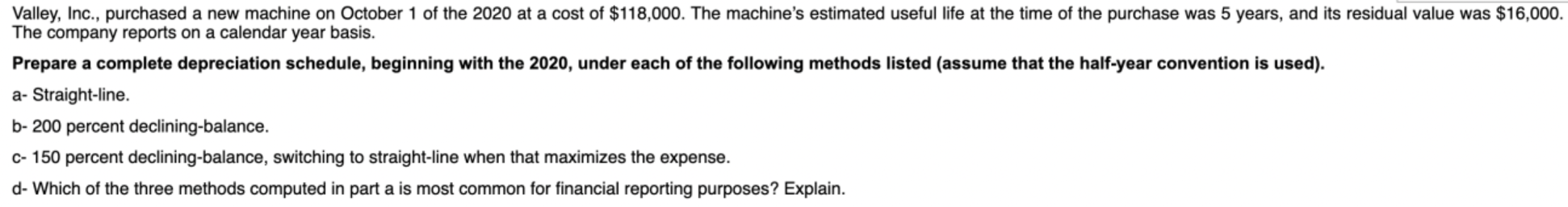

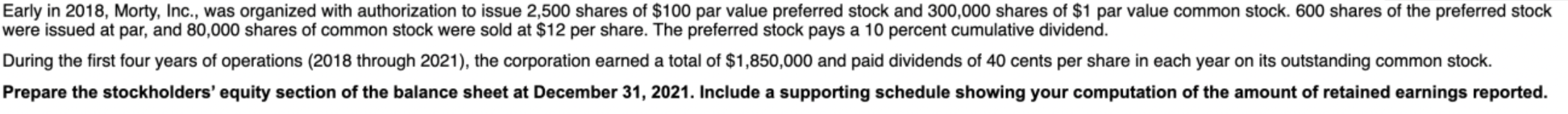

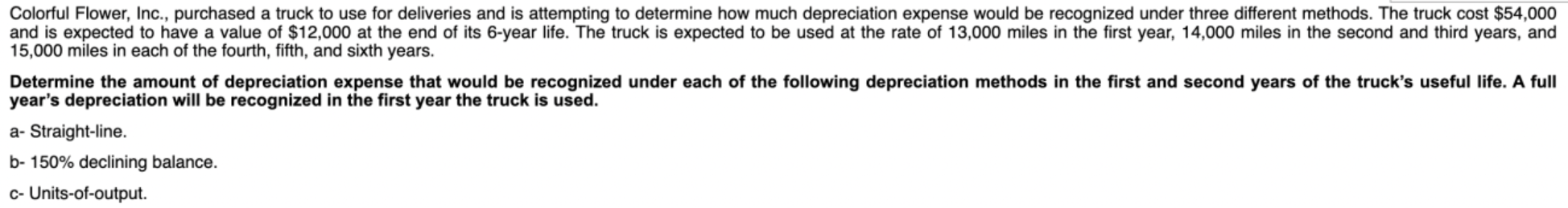

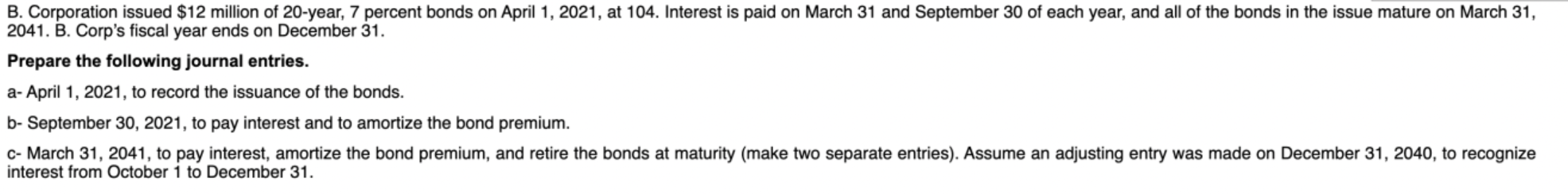

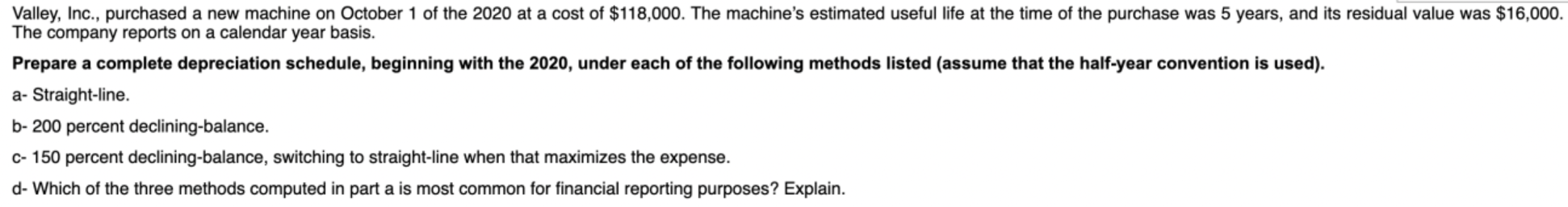

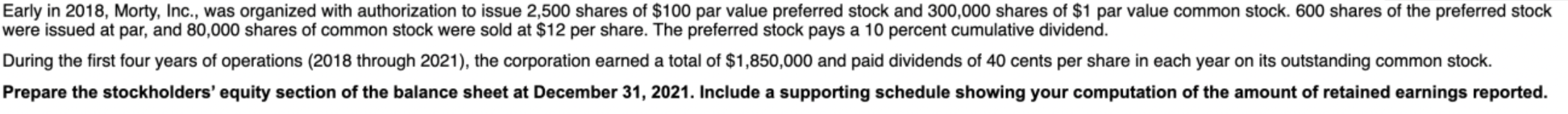

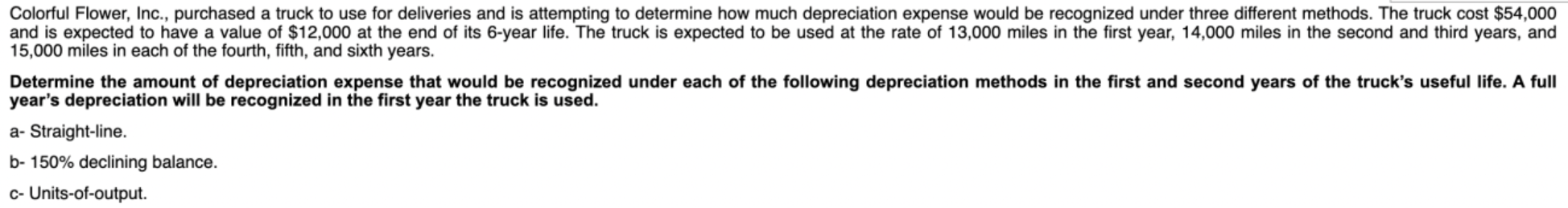

B. Corporation issued $12 million of 20 -year, 7 percent bonds on April 1,2021 , at 104 . Interest is paid on March 31 and September 30 of each year, and all of the bonds in the issue mature on March 31 , 2041. B. Corp's fiscal year ends on December 31 . Prepare the following journal entries. a- April 1,2021 , to record the issuance of the bonds. b- September 30,2021 , to pay interest and to amortize the bond premium. c- March 31,2041 , to pay interest, amortize the bond premium, and retire the bonds at maturity (make two separate entries). Assume an adjusting entry was made on December 31 , 2040, to recognize interest from October 1 to December 31 . Valley, Inc., purchased a new machine on October 1 of the 2020 at a cost of $118,000. The machine's estimated useful life at the time of the purchase was 5 years, and its residual value was $16,000 The company reports on a calendar year basis. Prepare a complete depreciation schedule, beginning with the 2020, under each of the following methods listed (assume that the half-year convention is used). a- Straight-line. b- 200 percent declining-balance. c- 150 percent declining-balance, switching to straight-line when that maximizes the expense. d- Which of the three methods computed in part a is most common for financial reporting purposes? Explain. Early in 2018 , Morty, Inc., was organized with authorization to issue 2,500 shares of $100 par value preferred stock and 300,000 shares of $1 par value common stock. 600 shares of the preferred stock were issued at par, and 80,000 shares of common stock were sold at $12 per share. The preferred stock pays a 10 percent cumulative dividend. During the first four years of operations (2018 through 2021), the corporation earned a total of $1,850,000 and paid dividends of 40 cents per share in each year on its outstanding common stock. Prepare the stockholders' equity section of the balance sheet at December 31,2021 . Include a supporting schedule showing your computation of the amount of retained earnings reported. Colorful Flower, Inc., purchased a truck to use for deliveries and is attempting to determine how much depreciation expense would be recognized under three different methods. The truck cost $54,000 and is expected to have a value of $12,000 at the end of its 6-year life. The truck is expected to be used at the rate of 13,000 miles in the first year, 14,000 miles in the second and third years, and 15,000 miles in each of the fourth, fifth, and sixth years. Determine the amount of depreciation expense that would be recognized under each of the following depreciation methods in the first and second years of the truck's useful life. A full year's depreciation will be recognized in the first year the truck is used. a- Straight-line. b- 150% declining balance. c- Units-of-output