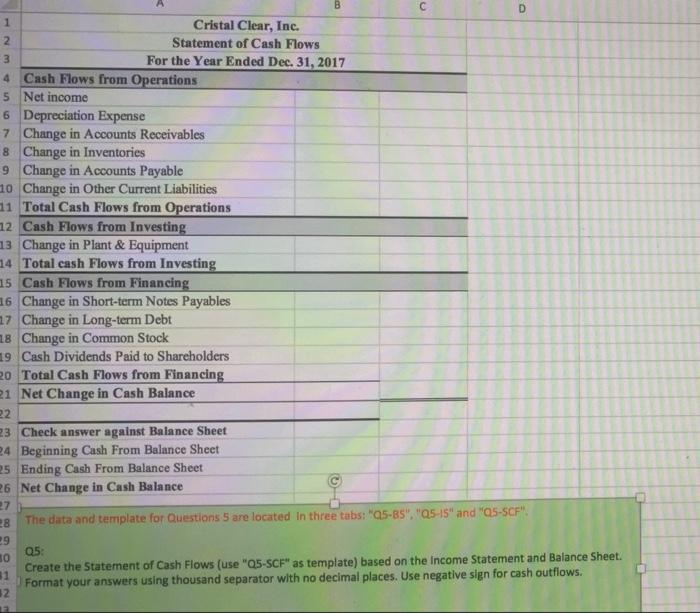

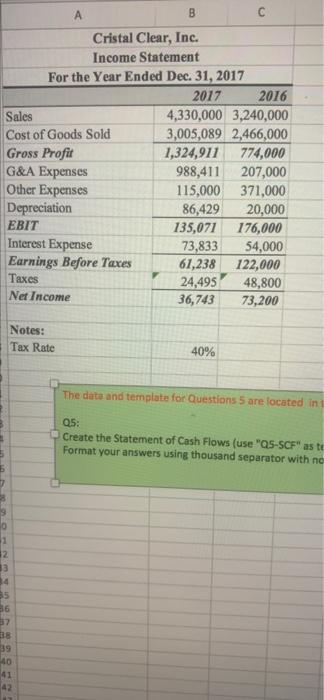

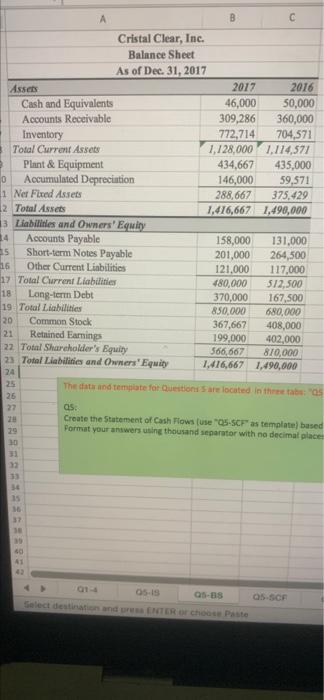

B Cristal Clear, Inc. Statement of Cash Flows For the Year Ended Dec. 31, 2017 C D 1 2 3 4 Cash Flows from Operations 5 Net income 6 Depreciation Expense 7 Change in Accounts Receivables Change in Inventories 8 9 Change in Accounts Payable 10 Change in Other Current Liabilities 11 Total Cash Flows from Operations 12 Cash Flows from Investing 13 Change in Plant & Equipment 14 Total cash Flows from Investing 15 Cash Flows from Financing 16 Change in Short-term Notes Payables 17 Change in Long-term Debt 18 Change in Common Stock 19 Cash Dividends Paid to Shareholders 20 Total Cash Flows from Financing 21 Net Change in Cash Balance 22 23 Check answer against Balance Sheet 24 Beginning Cash From Balance Sheet 25 Ending Cash From Balance Sheet 26 Net Change in Cash Balance 27 28 The data and template for Questions 5 are located in three tabs: "Q5-BS", "Q5-IS" and "Q5-SCF". 29 Q5: 50 81 Create the Statement of Cash Flows (use "Q5-SCF" as template) based on the Income Statement and Balance Sheet. Format your answers using thousand separator with no decimal places. Use negative sign for cash outflows. 12 $2 83 35 36 37 38 39 B Cristal Clear, Inc. Income Statement For the Year Ended Dec. 31, 2017 2017 2016 4,330,000 3,240,000 3,005,089 2,466,000 1,324,911 774,000 988,411 207,000 115,000 371,000 86,429 20,000 135,071 176,000 73,833 54,000 61,238 122,000 24,495 48,800 36,743 73,200 40% The data and template for Questions 5 are located in t Q5: Create the Statement of Cash Flows (use "QS-SCF" as to Format your answers using thousand separator with no Sales Cost of Goods Sold Gross Profit G&A Expenses Other Expenses Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net Income Notes: Tax Rate 40 41 42 A Assets C283=3E 37 Cash and Equivalents Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation 0 1 Net Fixed Assets 2 Total Assets 3 Liabilities and Owners' Equity Accounts Payable 14 15 Short-term Notes Payable Other Current Liabilities 16 17 Total Current Liabilities Long-term Debt 18 19 Total Liabilities 20 Common Stock 21 Retained Earnings 22 Total Shareholder's Equity 23 Total Liabilities and Owners' Equity 24 25 26 27 28 29 30 31 32 33 34 35 36 39 40 C 2017 2016 46,000 50,000 309,286 360,000 772,714 704,571 1,128,000 1,114,571 434,667 435,000 146,000 59,571 288,667 375,429 1,416,667 1,490,000 158,000 131,000 201,000 264,500 121,000 117,000 480,000 512,500 370,000 167,500 850,000 680,000 367,667 408,000 199,000 402,000 566,667 810,000 1,416,667 1,490,000 The data and template for Questions 5 are located in three tabs: "05 as: Create the Statement of Cash Flows (use "Q5-SCF" as template) based Format your answers using thousand separator with no decimal places 4 718 05-BS 05-15 Select destination and press ENTER or choose Paste Q5-SCF 41 42 A Cristal Clear, Inc. Balance Sheet As of Dec. 31, 2017