Answered step by step

Verified Expert Solution

Question

1 Approved Answer

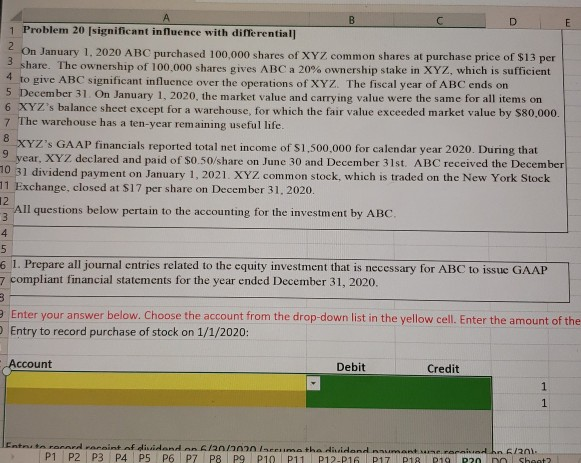

B D 8 9 E 1 Problem 20 [significant influence with differential 2 On January 1, 2020 ABC purchased 100,000 shares of XYZ common shares

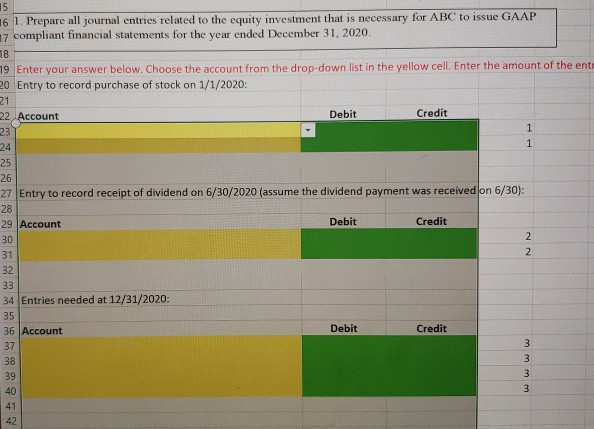

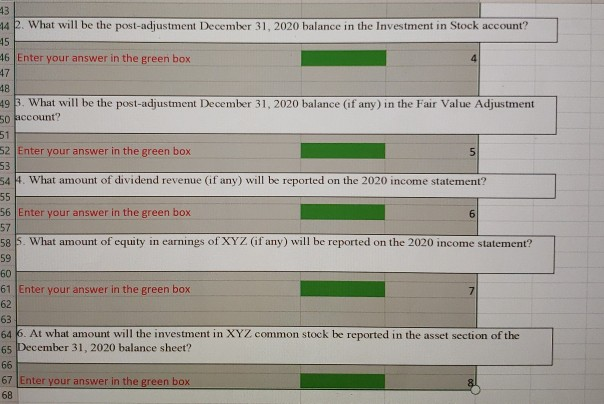

B D 8 9 E 1 Problem 20 [significant influence with differential 2 On January 1, 2020 ABC purchased 100,000 shares of XYZ common shares at purchase price of $13 per 3 share. The ownership of 100,000 shares gives ABC a 20% ownership stake in XYZ, which is sufficient 4 to give ABC significant influence over the operations of XYZ. The fiscal year of ABC ends on 5 December 31. On January 1, 2020, the market value and carrying value were the same for all items on 6 XYZ's balance sheet except for a warehouse, for which the fair value exceeded market value by $80,000. 7 The warehouse has a ten-year remaining useful life. XYZ'S GAAP financials reported total net income of S1,500,000 for calendar year 2020. During that year, XYZ declared and paid of $0.50/share on June 30 and December 31st. ABC received the December 70 31 dividend payment on January 1, 2021. XYZ common stock, which is traded on the New York Stock 11 Exchange, closed at $17 per share on December 31, 2020. 12 All questions below pertain to the accounting for the investment by ABC 3 4 5 6 1. Prepare all journal entries related to the equity investment that is necessary for ABC to issue GAAP 7 compliant financial statements for the year ended December 31, 2020. 3 Enter your answer below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the Entry to record purchase of stock on 1/1/2020: Account Debit Credit 1 1 Entext ronrraceint af dividend on 6/2n/309 Inme the dividend numante rarnarhn 6/201. P1 P2 P3 P4 P5 P6 P7 P8 P9 P10 P11 P12-P16 P17 P18 19 D20 D Sheet 15 16 1. Prepare all journal entries related to the equity investment that is necessary for ABC to issue GAAP 17 compliant financial statements for the year ended December 31, 2020. 18 79 Enter your answer below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the ent 20 Entry to record purchase of stock on 1/1/2020: 21 22 Account Debit Credit 23 1 24 1 25 26 27 Entry to record receipt of dividend on 6/30/2020 (assume the dividend payment was received on 6/30): 28 29 Account Debit Credit 30 2 31 2 32 33 34 Entries needed at 12/31/2020: 35 36 Account Debit Credit 37 3 38 3 39 3 40 41 42 NN 43 14. What will be the post-adjustment December 31, 2020 balance in the Investment in Stock account? 45 46 Enter your answer in the green box 4 47 48 49. What will be the post-adjustment December 31, 2020 balance (if any) in the Fair Value Adjustment 50 account? 51 52. Enter your answer in the green box 5 53 54. What amount of dividend revenue (if any) will be reported on the 2020 income statement? 55 56 Enter your answer in the green box 6 57 58 5. What amount of equity in earnings of XYZ (if any) will be reported on the 2020 income statement? 59 60 61 Enter your answer in the green box 7 62 63 64 6. At what amount will the investment in XYZ common stock be reported in the asset section of the 65 December 31, 2020 balance sheet? 66 67 Enter your answer in the green box 68

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started