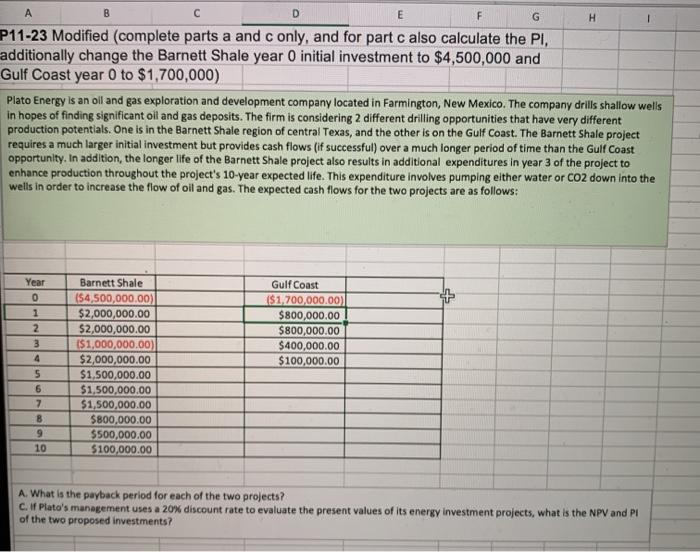

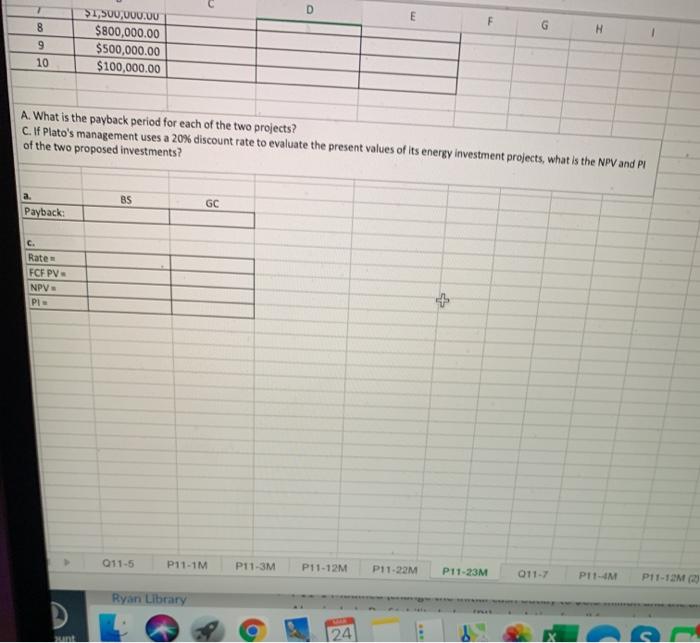

B D E F A G H P11-23 Modified (complete parts a and c only, and for part c also calculate the PI. additionally change the Barnett Shale year O initial investment to $4,500,000 and Gulf Coast year 0 to $1,700,000) Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drills shallow wells in hopes of finding significant oil and gas deposits. The firm is considering 2 different drilling opportunities that have very different production potentials. One is in the Barnett Shale region of central Texas, and the other is on the Gulf Coast. The Barnett Shale project requires a much larger initial investment but provides cash flows (if successful) over a much longer period of time than the Gulf Coast opportunity. In addition, the longer life of the Barnett Shale project also results in additional expenditures in year 3 of the project to enhance production throughout the project's 10-year expected life. This expenditure involves pumping either water or CO2 down into the wells in order to increase the flow of oil and gas. The expected cash flows for the two projects are as follows: Year 0 1 2 3 Barnett Shale (54,500,000.00) $2,000,000.00 $2,000,000.00 1$1,000,000.00) $2,000,000.00 $1,500,000.00 $1,500,000.00 $1,500,000.00 $800,000.00 $500,000.00 $100,000.00 Gulf Coast ($1.700,000,00) $800,000.00 $800,000.00 $400,000.00 $100,000.00 5 6 7 B 9 10 A. What is the payback period for each of the two projects? C. If Plato's management uses a 20% discount rate to evaluate the present values of its energy investment projects, what is the NPV and PI of the two proposed investments? D E F 7 8 9 H $1,500,000.00 $800,000.00 $500,000.00 $100,000.00 10 A. What is the payback period for each of the two projects? C. If Plato's management uses a 20% discount rate to evaluate the present values of its energy investment projects, what is the NPV and PI of the two proposed investments? BS a. Payback GC C. Rate FCFPV NPV PI + 011-5 P11-1M P11-3M P11-12M P11-22M P11-23M 011-7 PIM P111M (2) Ryan Library D 24 d