Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) d) e) f) Determine the product costs per unit using the existing cost accounting system. Show as clearly as possible all the intermediate

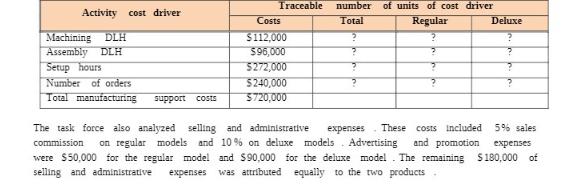

b) d) e) f) Determine the product costs per unit using the existing cost accounting system. Show as clearly as possible all the intermediate steps for allocations , including departmental cost driver (allocation base) rates and a breakdown of product costs into each of their components Determine the product costs and profits per unit using the new activity -based costing system. Show as clearly as possible all the intermediate steps, including the cost driver rates and components of product costs. Specify all the assumptions you make. Why do you think Alice, Inc. uses the number of setup hours [instead of the number of setups ] as the cost driver measure for the machine setup activity ? Explain the principal reasons that the old cost accounting system at Alice, Inc. may be distorting its product costs and profitability. Support your answer with numbers when necessary - Discuss, in great detail, to what extent the new cost accounting system at Alice, Inc. may be characterized as an ABC system. Analyze the profitability of the two products. What insight is provided by the new profitability analysis ? What should Alice, Inc. do to enhance its profitability ? What options may be available ? Ryan O'Reilley is a marketing manager with considerable experience as a salesper son. Discuss how he is likely to react to your analysis and recommendations Activity cost driver Machining DLH Assembly DLH Setup hours Number of orders Total manufacturing support costs Traceable number of units of cost driver Total Regular Costs $112,000 $96,000 $272,000 $240,000 $720,000 ? ? ? ? The task force also analyzed selling and administrative expenses These costs included. commission on regular models and 10% on deluxe models Advertising and promotion Deluxe ? ? ? ? 5% sales expenses were $50,000 for the regular model and $90,000 for the deluxe model. The remaining $180,000 of selling and administrative expenses was attributed equally to the two products

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To address the questions and perform the analysis we need specific data on the number of units produced for each product the number of setups and the number of setup hours for each product Additionall...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started