Answered step by step

Verified Expert Solution

Question

1 Approved Answer

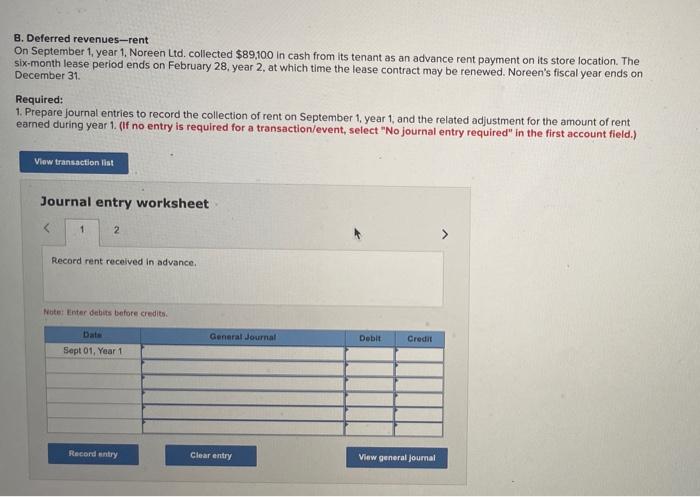

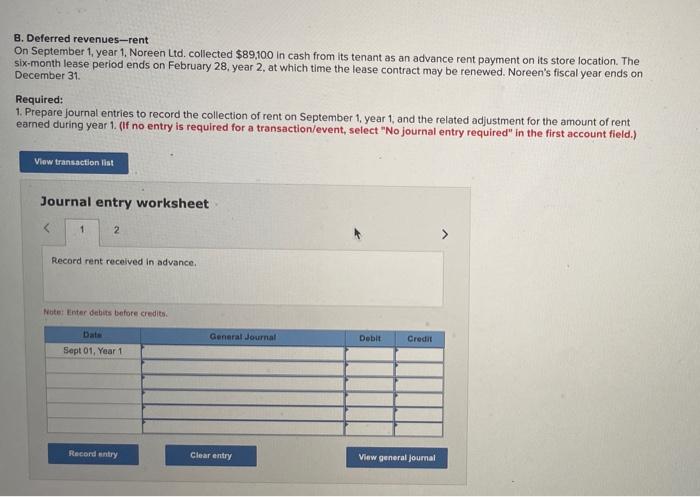

B. Deferred revenues-rent On September 1, year 1. Noreen Ltd. collected $89,100 in cash from its tenant as an advance rent payment on its store

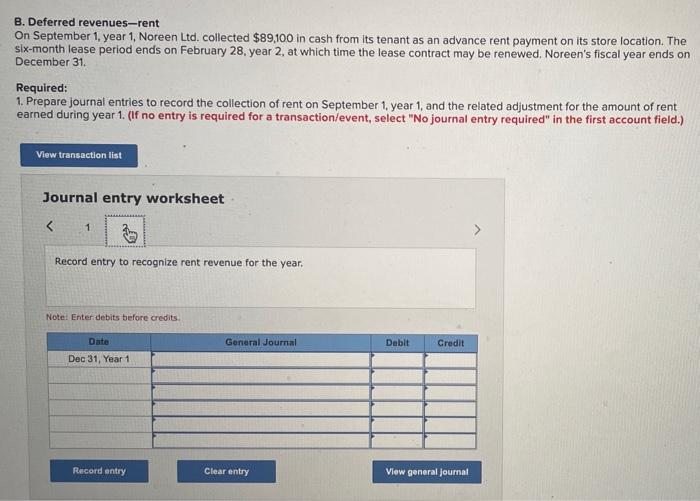

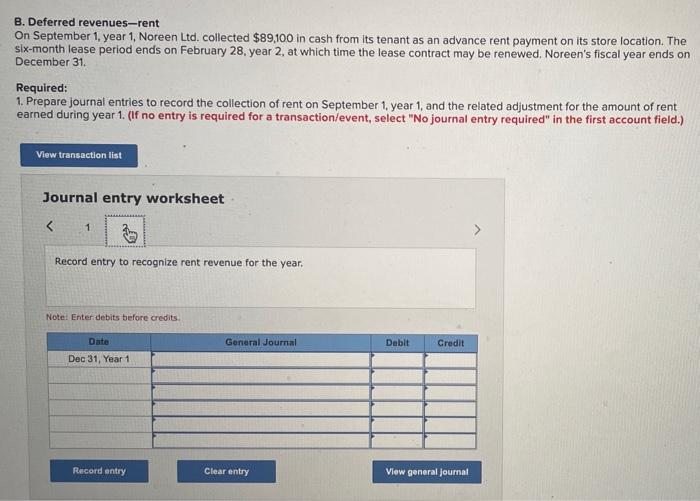

B. Deferred revenues-rent On September 1, year 1. Noreen Ltd. collected $89,100 in cash from its tenant as an advance rent payment on its store location. The six-month lease period ends on February 28, year 2, at which time the lease contract may be renewed. Noreen's fiscal year ends on December 31 . Required: 1. Prepare journal entries to record the collection of rent on September 1, year 1 , and the related adjustment for the amount of rent eamed during year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet B. Deferred revenues-rent On September 1, year 1, Noreen Ltd. collected $89,100 in cash from its tenant as an advance rent payment on its store location. The six-month lease period ends on February 28, year 2, at which time the lease contract may be renewed. Noreen's fiscal year ends on December 31. Required: 1. Prepare journal entries to record the collection of rent on September 1 y year 1 , and the related adjustment for the amount of rent earned during year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to recognize rent revenue for the year. Note: Enter debits before credits

B. Deferred revenues-rent On September 1, year 1. Noreen Ltd. collected $89,100 in cash from its tenant as an advance rent payment on its store location. The six-month lease period ends on February 28, year 2, at which time the lease contract may be renewed. Noreen's fiscal year ends on December 31 . Required: 1. Prepare journal entries to record the collection of rent on September 1, year 1 , and the related adjustment for the amount of rent eamed during year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet B. Deferred revenues-rent On September 1, year 1, Noreen Ltd. collected $89,100 in cash from its tenant as an advance rent payment on its store location. The six-month lease period ends on February 28, year 2, at which time the lease contract may be renewed. Noreen's fiscal year ends on December 31. Required: 1. Prepare journal entries to record the collection of rent on September 1 y year 1 , and the related adjustment for the amount of rent earned during year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to recognize rent revenue for the year. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started