Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. Determine Alpine Tourss sales and cost of goods sold for September. Sales: cost of goods sold: c. Calculate Alpine Tourss gross profit as a

b. Determine Alpine Tourss sales and cost of goods sold for September.

Sales:

cost of goods sold:

c. Calculate Alpine Tourss gross profit as a dollar amount and the gross profit margin as a percentage. (Round gross profit margin to 1 decimal place, e.g. 15.2%.)

gross profit:

gross profit margin:

Please help me to solve B&C, thanks!

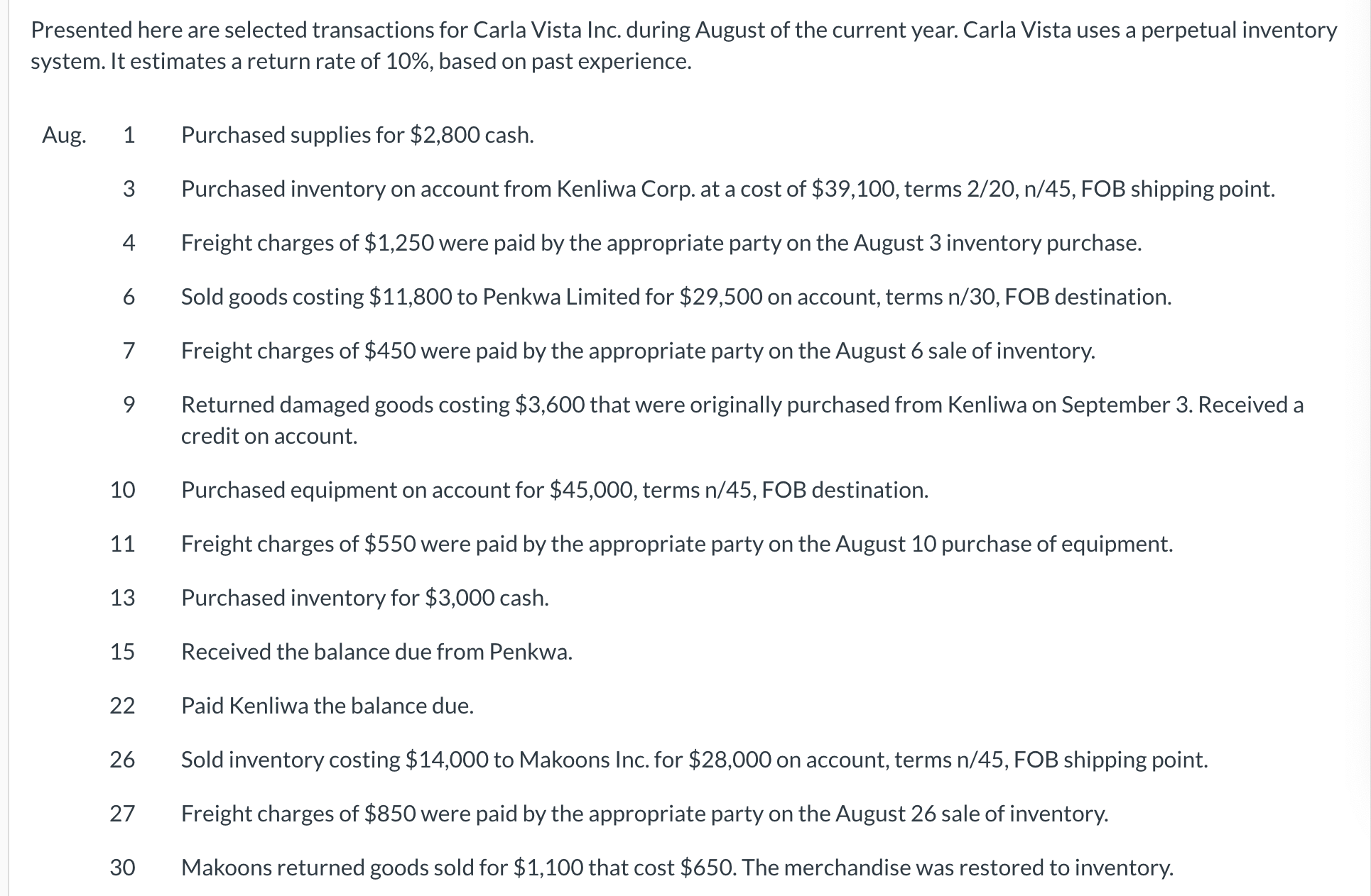

Presented here are selected transactions for Carla Vista Inc. during August of the current year. Carla Vista uses a perpetual inventc system. It estimates a return rate of 10%, based on past experience. Aug. 1 Purchased supplies for $2,800 cash. 3 Purchased inventory on account from Kenliwa Corp. at a cost of $39,100, terms 2/20, n/45, FOB shipping point. 4 Freight charges of $1,250 were paid by the appropriate party on the August 3 inventory purchase. 6 Sold goods costing $11,800 to Penkwa Limited for $29,500 on account, terms n/30, FOB destination. 7 Freight charges of $450 were paid by the appropriate party on the August 6 sale of inventory. 9 Returned damaged goods costing $3,600 that were originally purchased from Kenliwa on September 3. Received a credit on account. 10 Purchased equipment on account for $45,000, terms n/45, FOB destination. 11 Freight charges of $550 were paid by the appropriate party on the August 10 purchase of equipment. 13 Purchased inventory for $3,000 cash. 15 Received the balance due from Penkwa. 22 Paid Kenliwa the balance due. 26 Sold inventory costing $14,000 to Makoons Inc. for $28,000 on account, terms n/45, FOB shipping point. 27 Freight charges of $850 were paid by the appropriate party on the August 26 sale of inventory. 30 Makoons returned goods sold for $1,100 that cost $650. The merchandise was restored to inventoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started