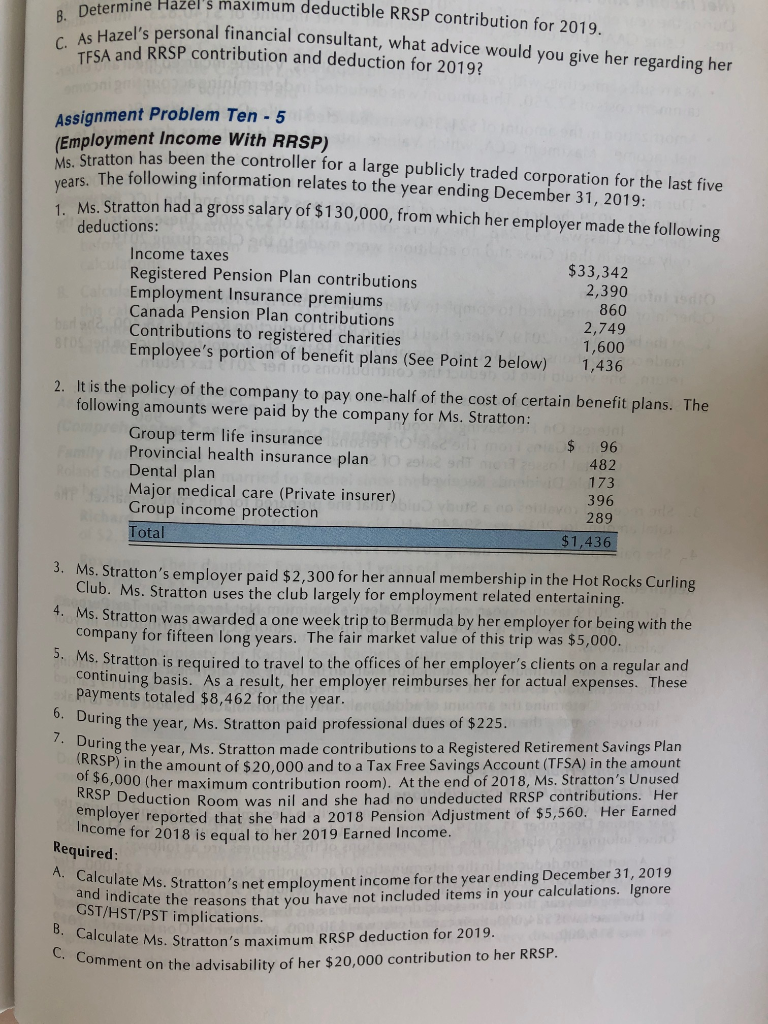

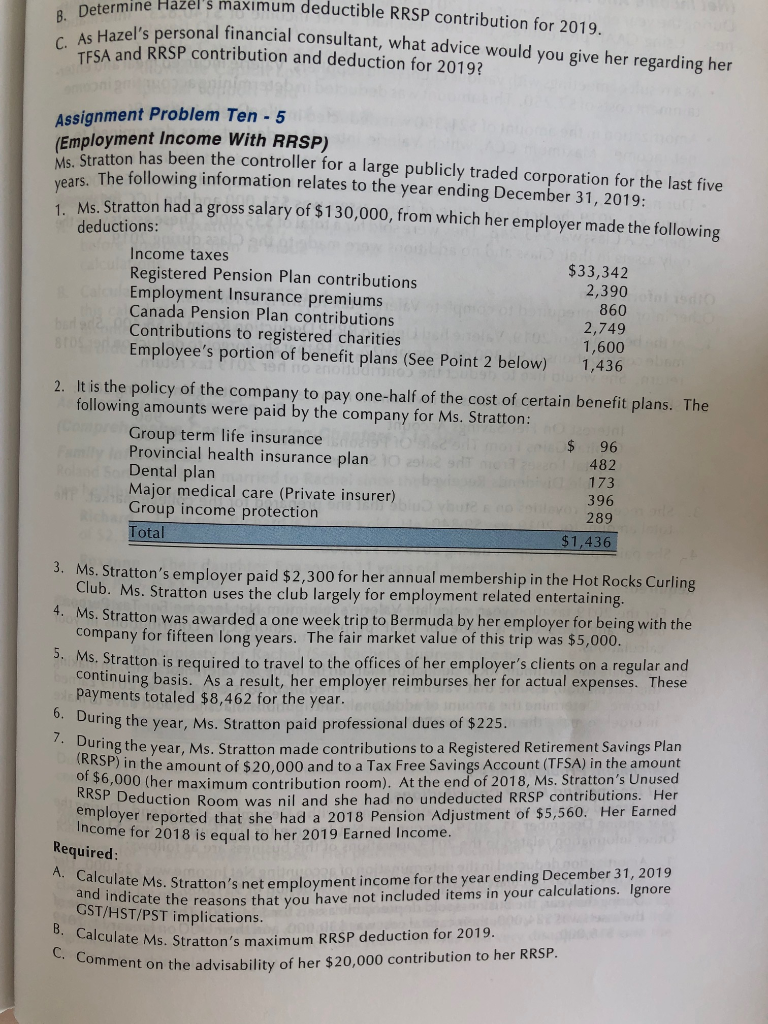

B. Determine Hazel's maximum deductible RRSP contribution for 2019. TFSA and RRSP contribution and deduction for 2019? Assignment Problem Ten - 5 (Employment Income With RRSP) Ms. Stratton has been the controller for a large publicly traded corporation for the last five years. The following information relates to the year ending December 31, 2019: 1. Ms. Stratton had a gross salary of $130,000, from which her employer made the following deductions: Income taxes Registered Pension Plan contributions Employment Insurance premiums Canada Pension Plan contributions Contributions to registered charities Bros Employee's portion of benefit plans (See Point 2 below) $33,342 2,390 860 2,749 1,600 1,436 96 2. It is the policy of the company to pay one-half of the cost of certain benefit plans. The following amounts were paid by the company for Ms. Stratton: Group term life insurance $ Provincial health insurance plano 482 Dental plan 173 Major medical care (Private insurer) 396 Group income protection 289 $1,436 Total 3. Ms. Stratton's employer paid $2,300 for her annual membership in the Hot Rocks Curling Club. Ms. Stratton uses the club largely for employment related entertaining. 4. Ms. Stratton was awarded a one week trip to Bermuda by her employer for being with the company for fifteen long years. The fair market value of this trip was $5,000. 5. Ms. Stratton is required to travel to the offices of her employer's clients on a regular and continuing basis. As a result, her employer reimburses her for actual expenses. These payments totaled $8,462 for the year. 6. During the year, Ms. Stratton paid professional dues of $225. 7. During the year, Ms. Stratton made contributions to a Registered Retirement Savings Plan (RRSP) in the amount of $20,000 and to a Tax Free Savings Account (TFSA) in the amount of $6,000 (her maximum contribution room). At the end of 2018, Ms. Stratton's Unused RRSP Deduction Room was nil and she had no undeducted RRSP contributions. Her employer reported that she had a 2018 Pension Adjustment of $5,560. Her Earned Income for 2018 is equal to her 2019 Earned Income. A. Calculate Ms. Stratton's net employment income for the year ending December 31, 2019 and indicate the reasons that you have not included items in your calculations. Ignore GST/HST/PST implications. B. Calculate Ms. Stratton's maximum RRSP deduction for 2019. C. Comment on the advisability of her $20,000 contribution to her RRSP. Required: B. Determine Hazel's maximum deductible RRSP contribution for 2019. TFSA and RRSP contribution and deduction for 2019? Assignment Problem Ten - 5 (Employment Income With RRSP) Ms. Stratton has been the controller for a large publicly traded corporation for the last five years. The following information relates to the year ending December 31, 2019: 1. Ms. Stratton had a gross salary of $130,000, from which her employer made the following deductions: Income taxes Registered Pension Plan contributions Employment Insurance premiums Canada Pension Plan contributions Contributions to registered charities Bros Employee's portion of benefit plans (See Point 2 below) $33,342 2,390 860 2,749 1,600 1,436 96 2. It is the policy of the company to pay one-half of the cost of certain benefit plans. The following amounts were paid by the company for Ms. Stratton: Group term life insurance $ Provincial health insurance plano 482 Dental plan 173 Major medical care (Private insurer) 396 Group income protection 289 $1,436 Total 3. Ms. Stratton's employer paid $2,300 for her annual membership in the Hot Rocks Curling Club. Ms. Stratton uses the club largely for employment related entertaining. 4. Ms. Stratton was awarded a one week trip to Bermuda by her employer for being with the company for fifteen long years. The fair market value of this trip was $5,000. 5. Ms. Stratton is required to travel to the offices of her employer's clients on a regular and continuing basis. As a result, her employer reimburses her for actual expenses. These payments totaled $8,462 for the year. 6. During the year, Ms. Stratton paid professional dues of $225. 7. During the year, Ms. Stratton made contributions to a Registered Retirement Savings Plan (RRSP) in the amount of $20,000 and to a Tax Free Savings Account (TFSA) in the amount of $6,000 (her maximum contribution room). At the end of 2018, Ms. Stratton's Unused RRSP Deduction Room was nil and she had no undeducted RRSP contributions. Her employer reported that she had a 2018 Pension Adjustment of $5,560. Her Earned Income for 2018 is equal to her 2019 Earned Income. A. Calculate Ms. Stratton's net employment income for the year ending December 31, 2019 and indicate the reasons that you have not included items in your calculations. Ignore GST/HST/PST implications. B. Calculate Ms. Stratton's maximum RRSP deduction for 2019. C. Comment on the advisability of her $20,000 contribution to her RRSP. Required