Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Does the market prediction (based on the forward rate) imply an appreciation or depreciation in the Australian dollar in relation to the Euro?

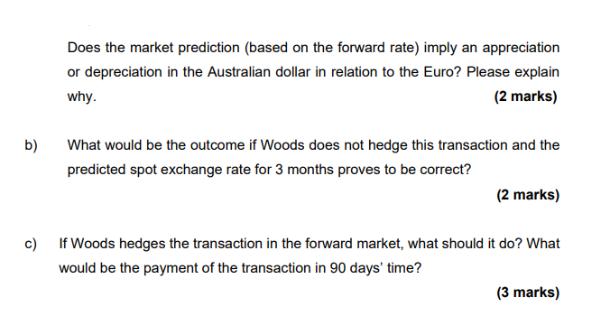

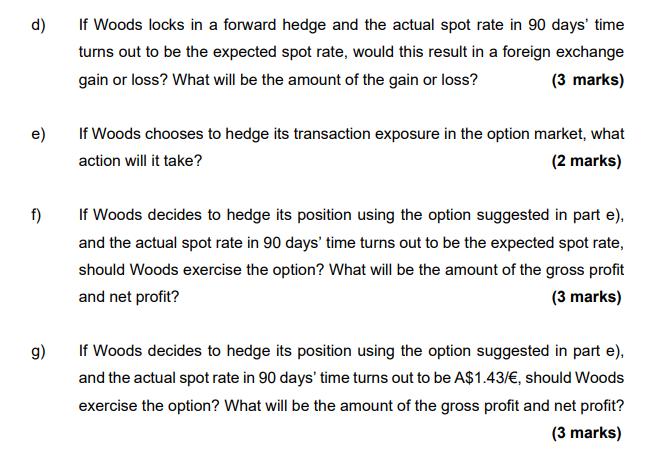

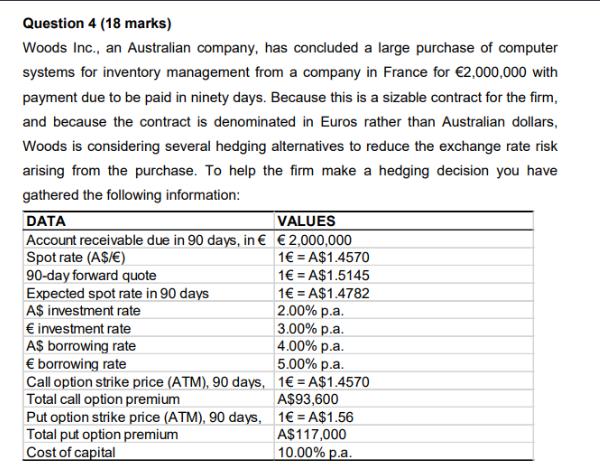

b) Does the market prediction (based on the forward rate) imply an appreciation or depreciation in the Australian dollar in relation to the Euro? Please explain why. (2 marks) What would be the outcome if Woods does not hedge this transaction and the predicted spot exchange rate for 3 months proves to be correct? (2 marks) c) If Woods hedges the transaction in the forward market, what should it do? What would be the payment of the transaction in 90 days' time? (3 marks) d) e) f) g) If Woods locks in a forward hedge and the actual spot rate in 90 days' time turns out to be the expected spot rate, would this result in a foreign exchange gain or loss? What will be the amount of the gain or loss? (3 marks) If Woods chooses to hedge its transaction exposure in the option market, what action will it take? (2 marks) If Woods decides to hedge its position using the option suggested in part e), and the actual spot rate in 90 days' time turns out to be the expected spot rate, should Woods exercise the option? What will be the amount of the gross profit and net profit? (3 marks) If Woods decides to hedge its position using the option suggested in part e), and the actual spot rate in 90 days' time turns out to be A$1.43/, should Woods exercise the option? What will be the amount of the gross profit and net profit? (3 marks) Question 4 (18 marks) Woods Inc., an Australian company, has concluded a large purchase of computer systems for inventory management from a company in France for 2,000,000 with payment due to be paid in ninety days. Because this is a sizable contract for the firm, and because the contract is denominated in Euros rather than Australian dollars, Woods is considering several hedging alternatives to reduce the exchange rate risk arising from the purchase. To help the firm make a hedging decision you have gathered the following information: DATA VALUES Account receivable due in 90 days, in 2,000,000 Spot rate (A$/) 90-day forward quote Expected spot rate in 90 days A$ investment rate investment rate A$ borrowing rate borrowing rate Call option strike price (ATM), 90 days, Total call option premium Put option strike price (ATM), 90 days, Total put option premium Cost of capital 1 = A$1.4570 1 = A$1.5145 1 = A$1.4782 2.00% p.a. 3.00% p.a. 4.00% p.a. 5.00% p.a. 1 = A$1.4570 A$93,600 1 =A$1.56 A$117,000 10.00% p.a. b) Does the market prediction (based on the forward rate) imply an appreciation or depreciation in the Australian dollar in relation to the Euro? Please explain why. (2 marks) What would be the outcome if Woods does not hedge this transaction and the predicted spot exchange rate for 3 months proves to be correct? (2 marks) c) If Woods hedges the transaction in the forward market, what should it do? What would be the payment of the transaction in 90 days' time? (3 marks) d) e) f) g) If Woods locks in a forward hedge and the actual spot rate in 90 days' time turns out to be the expected spot rate, would this result in a foreign exchange gain or loss? What will be the amount of the gain or loss? (3 marks) If Woods chooses to hedge its transaction exposure in the option market, what action will it take? (2 marks) If Woods decides to hedge its position using the option suggested in part e), and the actual spot rate in 90 days' time turns out to be the expected spot rate, should Woods exercise the option? What will be the amount of the gross profit and net profit? (3 marks) If Woods decides to hedge its position using the option suggested in part e), and the actual spot rate in 90 days' time turns out to be A$1.43/, should Woods exercise the option? What will be the amount of the gross profit and net profit? (3 marks) Question 4 (18 marks) Woods Inc., an Australian company, has concluded a large purchase of computer systems for inventory management from a company in France for 2,000,000 with payment due to be paid in ninety days. Because this is a sizable contract for the firm, and because the contract is denominated in Euros rather than Australian dollars, Woods is considering several hedging alternatives to reduce the exchange rate risk arising from the purchase. To help the firm make a hedging decision you have gathered the following information: DATA VALUES Account receivable due in 90 days, in 2,000,000 Spot rate (A$/) 90-day forward quote Expected spot rate in 90 days A$ investment rate investment rate A$ borrowing rate borrowing rate Call option strike price (ATM), 90 days, Total call option premium Put option strike price (ATM), 90 days, Total put option premium Cost of capital 1 = A$1.4570 1 = A$1.5145 1 = A$1.4782 2.00% p.a. 3.00% p.a. 4.00% p.a. 5.00% p.a. 1 = A$1.4570 A$93,600 1 =A$1.56 A$117,000 10.00% p.a.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer d If Woods locks in a forward hedge and the actual spot rate in 90 days time turns out to be the expected spot rate then Woods will realize a g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started