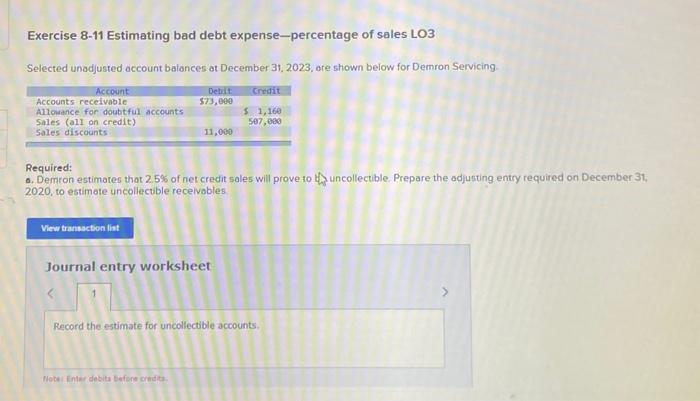

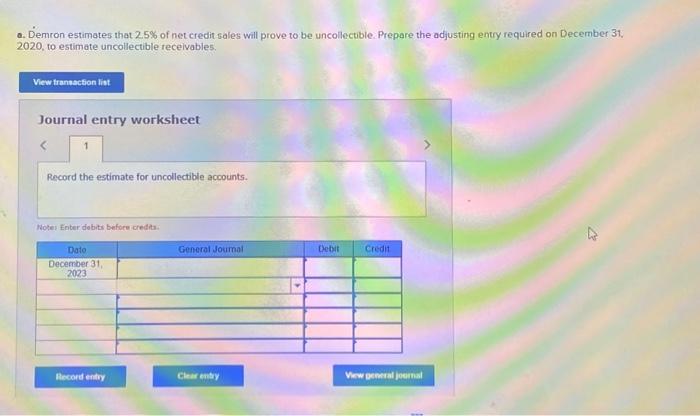

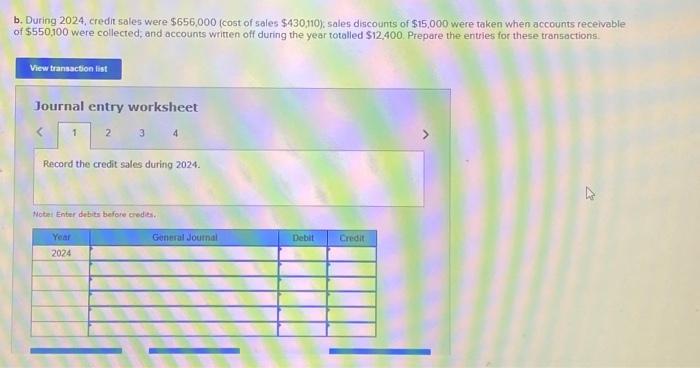

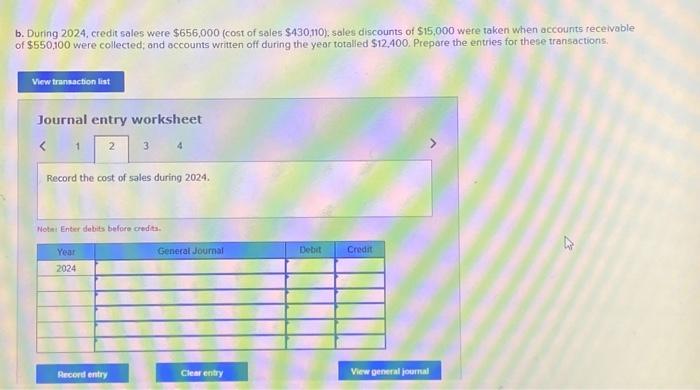

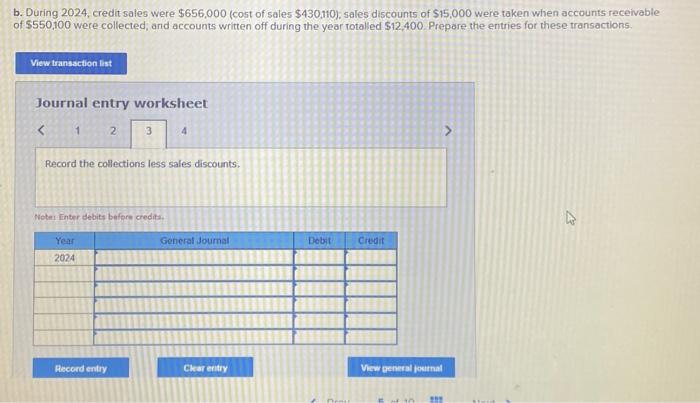

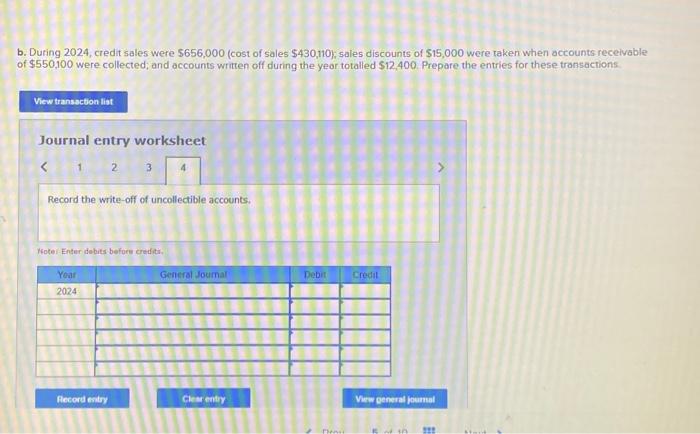

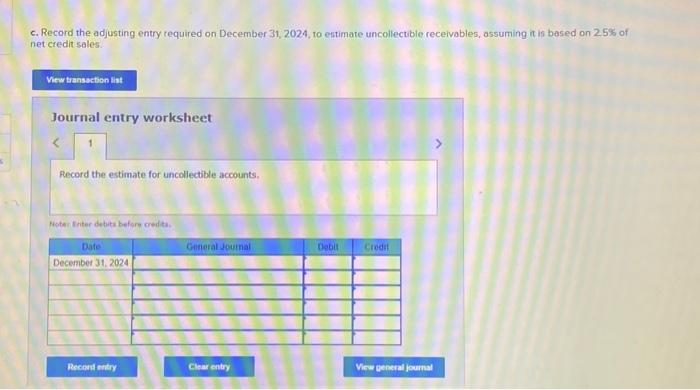

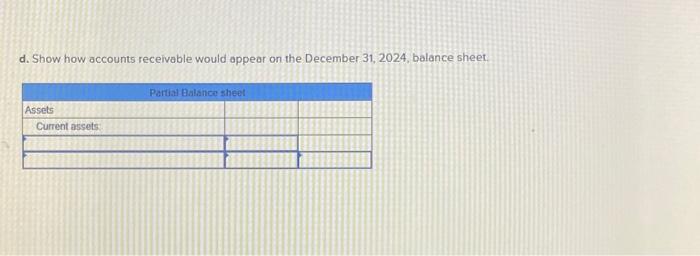

b. During 2024 , credit sales were \\( \\$ 656,000 \\) (cost of sales \\( \\$ 430,110 \\) ), sales discounts of \\( \\$ 15,000 \\) were taken when accounts recelvable of \\( \\$ 550,100 \\) were collected; and accounts written off during the year totalled \\( \\$ 12,400 \\). Prepare the entries for these transactions. Journal entry worksheet Record the write-off of uncollectible accounts. Hoter Enter debits before credits. c. Record the adjusting entry required on December 31, 2024, to estimate uncollectible receivables, assuming \\( \\pi \\) is based on \25 of net credit sales: Journal entry worksheet Precord the estimate for uncollectible accounts. Moter Enter detata before crefita. Exercise 8-11 Estimating bad debt expense-percentage of sales LO3 Selected unadjusted account balances at December 31, 2023, are shown below for Demron Servicing. Required: 0. Demron estimates that \2.5 of net credit sales will prove to th uncollectible. Prepare the adjusting entry required on December 31 , 2020, to estimote uncollectible recelvobles. d. Show how accounts receivable would appear on the December 31,2024 , balance sheet. b. During 2024 , credit sales were \\( \\$ 656,000 \\) (cost of sales \\( \\$ 430,110 \\) ), sales discounts of \\( \\$ 15,000 \\) were taken when accounts receivable of \\( \\$ 550,100 \\) were collected, and accounts written off during the year totalled \\( \\$ 12,400 \\). Prepare the entries for these transactions. Journal entry worksheet Record the collections less sales discounts. Neter finter debits before credita. Demran estimates that \2.5 of net credit sales will prove to be uncollectible. Prepare the adjusting entry required on December 31 , 2020, to estimate uncollectible recelvables. Journal entry worksheet Record the estimate for uncollectible accounts. Notes Enter dobits before credis. b. During 2024, credit sales were \\( \\$ 656,000 \\) (cost of sales \\( \\$ 430,110 \\) ), sales discounts of \\( \\$ 15,000 \\) were taken when accounts receivable of \\( \\$ 550,100 \\) were collected, and accounts writren off during the year totalled \\( \\$ 12,400 \\). Prepare the entries for these transactions. Journal entry worksheet 4 Record the credit sales during 2024. Moter Enter debits before ciedis. b. During 2024 , credit sales were \\( \\$ 656,000 \\) (cost of sales \\( \\$ 430,110) \\), sales discounts of \\( \\$ 15,000 \\) were taken when accounts receivable of \\( \\$ 550,100 \\) were collected; and accounts written off during the year totalied \\( \\$ 12.400 \\). Prepare the entries for these transactions. Journal entry worksheet Record the cost of sales during 2024. Noter Enter debits before condita