Answered step by step

Verified Expert Solution

Question

1 Approved Answer

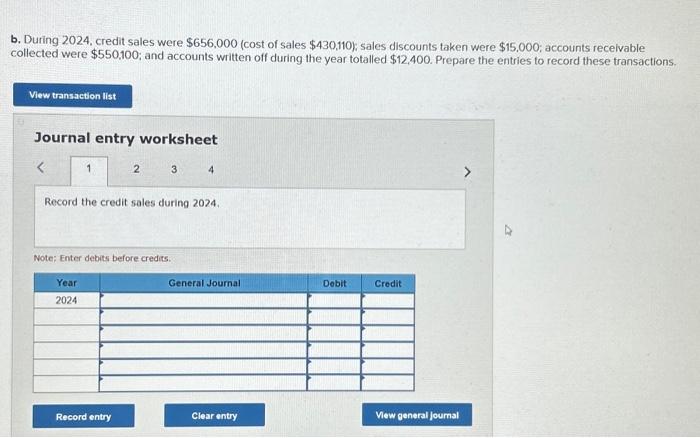

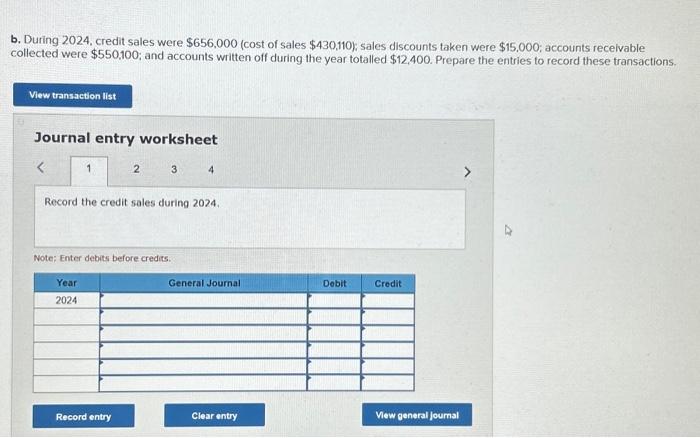

b. During 2024, credit sales were $656,000 (cost of sales $430,110 ); sales discounts taken were $15,000; accounts recelvable collected were $550,100; and accounts written

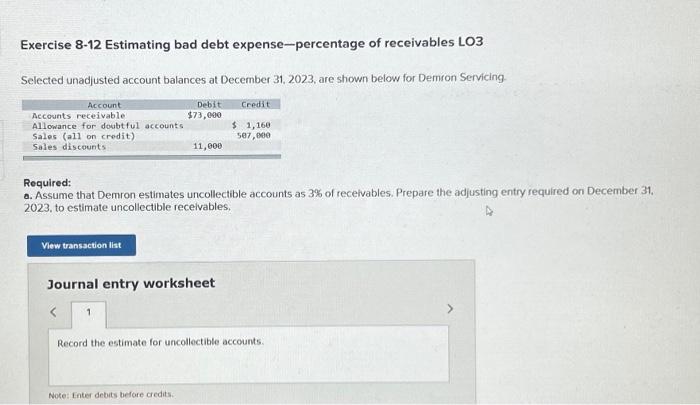

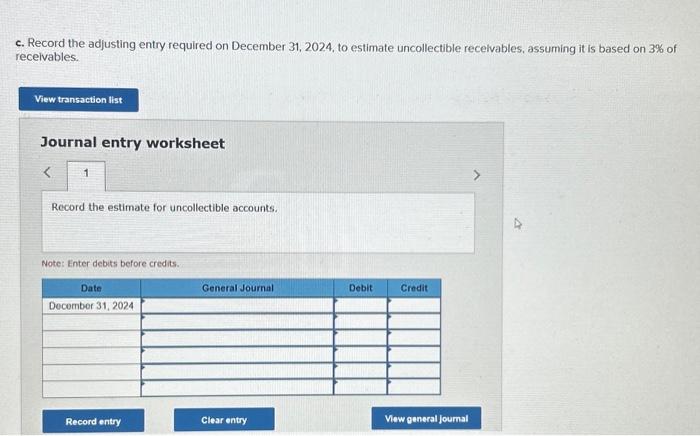

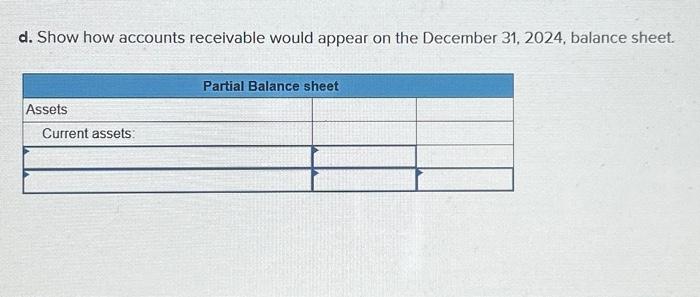

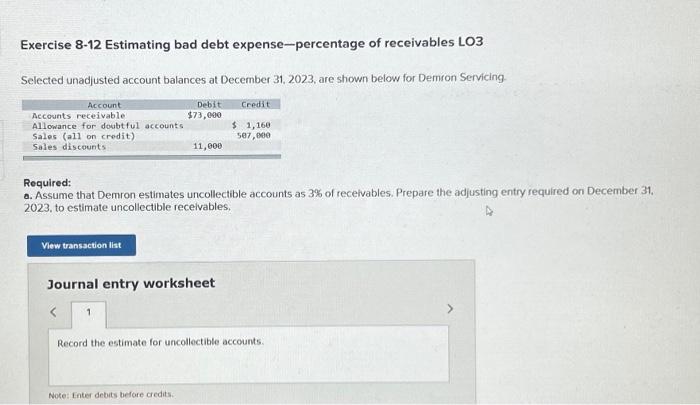

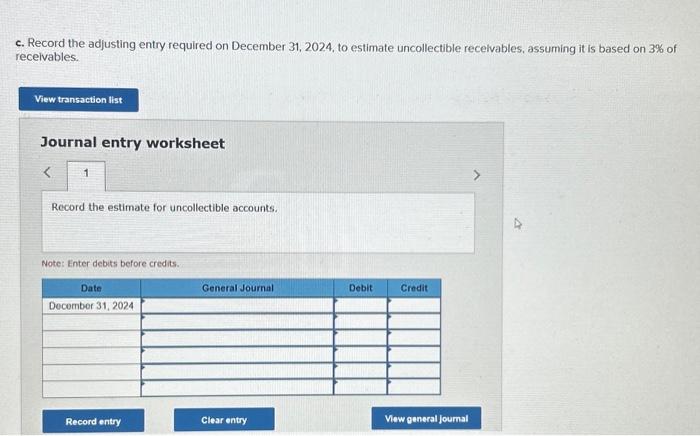

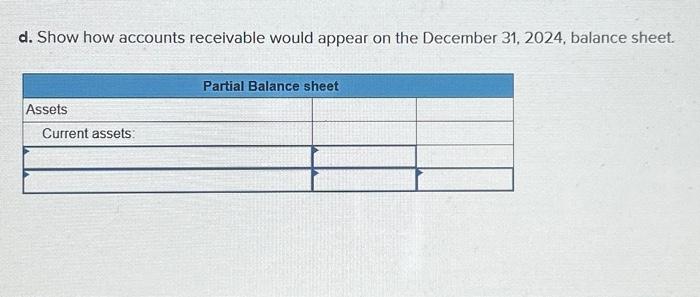

b. During 2024, credit sales were $656,000 (cost of sales $430,110 ); sales discounts taken were $15,000; accounts recelvable collected were $550,100; and accounts written off during the year totalled $12,400. Prepare the entries to record these transactions. Journal entry worksheet c. Record the adjusting entry required on December 31,2024 , to estimate uncollectible recelvables, assuming it is based on 3% of receivables. Journal entry worksheet Record the estimate for uncollectible accounts. Note: Enter debits before credits. Exercise 8-12 Estimating bad debt expense-percentage of receivables LO3 Selected unadjusted account balances at December 31, 2023, are shown below for Demron Servicing Required: a. Assume that Demron estimates uncollectible accounts as 3% of recelvables. Prepare the adjusting entry required on December 31. 2023, to estimate uncollectible recelvables. d. Show how accounts receivable would appear on the December 31,2024 , balance sheet

b. During 2024, credit sales were $656,000 (cost of sales $430,110 ); sales discounts taken were $15,000; accounts recelvable collected were $550,100; and accounts written off during the year totalled $12,400. Prepare the entries to record these transactions. Journal entry worksheet c. Record the adjusting entry required on December 31,2024 , to estimate uncollectible recelvables, assuming it is based on 3% of receivables. Journal entry worksheet Record the estimate for uncollectible accounts. Note: Enter debits before credits. Exercise 8-12 Estimating bad debt expense-percentage of receivables LO3 Selected unadjusted account balances at December 31, 2023, are shown below for Demron Servicing Required: a. Assume that Demron estimates uncollectible accounts as 3% of recelvables. Prepare the adjusting entry required on December 31. 2023, to estimate uncollectible recelvables. d. Show how accounts receivable would appear on the December 31,2024 , balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started