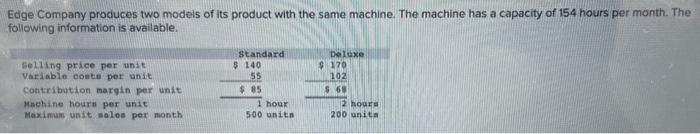

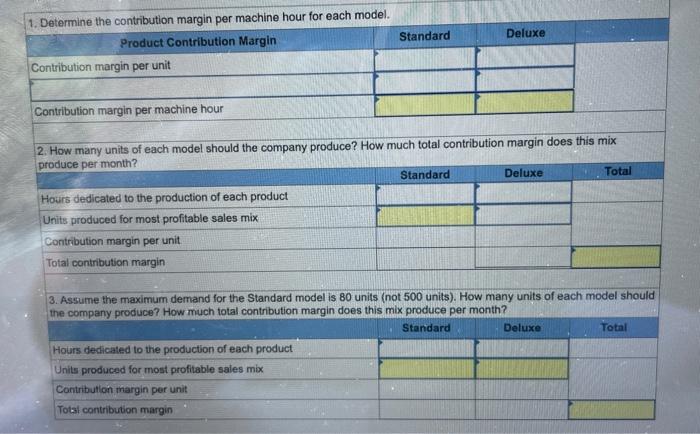

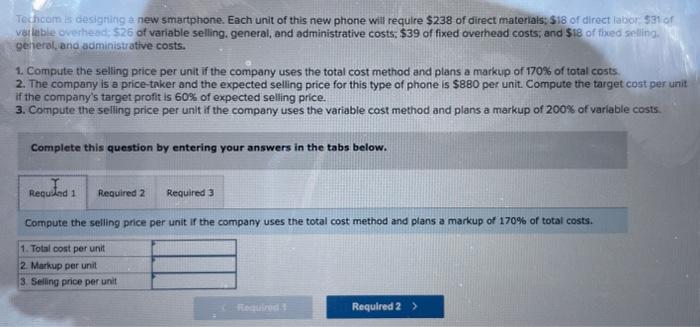

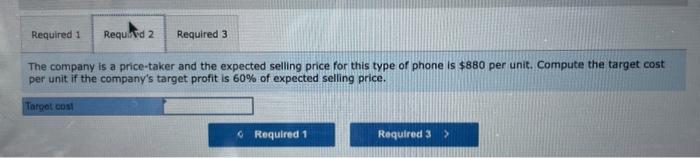

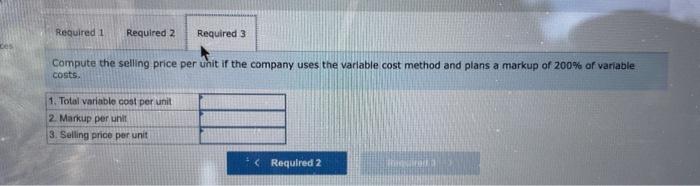

Edge Company produces two models of its product with the same machine. The machine has a capacity of 154 hours per month. The following information is available. 1. Determine the contribution margin per machine hour for each model. \begin{tabular}{|l|l|} \hline Product Contribution Margin \\ \hline Contribution margin per unit & Deluxe \\ \hline Contribution margin per machine hour & \\ \hline \end{tabular} 2. How many units of each model should the company produce? How much total contribution margin does this mix produce per month? \begin{tabular}{l} produce per month? \\ \hline Hours dedicated to the production of each product \\ Units produced for most profitable sales mix \\ \hline Contribution margin per unit \\ \hline Total contribution margin \\ \hline \end{tabular} 3. Assume the maximum demand for the Standard model is 80 units (not 500 units). How many units of each model should the company produce? How much total contribution margin does this mix produce per month? \begin{tabular}{l} Hours dedicated to the production of each product \\ Units produced for most profitable sales mix \\ \hline Contribution margin per unit \\ \hline Totsi contribution margin \end{tabular} Techcom is designing a new smartphone. Each unit of this new phone will require $238 of direct materials; $18 of direct labor. $31 of valable overheod; $26 of variable selling. general, and administrative costs; $39 of fixed overhead costs; and $18 of theed sellin 2 gerierol, and administrative costs. 1. Compute the selling price per unit if the company uses the total cost method and plans a markup of 170% of total costs. 2. The company is a price-taker and the expected selling price for this type of phone is $880 per unit. Compute the target cost per unit if the company's target profit is 60% of expected selling price. 3. Compute the selling price per unit if the company uses the variable cost method and plans a markup of 200% of variable costs. Complete this question by entering your answers in the tabs below. Compute the selling price per unit if the company uses the total cost method and plans a markup of 170% of total costs. The company is a price-taker and the expected selling price for this type of phone is $880 per unit. Compute the target cost per unit if the company's target profit is 60% of expected selling price. Compute the selling price per unit if the company uses the variable cost method and plans a markup of 200% of variable costs