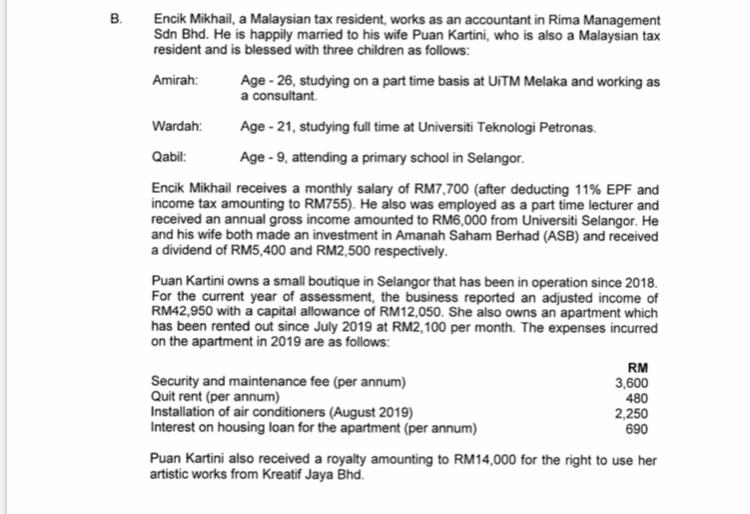

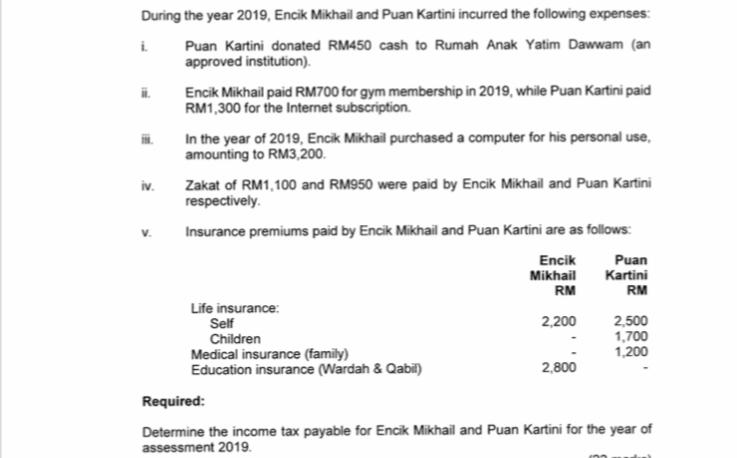

B. Encik Mikhail, a Malaysian tax resident, works as an accountant in Rima Management Sdn Bhd. He is happily married to his wife Puan Kartini, who is also a Malaysian tax resident and is blessed with three children as follows: Amirah: Age - 26, studying on a part time basis at UiTM Melaka and working as a consultant Wardah: Age - 21, studying full time at Universiti Teknologi Petronas, Qabil: Age - 9, attending a primary school in Selangor. Encik Mikhail receives a monthly salary of RM7,700 (after deducting 11% EPF and income tax amounting to RM755). He also was employed as a part time lecturer and received an annual gross income amounted to RM6,000 from Universiti Selangor. He and his wife both made an investment in Amanah Saham Berhad (ASB) and received a dividend of RM5,400 and RM2,500 respectively. Puan Kartini owns a small boutique in Selangor that has been in operation since 2018. For the current year of assessment, the business reported an adjusted income of RM42,950 with a capital allowance of RM12,050. She also owns an apartment which has been rented out since July 2019 at RM2,100 per month. The expenses incurred on the apartment in 2019 are as follows: RM Security and maintenance fee (per annum) 3,600 Quit rent (per annum) 480 Installation of air conditioners (August 2019) 2,250 Interest on housing loan for the apartment (per annum) 690 Puan Kartini also received a royalty amounting to RM14,000 for the right to use her artistic works from Kreatif Jaya Bhd. During the year 2019, Encik Mikhail and Puan Kartini incurred the following expenses Puan Kartini donated RM450 cash to Rumah Anak Yatim Dawwam (an approved institution). Encik Mikhail paid RM700 for gym membership in 2019, while Puan Kartini paid RM1,300 for the Internet subscription In the year of 2019, Encik Mikhail purchased a computer for his personal use, amounting to RM3,200 iv. Zakat of RM1,100 and RM950 were paid by Encik Mikhail and Puan Kartini respectively Insurance premiums paid by Encik Mikhail and Puan Kartini are as follows: Encik Puan Mikhail Kartini RM RM Life insurance: Self 2,200 2.500 Children 1,700 Medical insurance (family) 1.200 Education insurance (Wardah & Qabil) 2.800 Required: Determine the income tax payable for Encik Mikhail and Puan Kartini for the year of assessment 2019. B. Encik Mikhail, a Malaysian tax resident, works as an accountant in Rima Management Sdn Bhd. He is happily married to his wife Puan Kartini, who is also a Malaysian tax resident and is blessed with three children as follows: Amirah: Age - 26, studying on a part time basis at UiTM Melaka and working as a consultant Wardah: Age - 21, studying full time at Universiti Teknologi Petronas, Qabil: Age - 9, attending a primary school in Selangor. Encik Mikhail receives a monthly salary of RM7,700 (after deducting 11% EPF and income tax amounting to RM755). He also was employed as a part time lecturer and received an annual gross income amounted to RM6,000 from Universiti Selangor. He and his wife both made an investment in Amanah Saham Berhad (ASB) and received a dividend of RM5,400 and RM2,500 respectively. Puan Kartini owns a small boutique in Selangor that has been in operation since 2018. For the current year of assessment, the business reported an adjusted income of RM42,950 with a capital allowance of RM12,050. She also owns an apartment which has been rented out since July 2019 at RM2,100 per month. The expenses incurred on the apartment in 2019 are as follows: RM Security and maintenance fee (per annum) 3,600 Quit rent (per annum) 480 Installation of air conditioners (August 2019) 2,250 Interest on housing loan for the apartment (per annum) 690 Puan Kartini also received a royalty amounting to RM14,000 for the right to use her artistic works from Kreatif Jaya Bhd. During the year 2019, Encik Mikhail and Puan Kartini incurred the following expenses Puan Kartini donated RM450 cash to Rumah Anak Yatim Dawwam (an approved institution). Encik Mikhail paid RM700 for gym membership in 2019, while Puan Kartini paid RM1,300 for the Internet subscription In the year of 2019, Encik Mikhail purchased a computer for his personal use, amounting to RM3,200 iv. Zakat of RM1,100 and RM950 were paid by Encik Mikhail and Puan Kartini respectively Insurance premiums paid by Encik Mikhail and Puan Kartini are as follows: Encik Puan Mikhail Kartini RM RM Life insurance: Self 2,200 2.500 Children 1,700 Medical insurance (family) 1.200 Education insurance (Wardah & Qabil) 2.800 Required: Determine the income tax payable for Encik Mikhail and Puan Kartini for the year of assessment 2019