Answered step by step

Verified Expert Solution

Question

1 Approved Answer

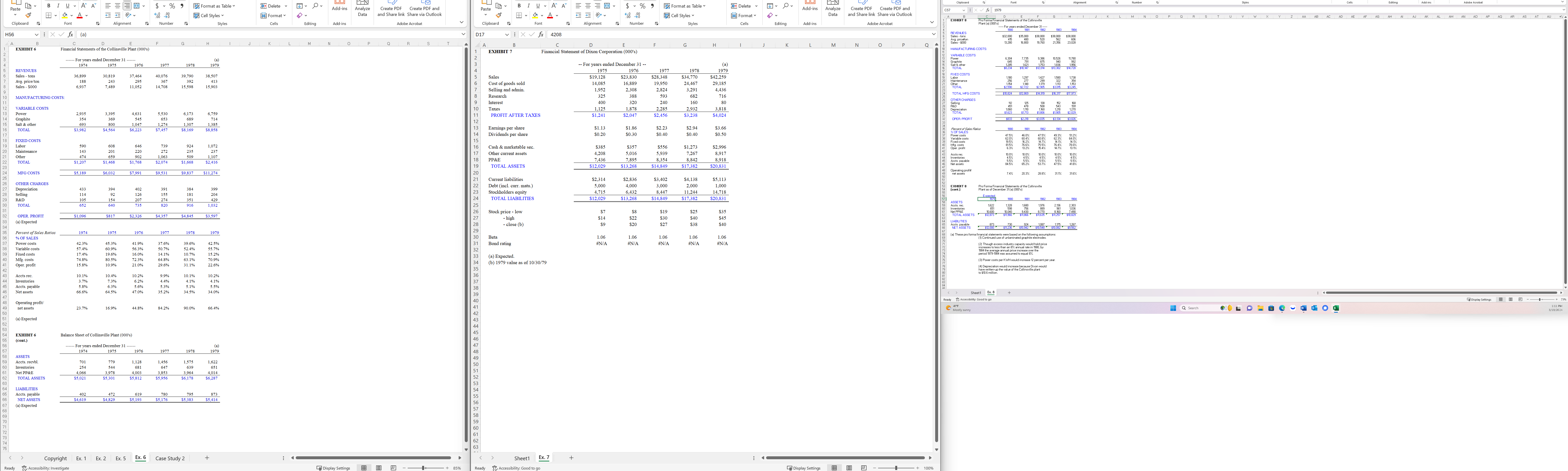

b . Estimate free cash flows for each year 1 9 8 0 - 1 9 8 9 . c . Estimate the free cash

b Estimate free cash flows for each year

c Estimate the free cash flows in This will include the free cash flow from operating the plant in and the cash flow consequences of shutting down the plant at the end of the year. Assume account receivables will be liquidated at of its book value, inventory at of its book value and PP&E at Treat the tax consequences of book losses of the liquidation of all these assets in the same way we treat book losses of PP&E so that any book losses ie the difference between liquidation value and book value can be used to lower taxable income Assume that Dixon will have enough taxable income and capital gains from its other operations so that the tax benefits of the book losses on all assets can be used right away in at the tax rate. Assume that accounts payable will be paid in full in

d Estimate Dixons opportunity cost of capital for acquiring the Collinsville plant? Assume managements target debt ratio ie NDNDE for the Collinsville plant is Use this ratio for your WACC calculation. Disregard the information on the second last paragraph about the proposed financing of the deal. For the cost of debt use we will discuss this number in class Information on potential comparable firms is provided in Exhibits and You should choose which firms to use and justify your choice. Footnote of the case reading provides information regarding the yield curve. Within that footnote, ShortTerm refers to a year yield and LongTerm refers to a year yield.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started