Answered step by step

Verified Expert Solution

Question

1 Approved Answer

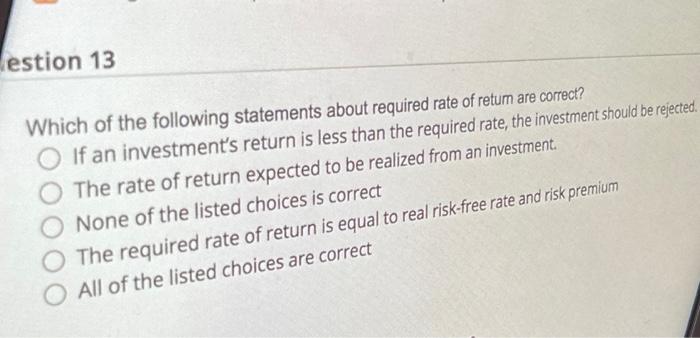

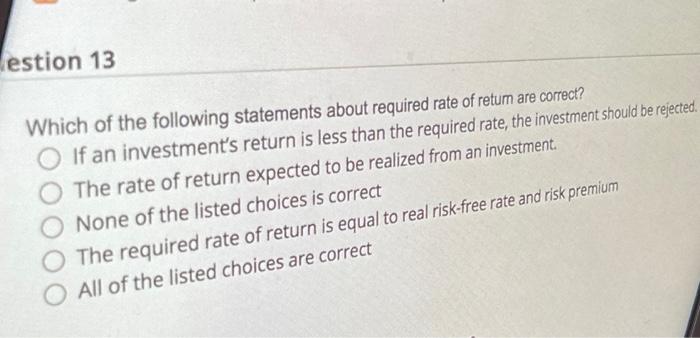

b estion 13 Which of the following statements about required rate of retum are correct? If an investment's return is less than the required rate,

b

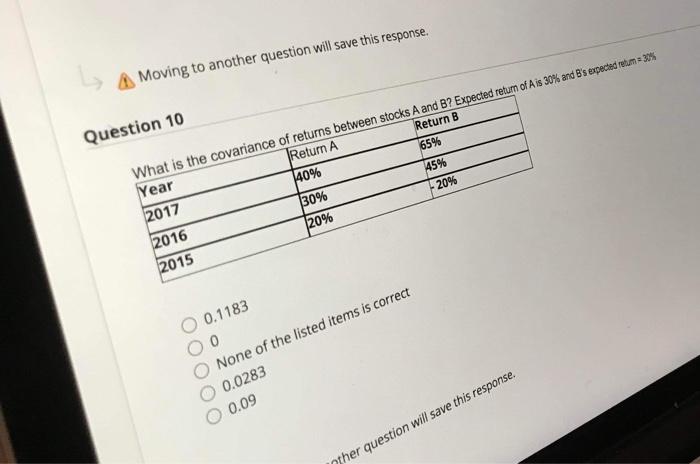

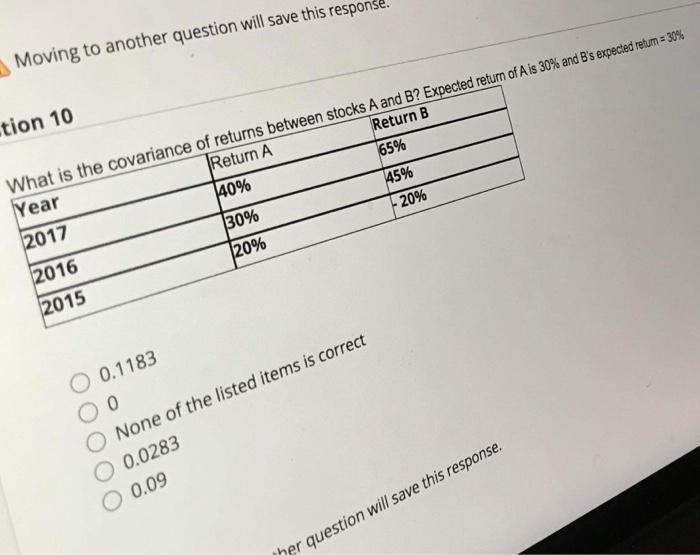

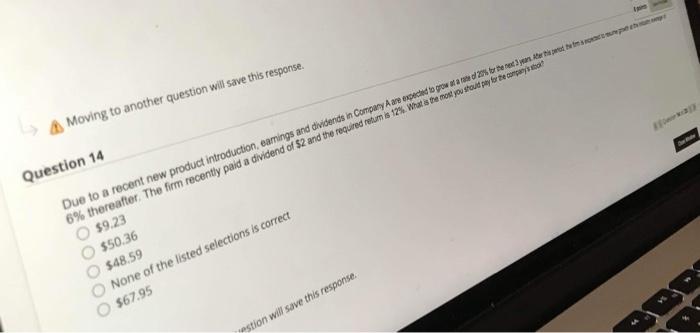

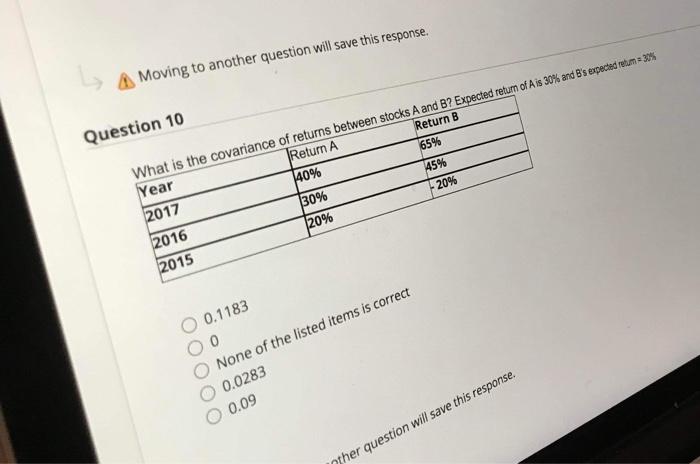

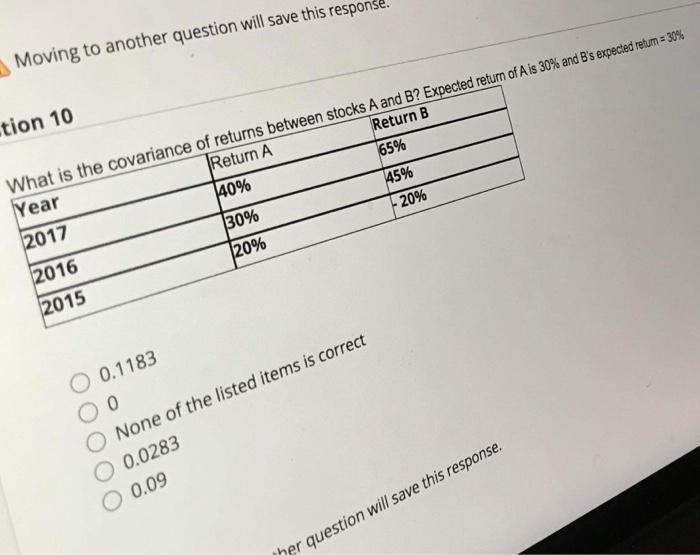

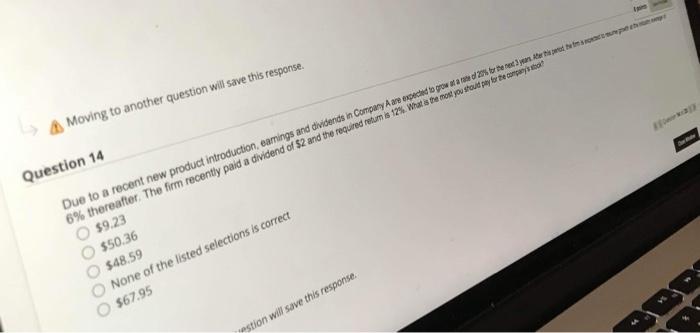

estion 13 Which of the following statements about required rate of retum are correct? If an investment's return is less than the required rate, the investment should be rejected. The rate of return expected to be realized from an investment O None of the listed choices is correct O The required rate of return is equal to real risk-free rate and risk premium All of the listed choices are correct Moving to another question will save this response. Question 10 45% 30% What is the covariance of returns between stocks A and B? Expected return of Ais 30% and B's expected retum = 30% Year Return A Return B 2017 40% 65% 2016 -20% 2015 20% O 0.1183 0 None of the listed items is correct 0.0283 O 0.09 other question will save this response. Moving to another question will save this respons tion 10 Year What is the covariance of returns between stocks A and B? Expected return of A is 30% and B's expected retum = 30% Return A Return B 2017 40% 65% 2016 30% 45% 20% 20% 2015 O 0.1183 O None of the listed items is correct O 0.0283 0 0.09 ther question will save this response. A Moving to another question will save this response. Question 14 Due to a recent new product introduction, eamings and dividends in Corrpany A are expected to grow and streret 3 porn star te praten op 6% thereafter. The firm recently paid a dividend of 52 and the required retum e 12% What's the most you should pay torte coreys to $9.23 $50.36 $48.59 None of the listed selections is correct $67.95 estion will save this response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started