Answered step by step

Verified Expert Solution

Question

1 Approved Answer

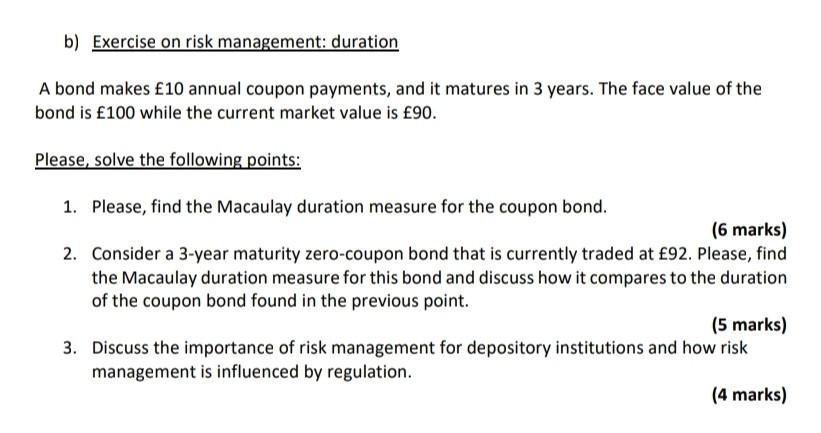

b) Exercise on risk management: duration A bond makes 10 annual coupon payments, and it matures in 3 years. The face value of the bond

b) Exercise on risk management: duration A bond makes 10 annual coupon payments, and it matures in 3 years. The face value of the bond is 100 while the current market value is 90. Please, solve the following points: 1. Please, find the Macaulay duration measure for the coupon bond. (6 marks) 2. Consider a 3-year maturity zero-coupon bond that is currently traded at 92. Please, find the Macaulay duration measure for this bond and discuss how it compares to the duration of the coupon bond found in the previous point. (5 marks) 3. Discuss the importance of risk management for depository institutions and how risk management is influenced by regulation. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started