Answered step by step

Verified Expert Solution

Question

1 Approved Answer

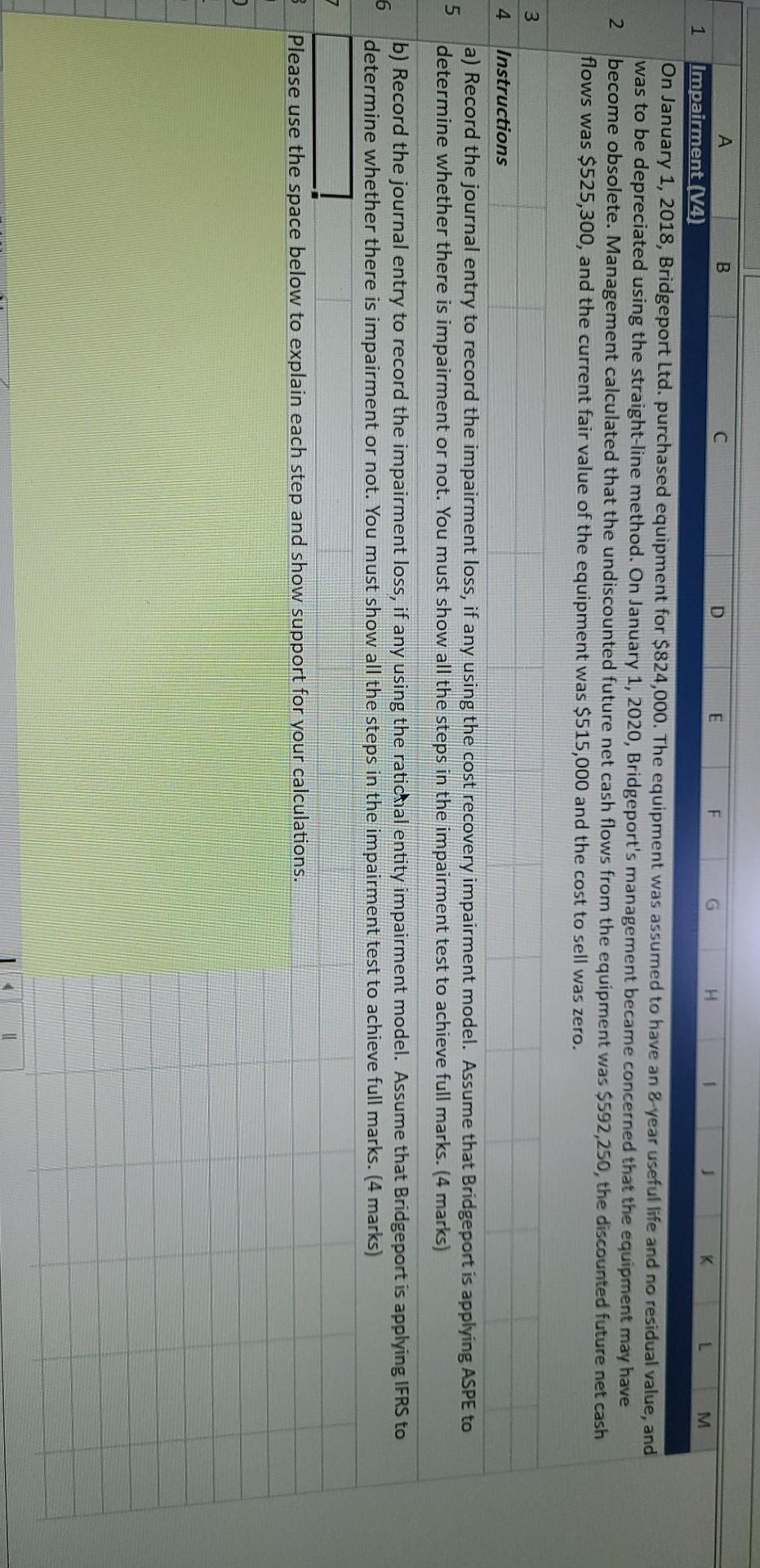

B. F H 1 A D E G K M Impairment (14) On January 1, 2018, Bridgeport Ltd. purchased equipment for $824,000. The equipment was

B. F H 1 A D E G K M Impairment (14) On January 1, 2018, Bridgeport Ltd. purchased equipment for $824,000. The equipment was assumed to have an 8-year useful life and no residual value, and was to be depreciated using the straight-line method. On January 1, 2020, Bridgeport's management became concerned that the equipment may have become obsolete. Management calculated that the undiscounted future net cash flows from the equipment was $592,250, the discounted future net cash flows was $525,300, and the current fair value of the equipment was $515,000 and the cost to sell was zero. 2 3 4 Instructions a) Record the journal entry to record the impairment loss, if any using the cost recovery impairment model. Assume that Bridgeport is applying ASPE to determine whether there is impairment or not. You must show all the steps in the impairment test to achieve full marks. (4 marks) 5 6 b) Record the journal entry to record the impairment loss, if any using the ratichal entity impairment model. Assume that Bridgeport is applying IFRS to determine whether there is impairment or not. You must show all the steps in the impairment test to achieve full marks. (4 marks) 3 Please use the space below to explain each step and show support for your calculations. 1 NNN 24 25 26 Please provide your complete journal entries (omit explanations in the table below. Date Accounts Debit Credit 27 28 29 30 31 32 33 34 35 36 37 Impairment (V4) New

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started