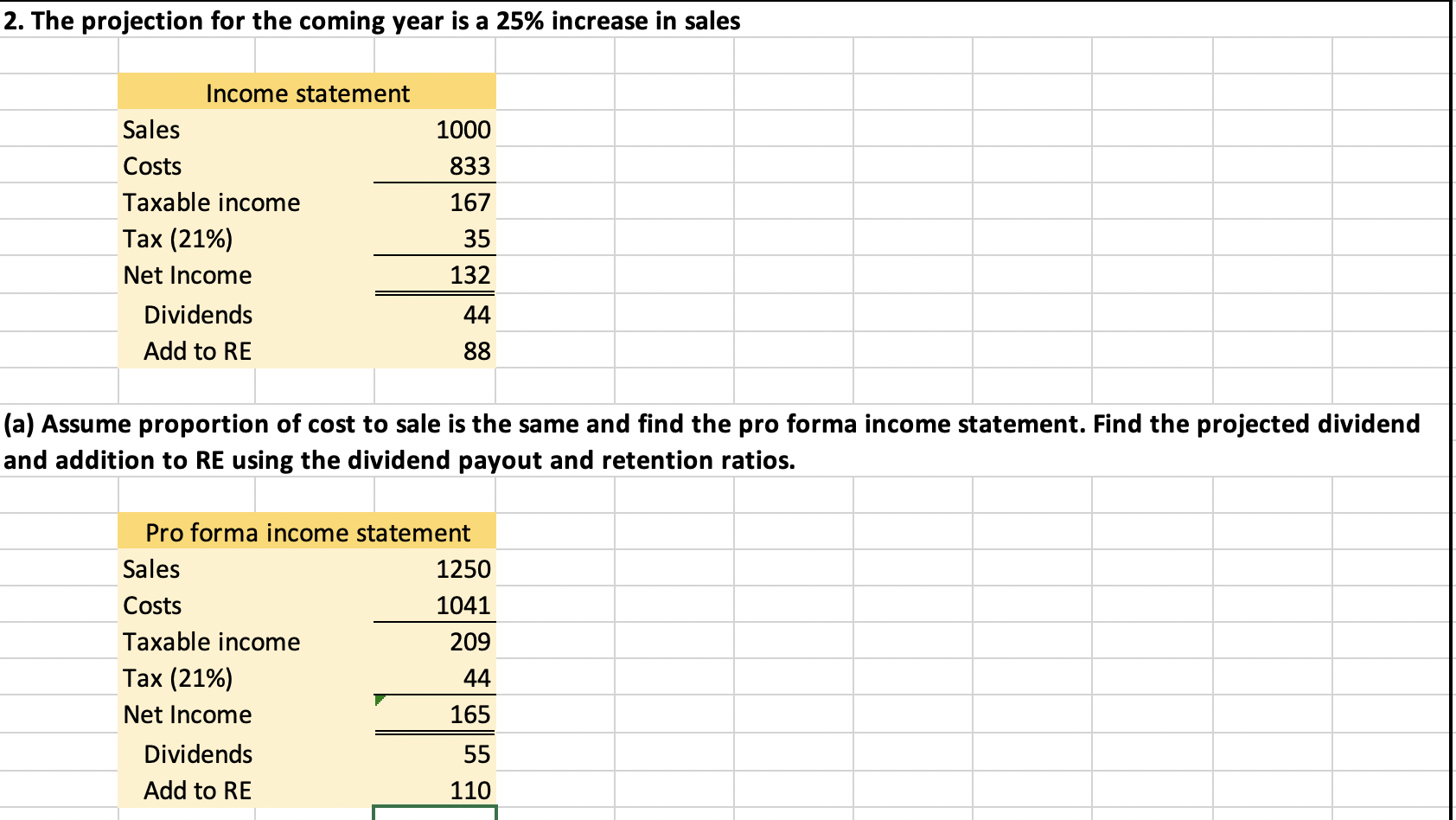

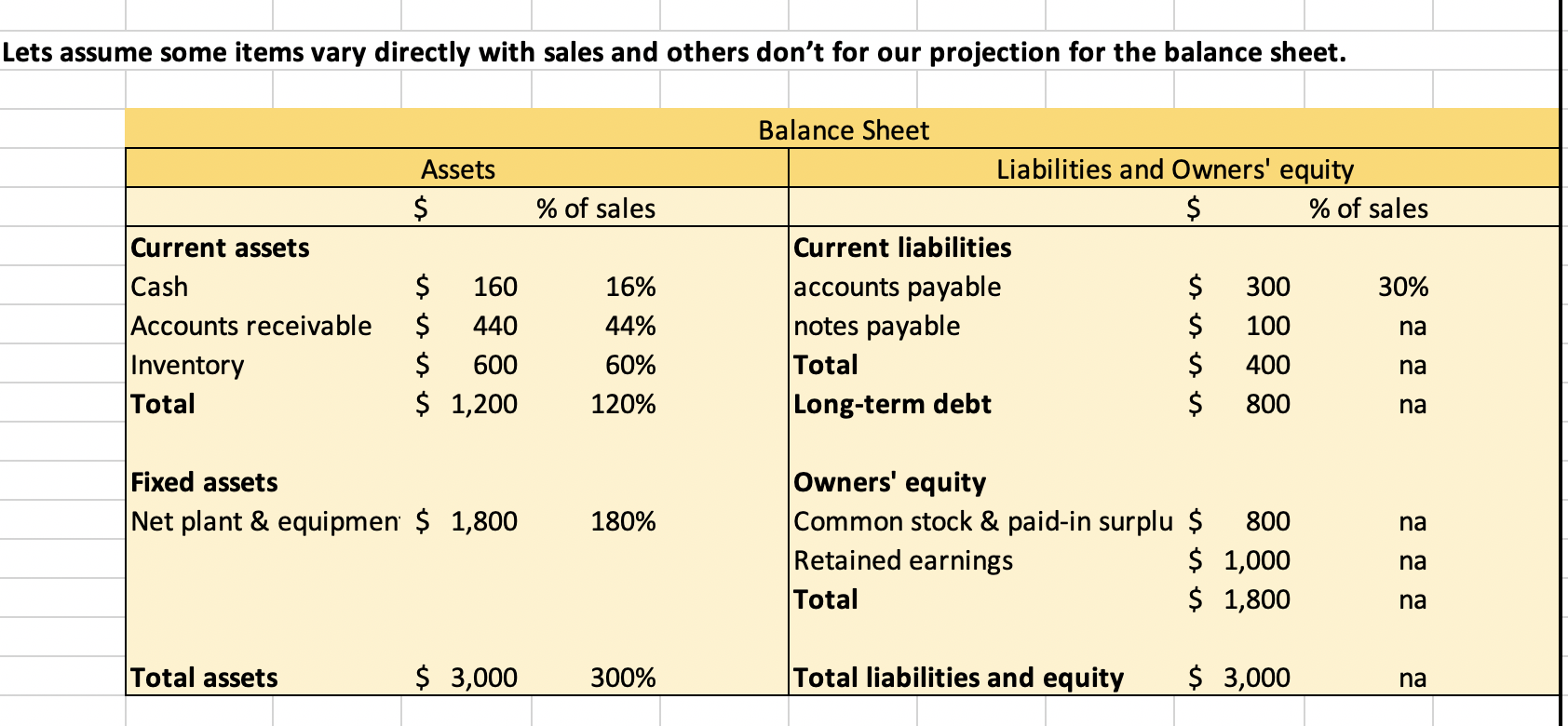

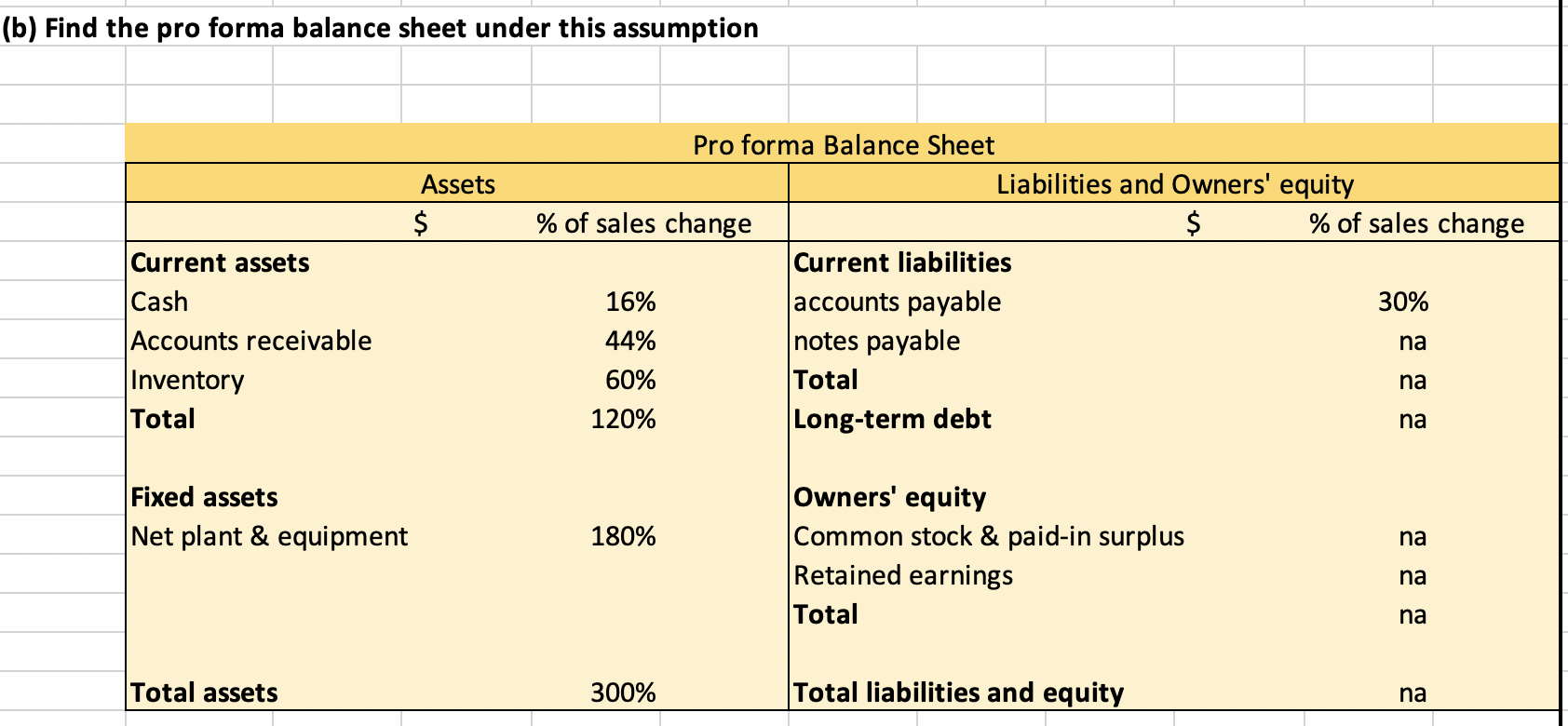

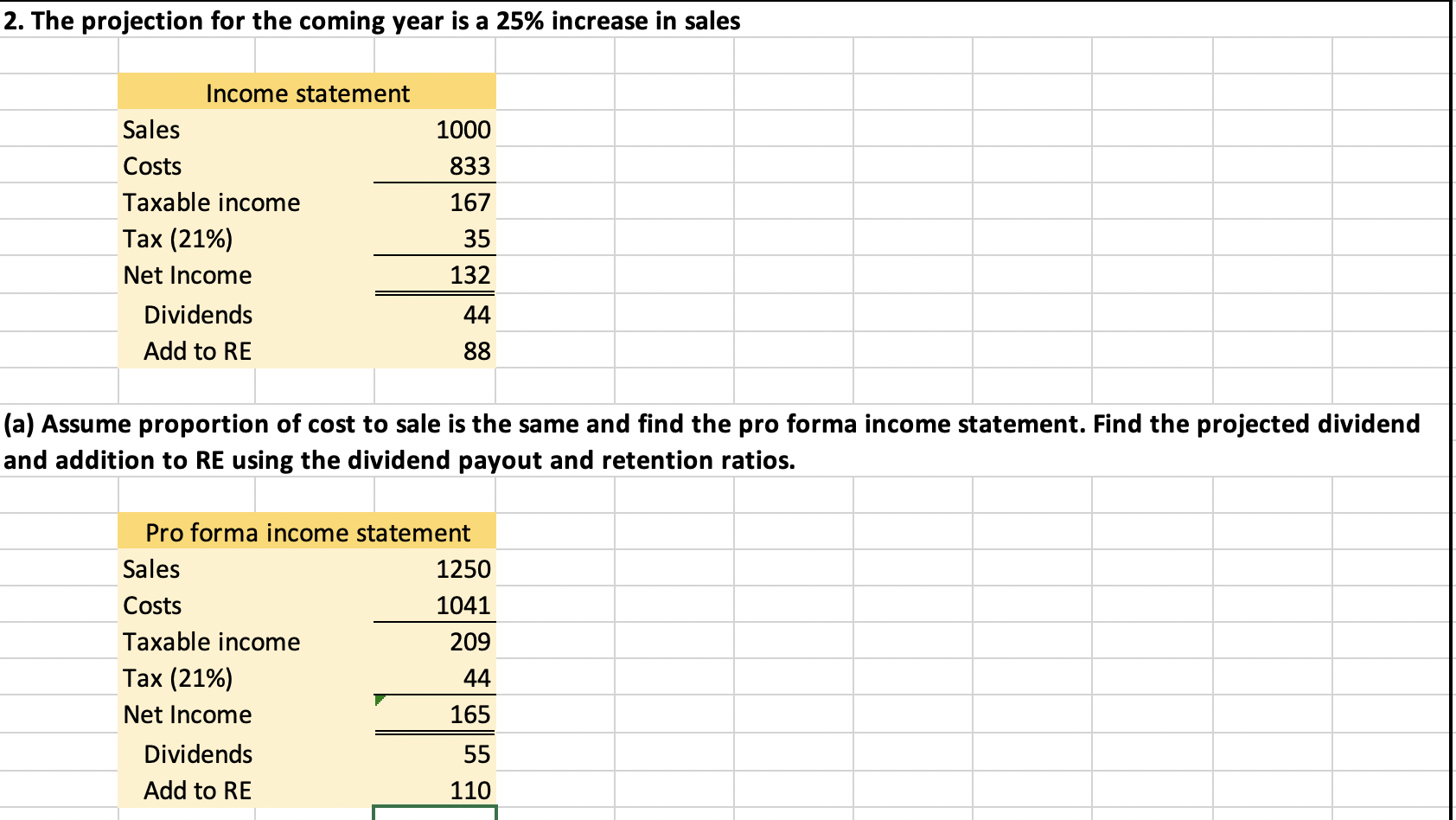

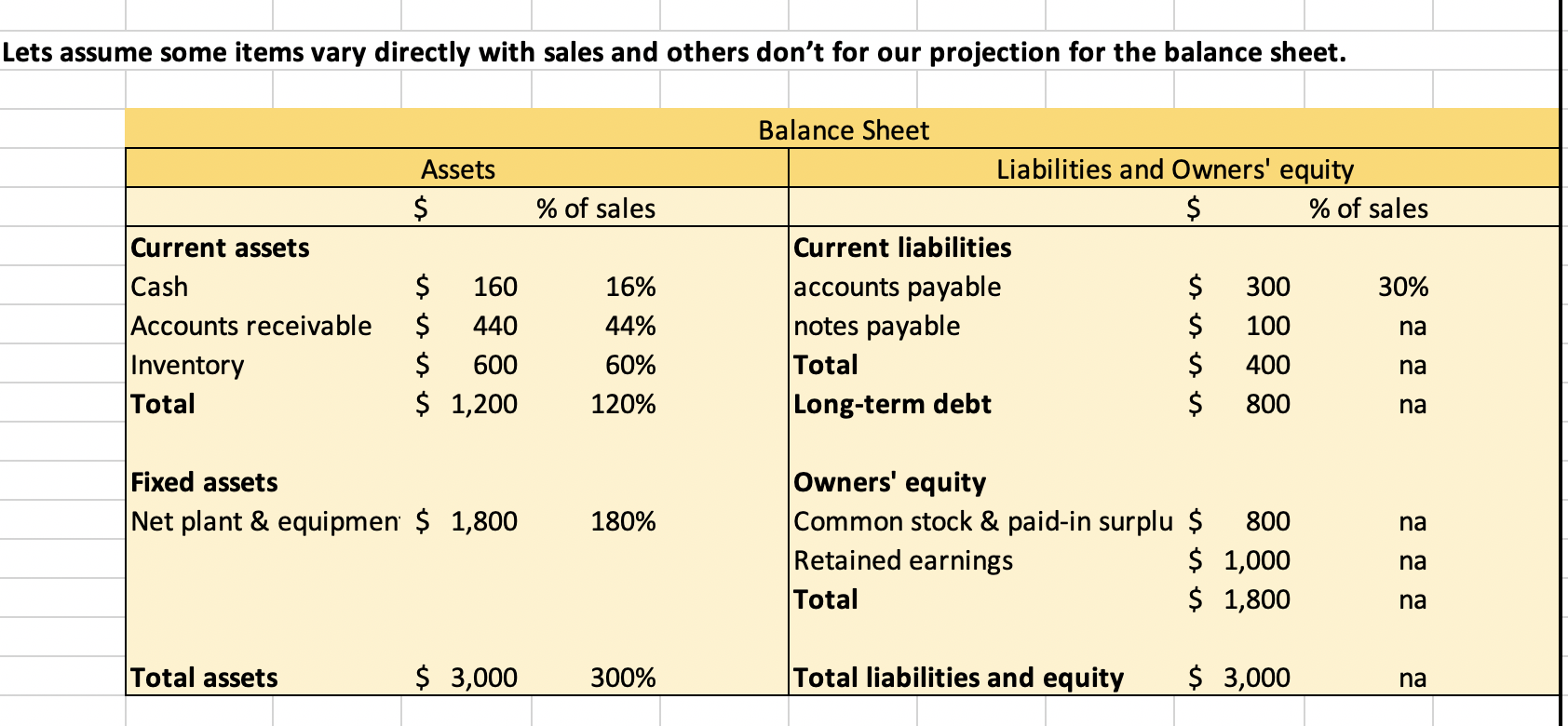

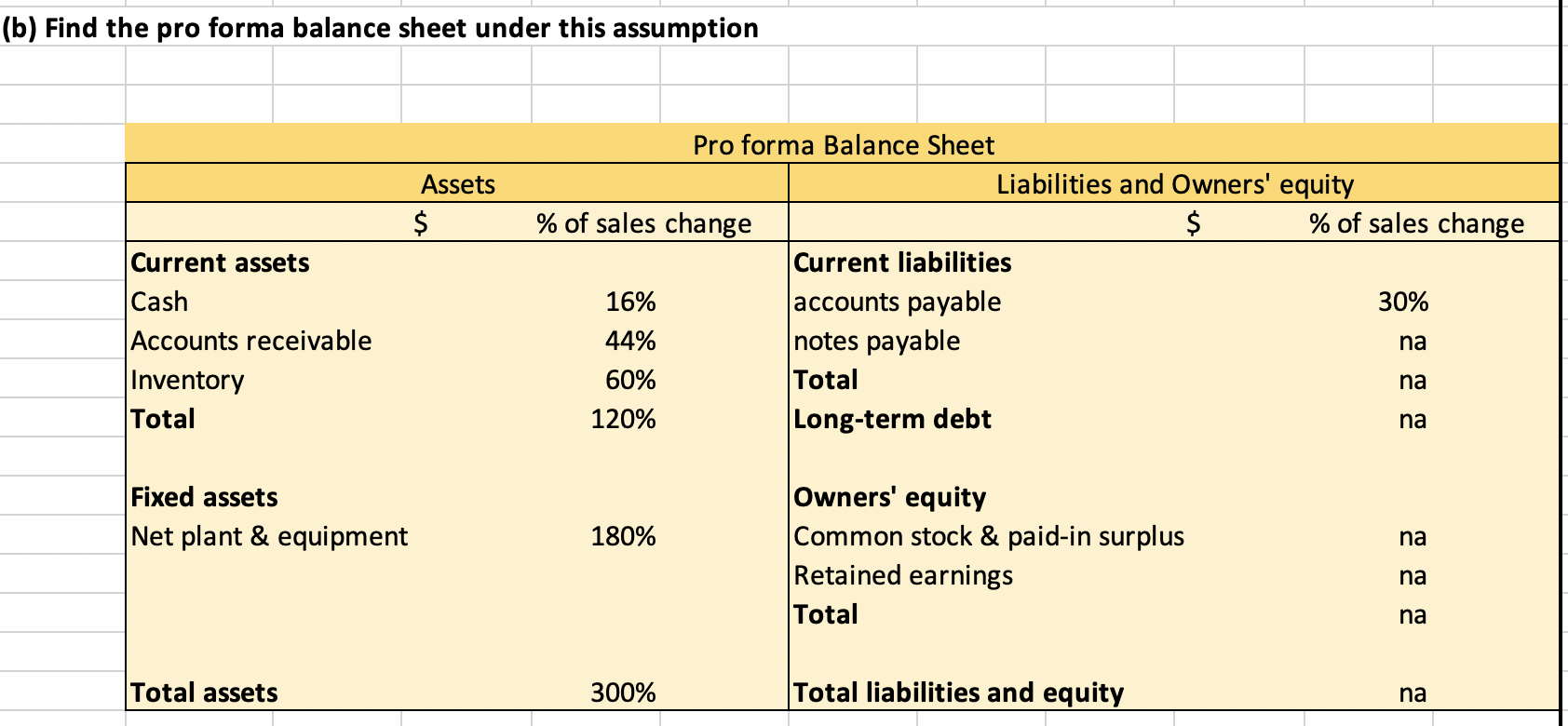

(b) Find the pro forma balance sheet under this assumption Assets $ Current assets Cash Accounts receivable Inventory Total Pro forma Balance Sheet Liabilities and Owners' equity % of sales change $ % of sales change Current liabilities 16% accounts payable 30% 44% notes payable na 60% Total 120% Long-term debt na na Fixed assets Net plant & equipment 180% na Owners' equity Common stock & paid-in surplus Retained earnings Total na na Total assets 300% Total liabilities and equity na Lets assume some items vary directly with sales and others don't for our projection for the balance sheet. Assets $ % of sales Current assets Cash Accounts receivable Inventory Total Balance Sheet Liabilities and Owners' equity $ % of sales Current liabilities accounts payable $ 300 30% notes payable $ 100 na Total $ 400 na Long-term debt $ 800 $ 160 $ 440 $ 600 $ 1,200 16% 44% 60% 120% na Fixed assets Net plant & equipmen $ 1,800 180% na Owners' equity Common stock & paid-in surplu $ 800 Retained earnings $ 1,000 Total $ 1,800 na na Total assets $ 3,000 300% Total liabilities and equity $ 3,000 na 2. The projection for the coming year is a 25% increase in sales 1000 833 Income statement Sales Costs Taxable income Tax (21%) Net Income Dividends Add to RE 167 35 132 44 88 (a) Assume proportion of cost to sale is the same and find the pro forma income statement. Find the projected dividend and addition to RE using the dividend payout and retention ratios. Pro forma income statement Sales 1250 Costs 1041 Taxable income 209 Tax (21%) 44 Net Income 165 Dividends 55 Add to RE 110 (b) Find the pro forma balance sheet under this assumption Assets $ Current assets Cash Accounts receivable Inventory Total Pro forma Balance Sheet Liabilities and Owners' equity % of sales change $ % of sales change Current liabilities 16% accounts payable 30% 44% notes payable na 60% Total 120% Long-term debt na na Fixed assets Net plant & equipment 180% na Owners' equity Common stock & paid-in surplus Retained earnings Total na na Total assets 300% Total liabilities and equity na Lets assume some items vary directly with sales and others don't for our projection for the balance sheet. Assets $ % of sales Current assets Cash Accounts receivable Inventory Total Balance Sheet Liabilities and Owners' equity $ % of sales Current liabilities accounts payable $ 300 30% notes payable $ 100 na Total $ 400 na Long-term debt $ 800 $ 160 $ 440 $ 600 $ 1,200 16% 44% 60% 120% na Fixed assets Net plant & equipmen $ 1,800 180% na Owners' equity Common stock & paid-in surplu $ 800 Retained earnings $ 1,000 Total $ 1,800 na na Total assets $ 3,000 300% Total liabilities and equity $ 3,000 na 2. The projection for the coming year is a 25% increase in sales 1000 833 Income statement Sales Costs Taxable income Tax (21%) Net Income Dividends Add to RE 167 35 132 44 88 (a) Assume proportion of cost to sale is the same and find the pro forma income statement. Find the projected dividend and addition to RE using the dividend payout and retention ratios. Pro forma income statement Sales 1250 Costs 1041 Taxable income 209 Tax (21%) 44 Net Income 165 Dividends 55 Add to RE 110