Question

B. In 1990, Ayayai Company completed the construction of a building at a cost of $2,140,000 and first occupied it in January 1991. It was

B. In 1990, Ayayai Company completed the construction of a building at a cost of $2,140,000 and first occupied it in January 1991. It was estimated that the building will have a useful life of 40 years and a salvage value of $64,200 at the end of that time. Early in 2001, an addition to the building was constructed at a cost of $535,000. At that time, it was estimated that the remaining life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a salvage value of $21,400. In 2019, it is determined that the probable life of the building and addition will extend to the end of 2050, or 20 years beyond the original estimate.

Prepare the entry, if necessary, to adjust the account balances because of the revision of the estimated life in 2019. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

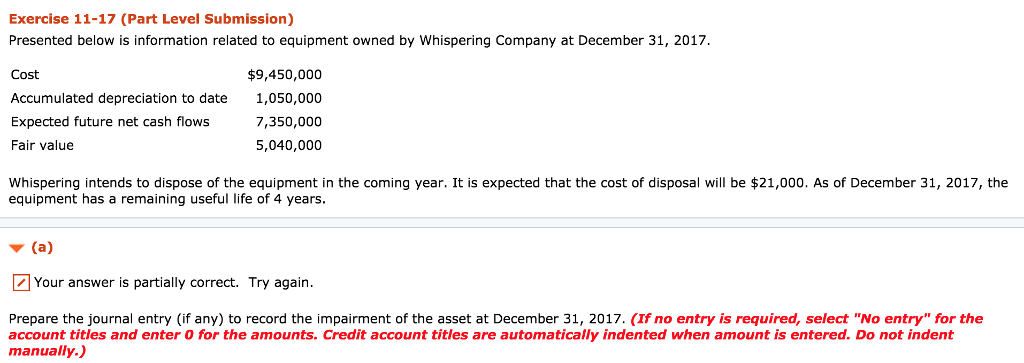

Exercise 11-17 (Part Level Submission) Presented below is information related to equipment owned by Whispering Company at December 31, 2017. Cost Accumulated depreciation to date 1,050,000 Expected future net cash flows 7,350,000 Fair value $9,450,000 5,040,000 Whispering intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $21,000. As of December 31, 2017, the equipment has a remaining useful life of 4 years. (a) Your answer is partially correct. Try again. Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2017. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started