Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. Instead of using the vesting table above, Larry's company had the following vesting schedule: - Year one: 0% vested - Year two: 25% vested

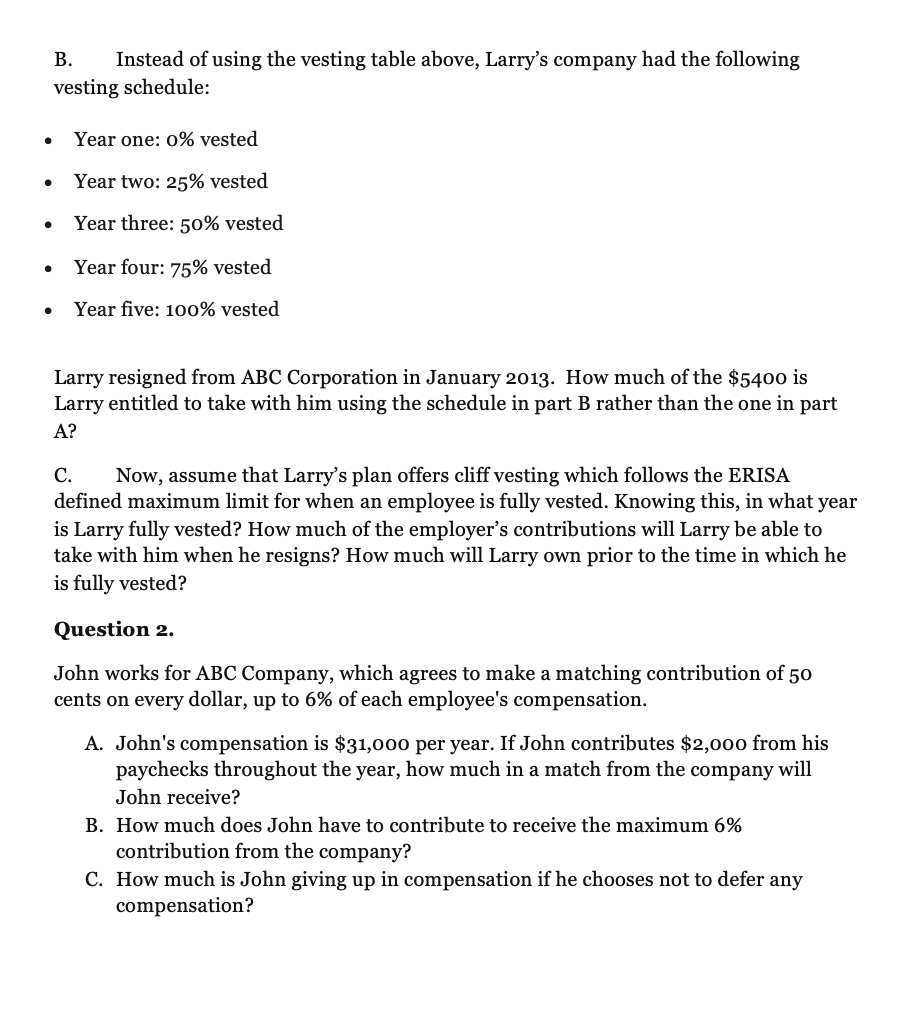

B. Instead of using the vesting table above, Larry's company had the following vesting schedule: - Year one: 0% vested - Year two: 25\% vested - Year three: 50% vested - Year four: 75% vested - Year five: 100% vested Larry resigned from ABC Corporation in January 2013. How much of the $5400 is Larry entitled to take with him using the schedule in part B rather than the one in part A? C. Now, assume that Larry's plan offers cliff vesting which follows the ERISA defined maximum limit for when an employee is fully vested. Knowing this, in what year is Larry fully vested? How much of the employer's contributions will Larry be able to take with him when he resigns? How much will Larry own prior to the time in which he is fully vested? Question 2. John works for ABC Company, which agrees to make a matching contribution of 50 cents on every dollar, up to 6% of each employee's compensation. A. John's compensation is $31,000 per year. If John contributes $2,000 from his paychecks throughout the year, how much in a match from the company will John receive? B. How much does John have to contribute to receive the maximum 6% contribution from the company? C. How much is John giving up in compensation if he chooses not to defer any compensation

B. Instead of using the vesting table above, Larry's company had the following vesting schedule: - Year one: 0% vested - Year two: 25\% vested - Year three: 50% vested - Year four: 75% vested - Year five: 100% vested Larry resigned from ABC Corporation in January 2013. How much of the $5400 is Larry entitled to take with him using the schedule in part B rather than the one in part A? C. Now, assume that Larry's plan offers cliff vesting which follows the ERISA defined maximum limit for when an employee is fully vested. Knowing this, in what year is Larry fully vested? How much of the employer's contributions will Larry be able to take with him when he resigns? How much will Larry own prior to the time in which he is fully vested? Question 2. John works for ABC Company, which agrees to make a matching contribution of 50 cents on every dollar, up to 6% of each employee's compensation. A. John's compensation is $31,000 per year. If John contributes $2,000 from his paychecks throughout the year, how much in a match from the company will John receive? B. How much does John have to contribute to receive the maximum 6% contribution from the company? C. How much is John giving up in compensation if he chooses not to defer any compensation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started