Answered step by step

Verified Expert Solution

Question

1 Approved Answer

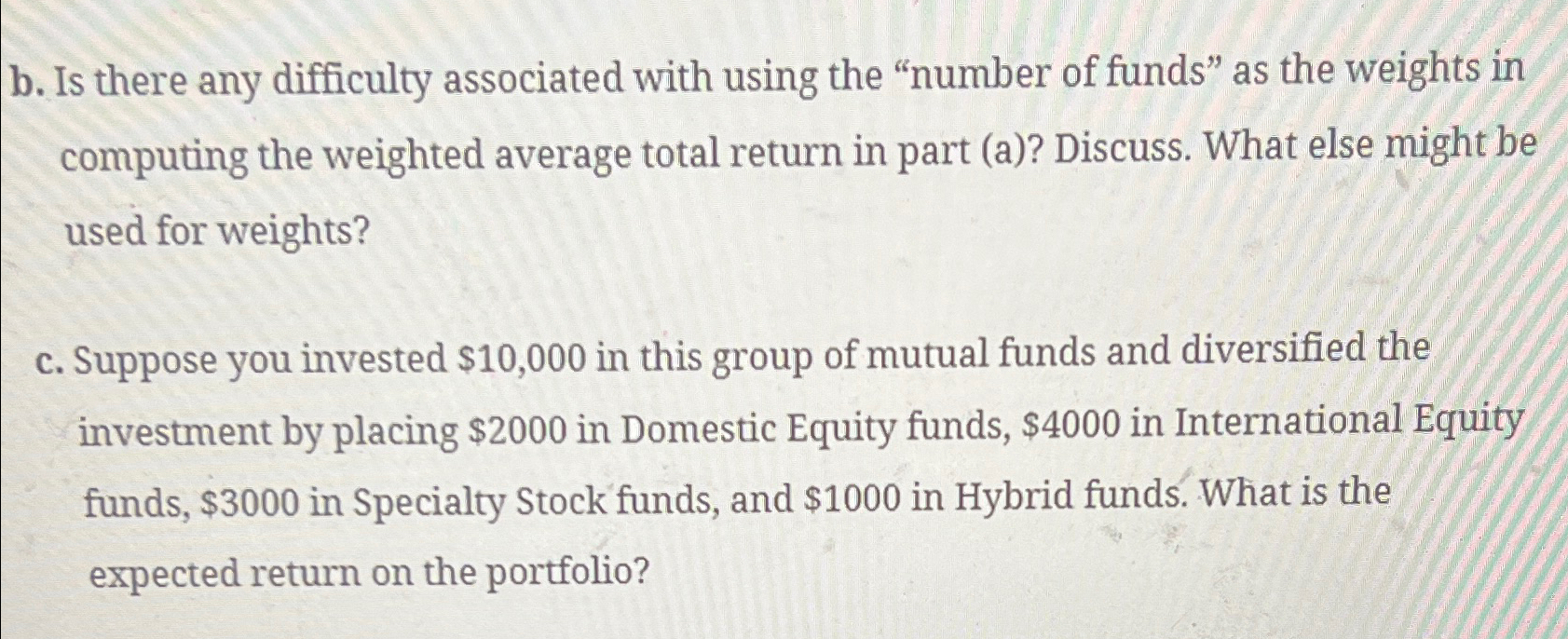

b. Is there any difficulty associated with using the number of funds as the weights in computing the weighted average total return in part (a)?

b. Is there any difficulty associated with using the "number of funds" as the weights in computing the weighted average total return in part (a)? Discuss. What else might be used for weights?\ c. Suppose you invested

$10,000in this group of mutual funds and diversified the investment by placing

$2000in Domestic Equity funds,

$4000in International Equity funds,

$3000in Specialty Stock funds, and

$1000in Hybrid funds. What is the expected return on the portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started