Question

(b) Jakel Development Berhad is considering to merge with Recron Malaysia Sdn Bhd at a cost of RM55 per shares. Jakel Development expects its shares

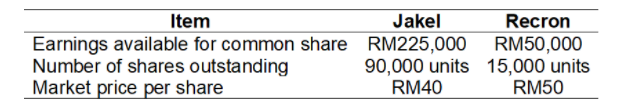

(b) Jakel Development Berhad is considering to merge with Recron Malaysia Sdn Bhd at a cost of RM55 per shares. Jakel Development expects its shares to sell at the same price earnings or multiple increase after the merger as before merging. The following information for both firms: Based on the above information:

i. Calculate the share price of the merged firm. (5 marks)

ii. Jakel Development Berhad is the largest textile company while Recron Malaysia is a cotton yarn manufacturer in Malaysia. If both companies are agreed to merge, identify the type of merger and explain how the merge can foster growth and long-term success for the firm. (3 marks)

Item Jakel Recron Earnings available for common share RM225,000 RM50,000 Number of shares outstanding 90,000 units 15,000 units Market price per share RM40 RM50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started