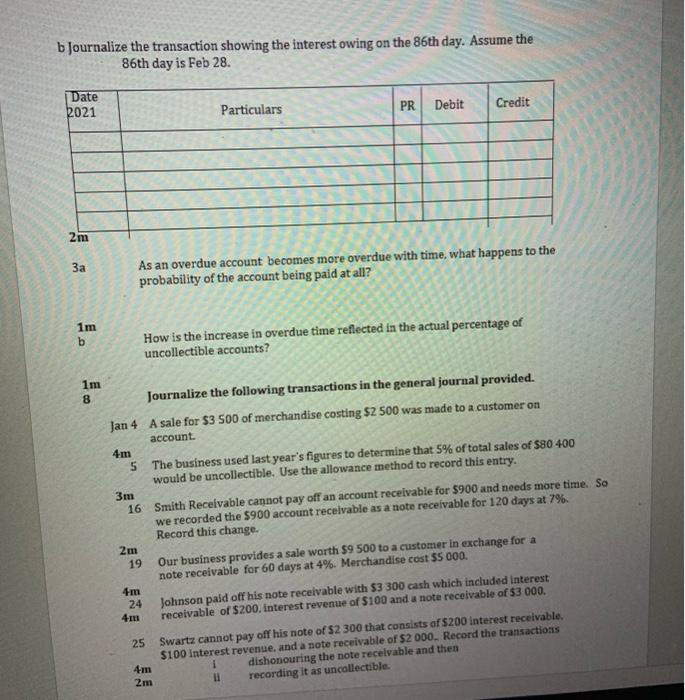

b Journalize the transaction showing the interest owing on the 86th day. Assume the 86th day is Feb 28. Date 2021 Particulars PR Debit Credit 2m 3a As an overdue account becomes more overdue with time, what happens to the probability of the account being paid at all? 1m b How is the increase in overdue time reflected in the actual percentage of uncollectible accounts? 1m 8 3m Journalize the following transactions in the general journal provided. Jan 4 A sale for $3 500 of merchandise costing $2 500 was made to a customer on account. 4m 5 The business used last year's figures to determine that 5% of total sales of $80 400 would be uncollectible. Use the allowance method to record this entry. 16 Smith Receivable cannot pay off an account receivable for $900 and needs more time. So we recorded the $900 account recevable as a note receivable for 120 days at 7%. Record this change 2m 19 Our business provides a sale worth $9 500 to a customer in exchange for a note receivable for 60 days at 4%. Merchandise cost 55 000. 24 Johnson paid off his note receivable with $3 300 cash which included interest 4m receivable of $200, interest revenue of $100 and a note receivable of $3 000. 4m 25 Swartz cannot pay off his note of $2 300 that consists of $200 interest receivable. $100 interest revenue and a note receivable of $2 000. Record the transactions dishonouring the note receivable and then recording it as uncollectible. 2m b Journalize the transaction showing the interest owing on the 86th day. Assume the 86th day is Feb 28. Date 2021 Particulars PR Debit Credit 2m 3a As an overdue account becomes more overdue with time, what happens to the probability of the account being paid at all? 1m b How is the increase in overdue time reflected in the actual percentage of uncollectible accounts? 1m 8 3m Journalize the following transactions in the general journal provided. Jan 4 A sale for $3 500 of merchandise costing $2 500 was made to a customer on account. 4m 5 The business used last year's figures to determine that 5% of total sales of $80 400 would be uncollectible. Use the allowance method to record this entry. 16 Smith Receivable cannot pay off an account receivable for $900 and needs more time. So we recorded the $900 account recevable as a note receivable for 120 days at 7%. Record this change 2m 19 Our business provides a sale worth $9 500 to a customer in exchange for a note receivable for 60 days at 4%. Merchandise cost 55 000. 24 Johnson paid off his note receivable with $3 300 cash which included interest 4m receivable of $200, interest revenue of $100 and a note receivable of $3 000. 4m 25 Swartz cannot pay off his note of $2 300 that consists of $200 interest receivable. $100 interest revenue and a note receivable of $2 000. Record the transactions dishonouring the note receivable and then recording it as uncollectible. 2m