Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) MAGOMOLA WINE CO, is Tanzanian company producing wine using local grapes produced in Dodoma. The company buys some other raw materials from a USA

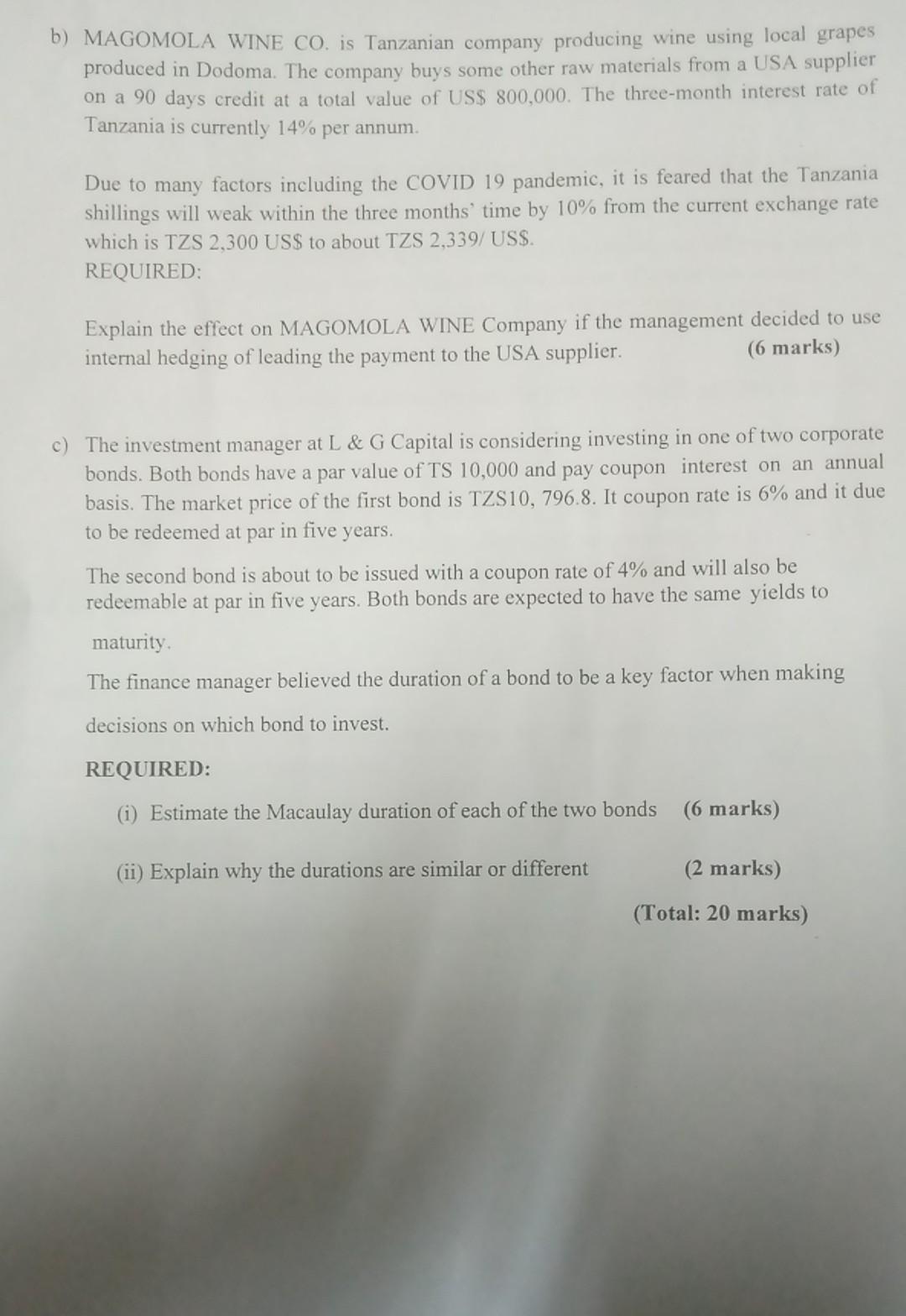

b) MAGOMOLA WINE CO, is Tanzanian company producing wine using local grapes produced in Dodoma. The company buys some other raw materials from a USA supplier on a 90 days credit at a total value of US$ 800,000. The three-month interest rate of Tanzania is currently 14% per annum. Due to many factors including the COVID 19 pandemic, it is feared that the Tanzania shillings will weak within the three months' time by 10% from the current exchange rate which is TZS 2,300 US$ to about TZS 2,339/ US$. REQUIRED: Explain the effect on MAGOMOLA WINE Company if the management decided to use internal hedging of leading the payment to the USA supplier. (6 marks) c) The investment manager at L & G Capital is considering investing in one of two corporate bonds. Both bonds have a par value of TS 10,000 and pay coupon interest on an annual basis. The market price of the first bond is TZS10, 796.8. It coupon rate is 6% and it due to be redeemed at par in five years. The second bond is about to be issued with a coupon rate of 4% and will also be redeemable at par in five years. Both bonds are expected to have the same yields to maturity The finance manager believed the duration of a bond to be a key factor when making decisions on which bond to invest. REQUIRED: (i) Estimate the Macaulay duration of each of the two bonds (6 marks) (ii) Explain why the durations are similar or different (2 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started