Answered step by step

Verified Expert Solution

Question

1 Approved Answer

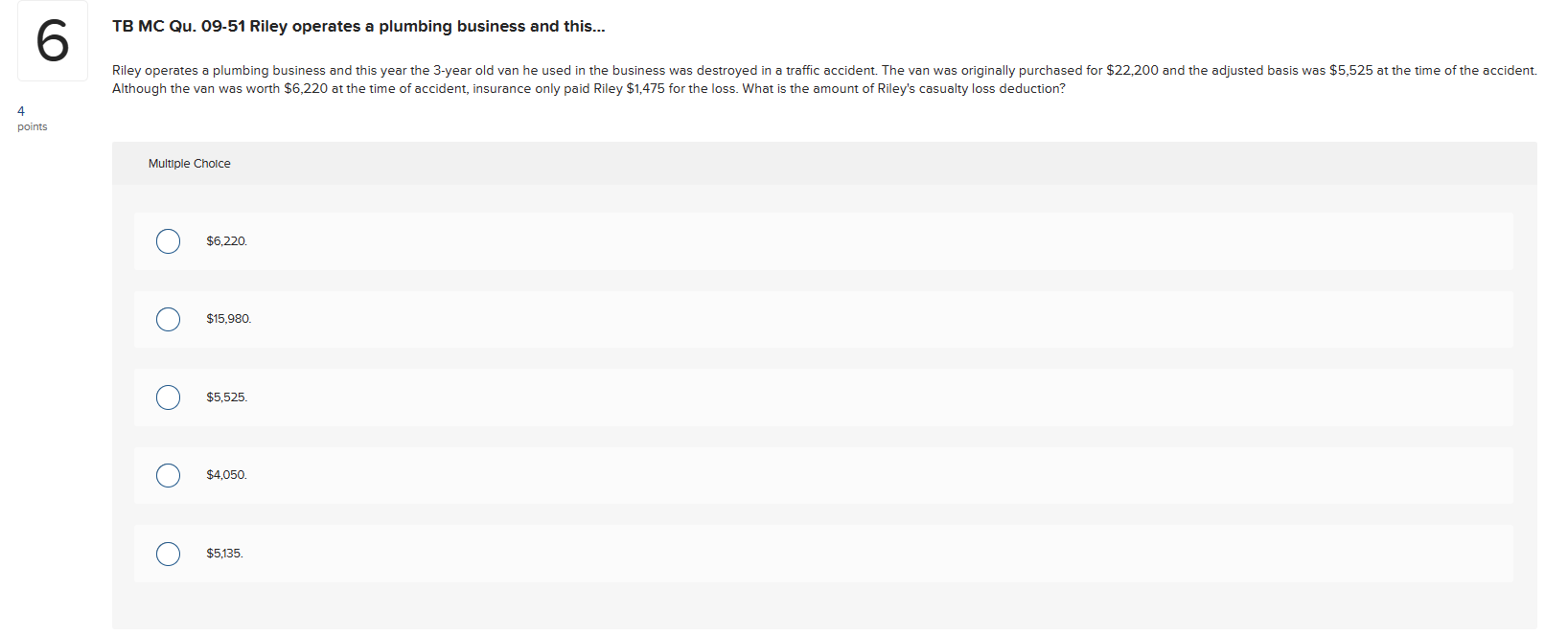

B MC Qu. 09-51 Riley operates a plumbing business and this... lthough the van was worth $6,220 at the time of accident, insurance only paid

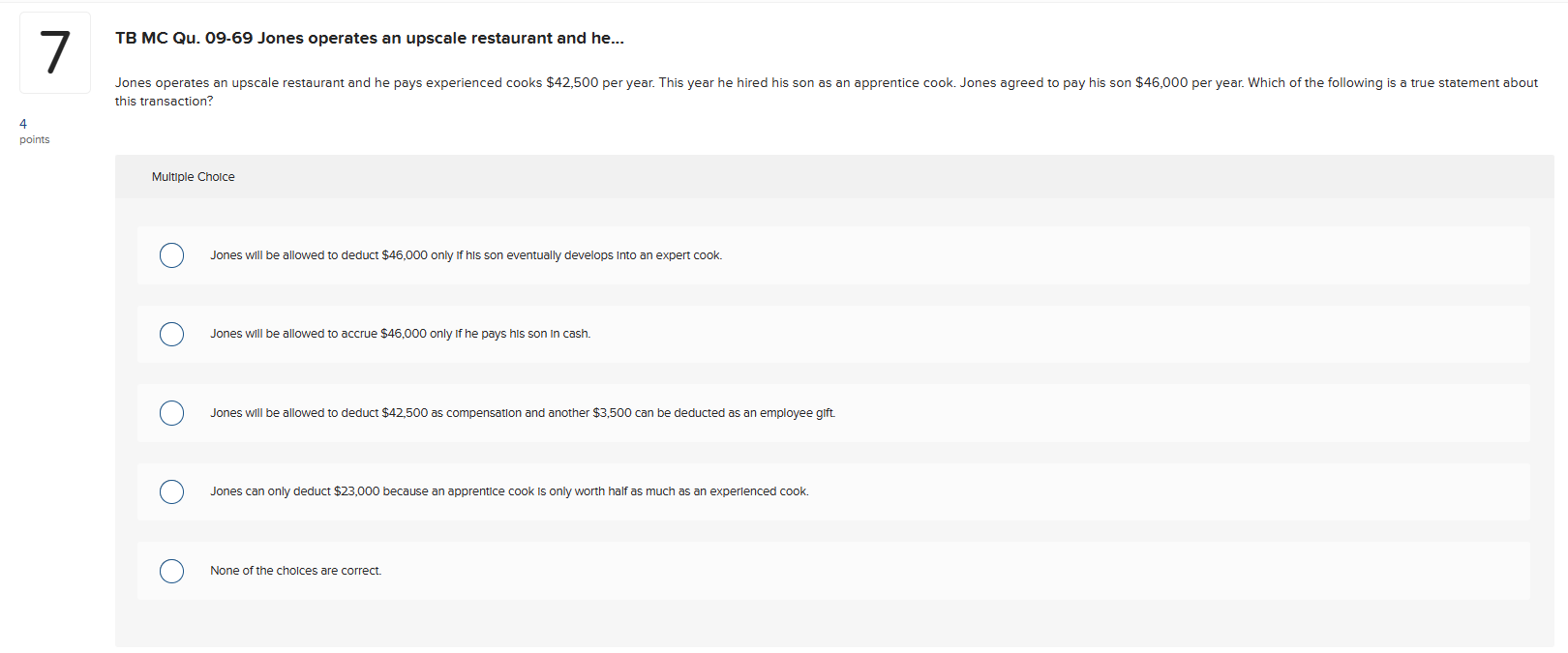

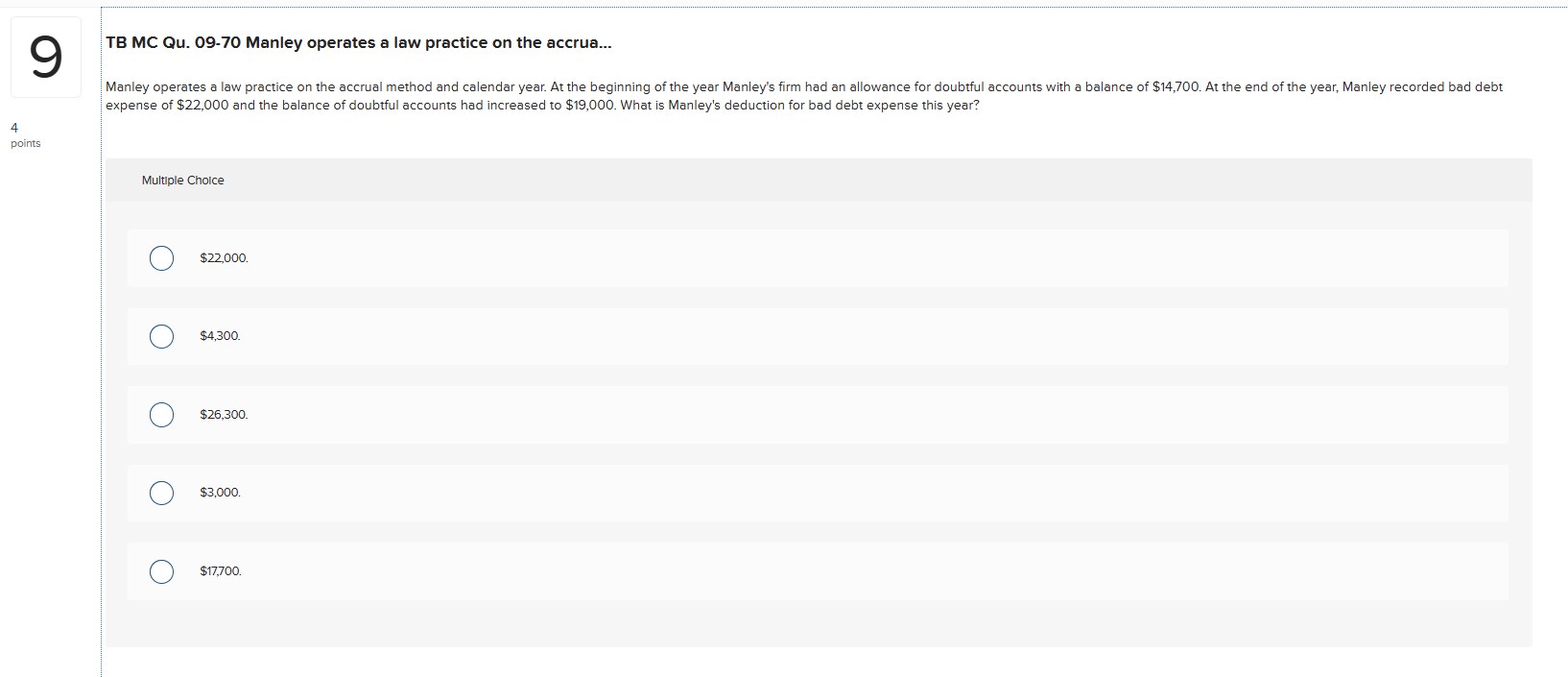

B MC Qu. 09-51 Riley operates a plumbing business and this... lthough the van was worth $6,220 at the time of accident, insurance only paid Riley $1,475 for the loss. What is the amount of Riley's casualty loss deduction? Multiple Choice $6,220. $15,980. $5,525. $4,050. $5,135. B MC Qu. 09-69 Jones operates an upscale restaurant and he... is transaction? Multiple Choice Jones will be allowed to deduct $46,000 only if his son eventually develops into an expert cook. Jones will be allowed to accrue $46,000 only if he pays his son in cash. Jones will be allowed to deduct $42,500 as compensation and another $3,500 can be deducted as an employee glft. Jones can only deduct $23,000 because an apprentice cook is only worth half as much as an experlenced cook. None of the choices are correct. B MC Qu. 09-70 Manley operates a law practice on the accrua... anse of $22,000 and the balance of doubtful accounts had increased to $19,000. What is Manley's deduction for bad debt expense this year? Multiple Choice $22,000. $4,300 $26,300. $3,000. $17,700

B MC Qu. 09-51 Riley operates a plumbing business and this... lthough the van was worth $6,220 at the time of accident, insurance only paid Riley $1,475 for the loss. What is the amount of Riley's casualty loss deduction? Multiple Choice $6,220. $15,980. $5,525. $4,050. $5,135. B MC Qu. 09-69 Jones operates an upscale restaurant and he... is transaction? Multiple Choice Jones will be allowed to deduct $46,000 only if his son eventually develops into an expert cook. Jones will be allowed to accrue $46,000 only if he pays his son in cash. Jones will be allowed to deduct $42,500 as compensation and another $3,500 can be deducted as an employee glft. Jones can only deduct $23,000 because an apprentice cook is only worth half as much as an experlenced cook. None of the choices are correct. B MC Qu. 09-70 Manley operates a law practice on the accrua... anse of $22,000 and the balance of doubtful accounts had increased to $19,000. What is Manley's deduction for bad debt expense this year? Multiple Choice $22,000. $4,300 $26,300. $3,000. $17,700 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started