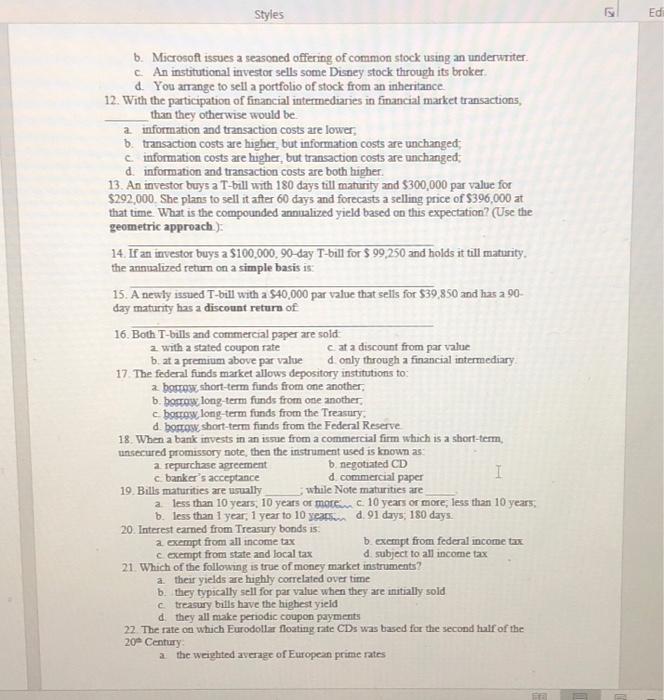

b. Microsoft issues a seasoned offering of common stock using an underwriter. c. An institutional investor sells some Disney stock through its broker. d. You arrange to sell a portfolio of stock from an inheritance. 12. With the participation of financial intermediaries in financial market transactions, than they otherwise would be a. information and transaction costs are lower, b. transaction costs are higher, but information costs are unchanged; c. information costs are higher, but transaction costs are unchanged; d. information and transaction costs are both higher. 13. An investor buys a T-bill with 180 days till maturity and $300,000 par value for $292,000. She plans to sell it after 60 days and forecasts a selling price of $396,000 at that time. What is the compounded annualized yield based on this expectation? (Use the geometric approach): 14. If an investor buys a $100,000,90-day T-bill for $99,250 and holds it till maturity. the annualized retum on a simple basis is: 15. A newly issued T-bill with a $40,000 par value that sells for $39.850 and has a 90 day maturity has a discount return of. 16. Both T-bills and commercial paper are sold 2 . with a stated coupon rate c. at a discount from par value b. at a premium above par value d. only through a financial intermediary. 17. The federal funds market allows depository institutions to: a bopros short-term finds from one another; b. borros long-term funds from one another, c. bogray, long-term funds from the Treasury, d. borroyk short-term finds from the Federal Reserve 18. When a bank invests in an issue from a commercial firm which is a short-term, unserured promissory note, then the instrument used is known as: a. repurchase agreement b. negotiated CD c. banker's acceptance d. commercial paper 19. Bills maturities are uswally while Note maturities are a. less than 10 years, 10 years or more: c.10 years or more; less than 10 years; b. less than 1 year, 1 year to 10 years. d. 91 days; 180 days. 20. Interest earned from Treasury bonds is a. exempt from all income tax b. exempt from federal income tax c exempt from state and local tax d. subject to all income tax 21. Which of the following is true of money market instruments? a. their yields are highly correlated over time b. they typically sell for par value when they are initially sold c. treasury bills have the highest yield d. they all make periodic coupon payments 22. The rate on which Eurodollar floating rate CDs was based for the second half of the 20 Century. a. the weighted average of European prime rates