Answered step by step

Verified Expert Solution

Question

1 Approved Answer

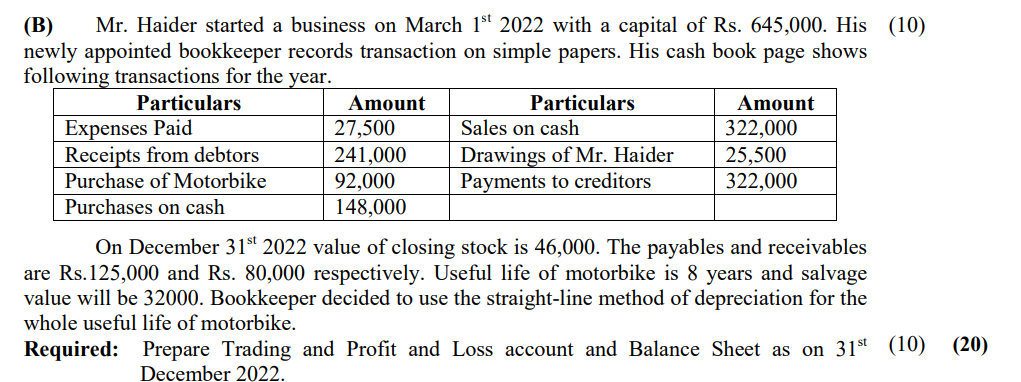

(B) Mr. Haider started a business on March 1st 2022 with a capital of Rs. 645,000. His (10) newly appointed bookkeeper records transaction on

(B) Mr. Haider started a business on March 1st 2022 with a capital of Rs. 645,000. His (10) newly appointed bookkeeper records transaction on simple papers. His cash book page shows following transactions for the year. Particulars Amount Particulars Amount Expenses Paid 27,500 Sales on cash 322,000 Receipts from debtors 241,000 Drawings of Mr. Haider 25,500 Purchase of Motorbike 92,000 Payments to creditors 322,000 Purchases on cash 148,000 On December 31st 2022 value of closing stock is 46,000. The payables and receivables are Rs.125,000 and Rs. 80,000 respectively. Useful life of motorbike is 8 years and salvage value will be 32000. Bookkeeper decided to use the straight-line method of depreciation for the whole useful life of motorbike. Required: Prepare Trading and Profit and Loss account and Balance Sheet as on 31st (10) (20) December 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the Trading and Profit and Loss account and Balance Sheet we need to follow these steps 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started