Question

b. Net income for the year ended September 30, 2019, is $ 102000. The first $ 40000 is allocated on the basis of relative partner

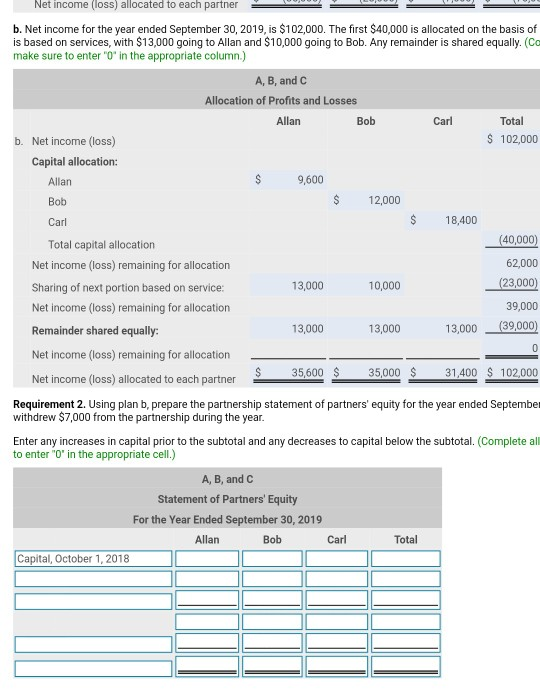

b. Net income for the year ended September 30, 2019, is $ 102000. The first $ 40000 is allocated on the basis of relative partner capital balances. The next $ 23000 is based on services, with $ 13000 going to Allan and $ 10000 going to Bob. Any remainder is

shared equally. (Complete all answer boxes. For amounts that are $0, make sure to enter "0" in the appropriate column.) Using plan b, prepare the partnership statement of partners' equity for the year ended September 30, 2019. Assume Allan, Bob, and Carl each withdrew $ 7000 from the partnership during the year. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started