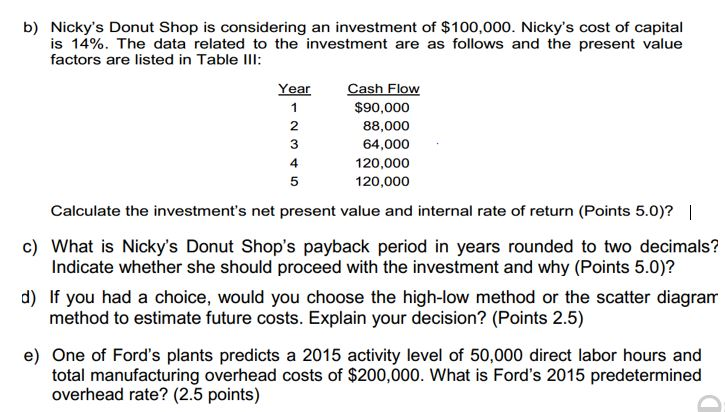

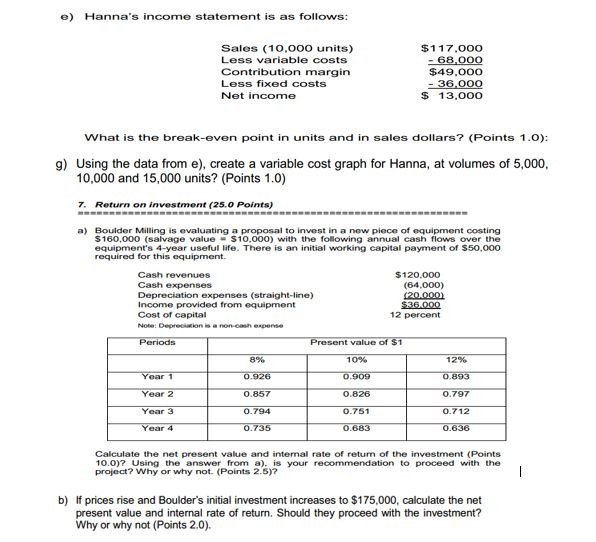

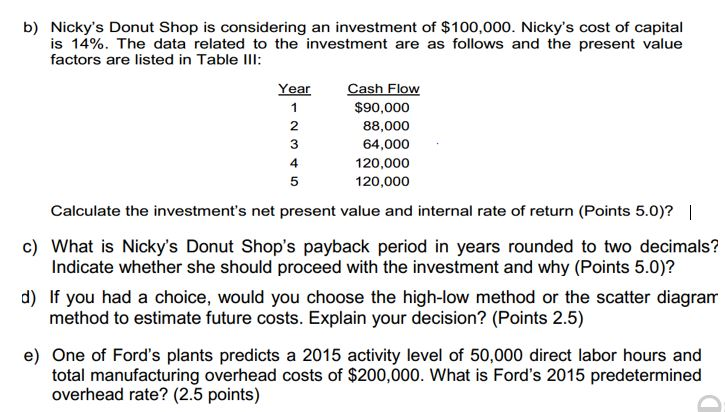

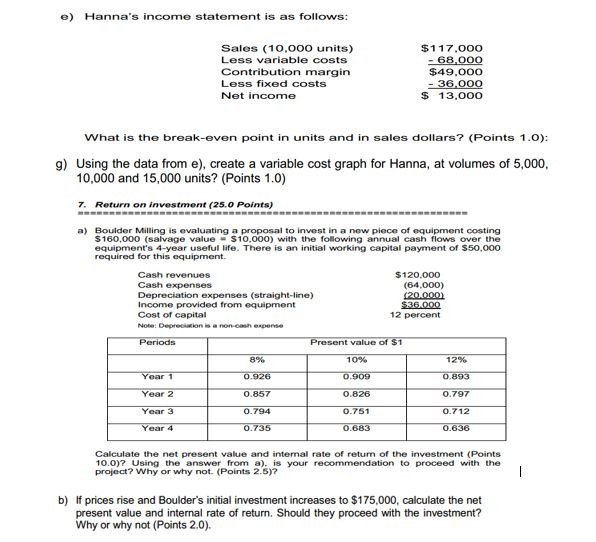

b) Nicky's Donut Shop is considering an investment of $100,000. Nicky's cost of capital is 14%. The data related to the investment are as follows and the present value factors are listed in Table III Year Cash Flow 2 3 4 5 $90,000 88,000 64,000 120,000 120,000 Calculate the investment's net present value and internal rate of return (Points 5.0)? | c) What is Nicky's Donut Shop's payback period in years rounded to two decimals? Indicate whether she should proceed with the investment and why (Points 5.0)? d) If you had a choice, would you choose the high-low method or the scatter diagram method to estimate future costs. Explain your decision? (Points 2.5) e) One of Ford's plants predicts a 2015 activity level of 50,000 direct labor hours and total manufacturing overhead costs of $200,000. What is Ford's 2015 predetermined overhead rate? (2.5 points) e) Hanna's income statement is as follows Sales (10,00O units) Less variable costs Contribution margin Less fixed costs Net income $117.o0O $49.00O - 36 000 S 13.000 What is the break-even point in units and in sales dollars? (Points 1.0) g) Using the data from e), create a variable cost graph for Hanna, at volumes of 5,000 10,000 and 15,000 units? (Points 1.0) 7. Return on investment (25.0 Points) a) Boulder Milling is evaluating a proposal to invest in a new piece of equipment costing $160,000 (salvage value $10.000) with the following annual cash flows over th equipment's 4-year useful life. There is an initial working capital payment of $50,000 required for this equipment. Cash revenues Cash expenses $120,000 (64,000) 20.000) Income provided from equipment Cost of capital 12 percent 8% 10% 12% ear 2 0.857 0.826 0.7 Year 3 0.794 0.751 0.712 Calculate the net present value and internal rate of retum of the investment (Points 10.0)? Using the answer from a). is your recommendation to proceed with the project? Why or why not. (Points 2.5)? not (Points 2.6? your recommendation to b) If prices rise and Boulder's initial investment increases to $175,000, calculate the net present value and internal rate of return. Should they proceed with the investment? Why or why not (Points 2.0)