Answered step by step

Verified Expert Solution

Question

1 Approved Answer

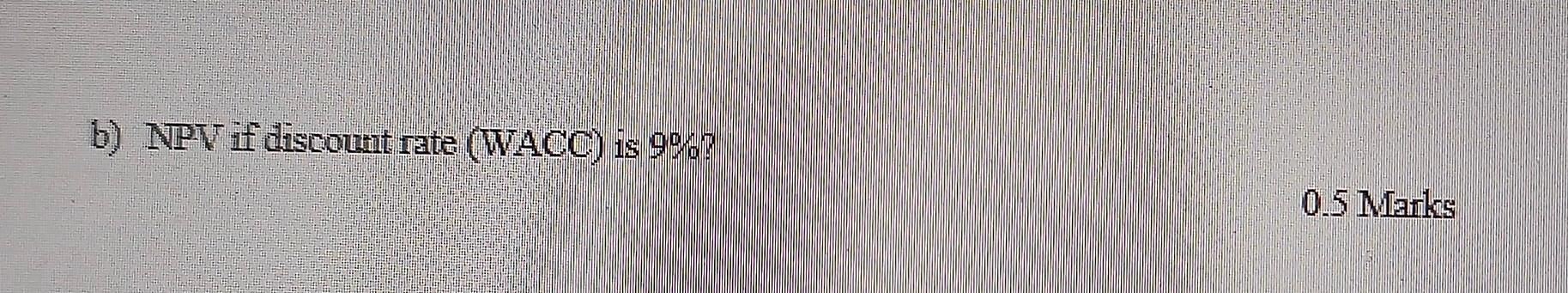

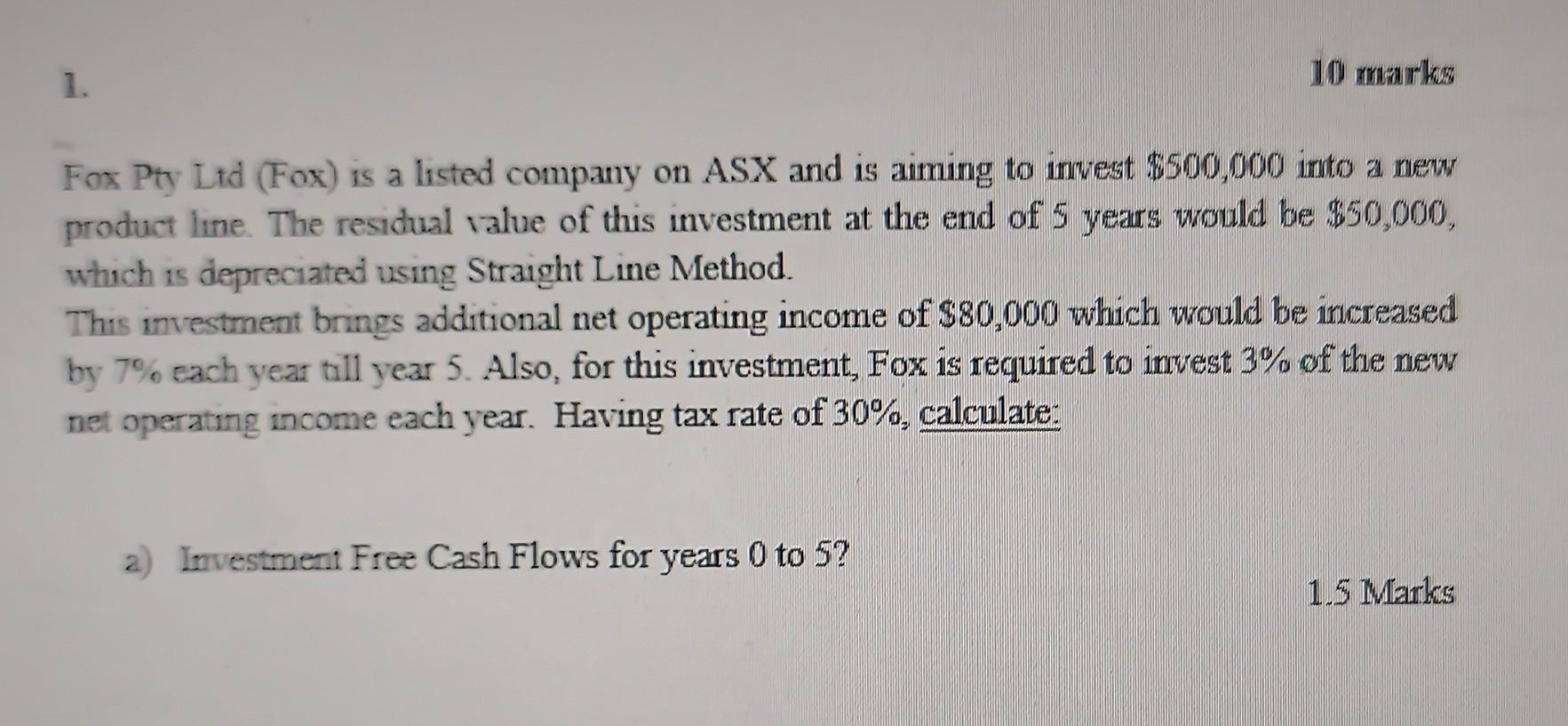

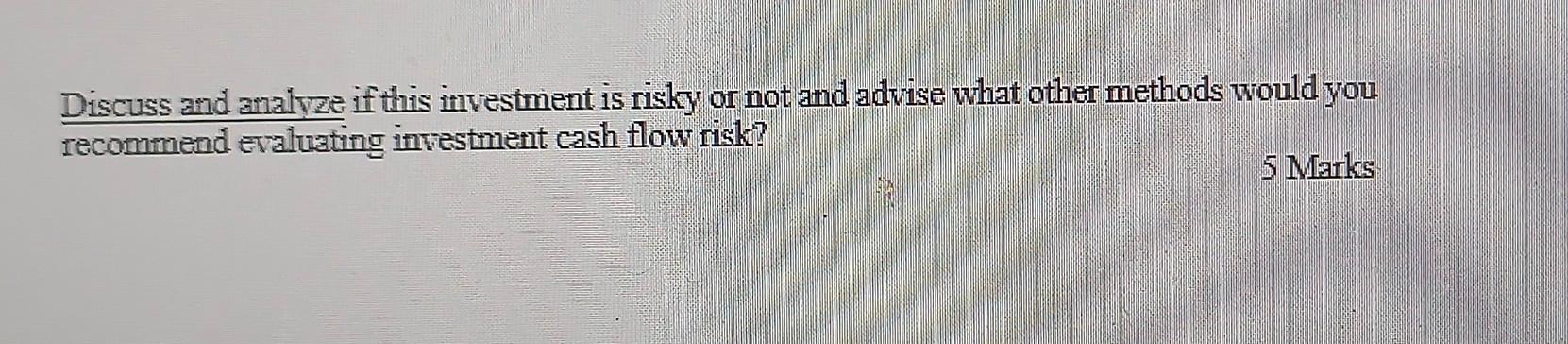

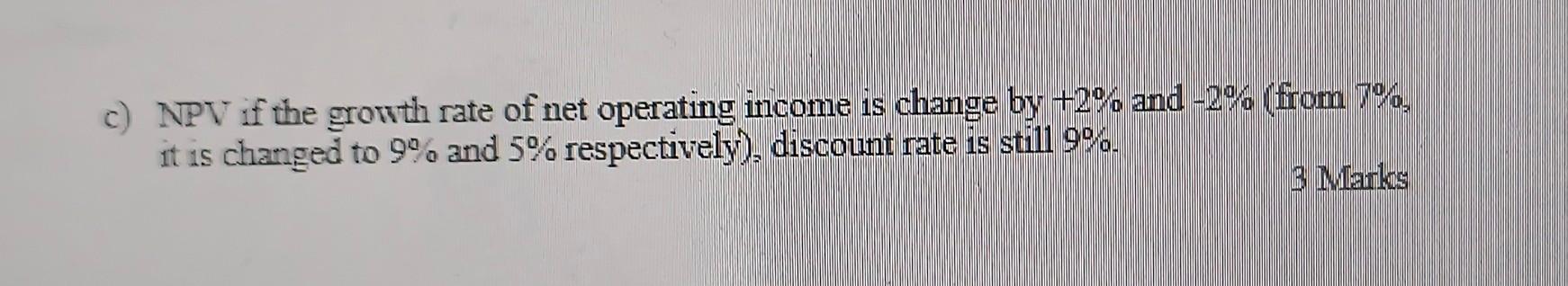

b) NPV if discount rate (WACC) is 9% ? Fox Pty Ltd (Fox) is a listed company on ASX and is aiming to invest $500,000

b) NPV if discount rate (WACC) is 9% ? Fox Pty Ltd (Fox) is a listed company on ASX and is aiming to invest $500,000 into a new product line. The residual value of this investment at the end of 5 years would be $50,000, which is depreciated using Straight Line Method. This investment brings additional net operating income of $80,000 which would be increased by 7% each year till year 5 . Also, for this investment, Fox is required to invest 3% of the mew net operating income each year. Having tax rate of 30%, calculate: Discuss and analvze if this investment is risky or not and advise what other methods would you recommend evaluating investment cash flow risk? 5 Marks c) NPV if the growth rate of net operating income is change by +2% and 2% from 7%, it is changed to 9% and 5% respectively), discount rate is still 9%. 3 Mirks b) NPV if discount rate (WACC) is 9% ? Fox Pty Ltd (Fox) is a listed company on ASX and is aiming to invest $500,000 into a new product line. The residual value of this investment at the end of 5 years would be $50,000, which is depreciated using Straight Line Method. This investment brings additional net operating income of $80,000 which would be increased by 7% each year till year 5 . Also, for this investment, Fox is required to invest 3% of the mew net operating income each year. Having tax rate of 30%, calculate: Discuss and analvze if this investment is risky or not and advise what other methods would you recommend evaluating investment cash flow risk? 5 Marks c) NPV if the growth rate of net operating income is change by +2% and 2% from 7%, it is changed to 9% and 5% respectively), discount rate is still 9%. 3 Mirks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started