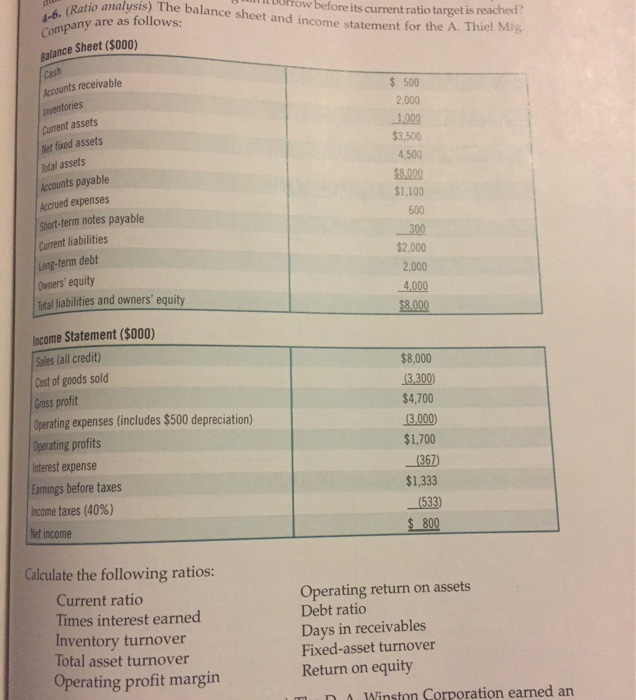

Question: B o rrow before its current ratio target is reached? (Ratio analysis) The balan balance sheet and income statement for the A. Thiel MS company

B o rrow before its current ratio target is reached? (Ratio analysis) The balan balance sheet and income statement for the A. Thiel MS company are as follows: Balance Sheet($000) (cast Accounts receivable Inventories Current assets Net foed assets Total assets Accounts payable Accrued expenses $ 500 2,000 1,000 $3,500 4,500 $8,000 $1,100 500 -300 Short-term notes payable Current liabilities Long-term debt Owners' equity $2,000 2,000 4,000 Total liabilities and owners' equity $8.000 Income Statement ($000) Sales (all credit) Cost of goods sold Gruss profit Operating expenses (includes $500 depreciation) Operating profits Interest expense Earnings before taxes Income taxes (40%) liet income $8,000 (3,300) $4,700 (3.000) $1,700 (367) $1,333 (533) $ 800 Calculate the following ratios: Current ratio Times interest earned Inventory turnover Total asset turnover Operating profit margin Operating return on assets Debt ratio Days in receivables Fixed-asset turnover Return on equity n Winston Corporation earned an m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts