Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. On 1st July, 2019 Ballyho Ltd has Shareholders Funds worth $800,000 comprising of share capital of $650,000 and Retained Earnings of $150,000. On Sth

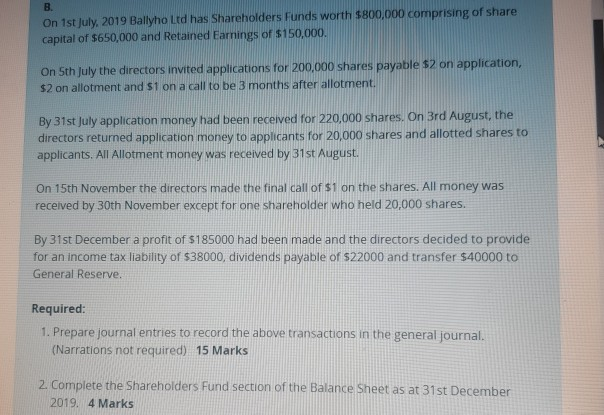

B. On 1st July, 2019 Ballyho Ltd has Shareholders Funds worth $800,000 comprising of share capital of $650,000 and Retained Earnings of $150,000. On Sth July the directors invited applications for 200,000 shares payable $2 on application, $2 on allotment and $1 on a call to be 3 months after allotment. By 31st July application money had been received for 220,000 shares. On 3rd August, the directors returned application money to applicants for 20,000 shares and allotted shares to applicants. All Allotment money was received by 31st August. On 15th November the directors made the final call of $1 on the shares. All money was received by 30th November except for one shareholder who held 20,000 shares. By 31st December a profit of $185000 had been made and the directors decided to provide for an income tax liability of $38000, dividends payable of $22000 and transfer $40000 to General Reserve Required: 1. Prepare journal entries to record the above transactions in the general journal. (Narrations not required) 15 Marks 2. Complete the Shareholders Fund section of the Balance Sheet as at 31st December 2019. 4 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started