b) only , pls.

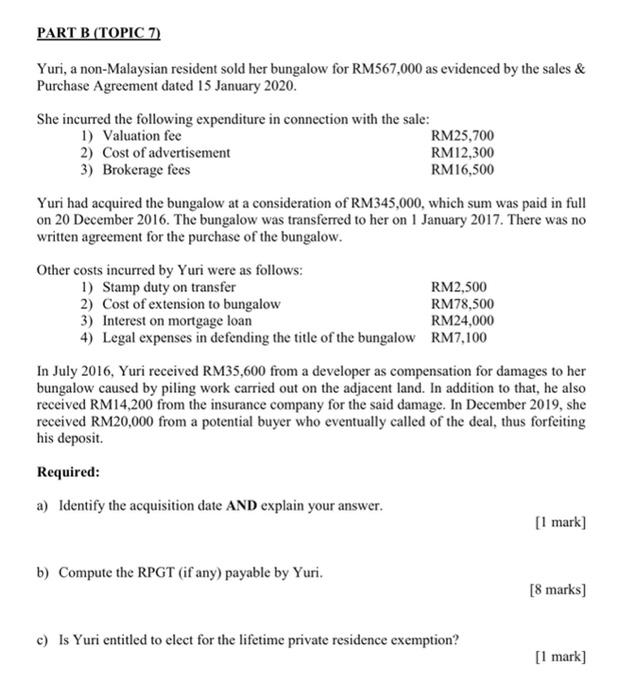

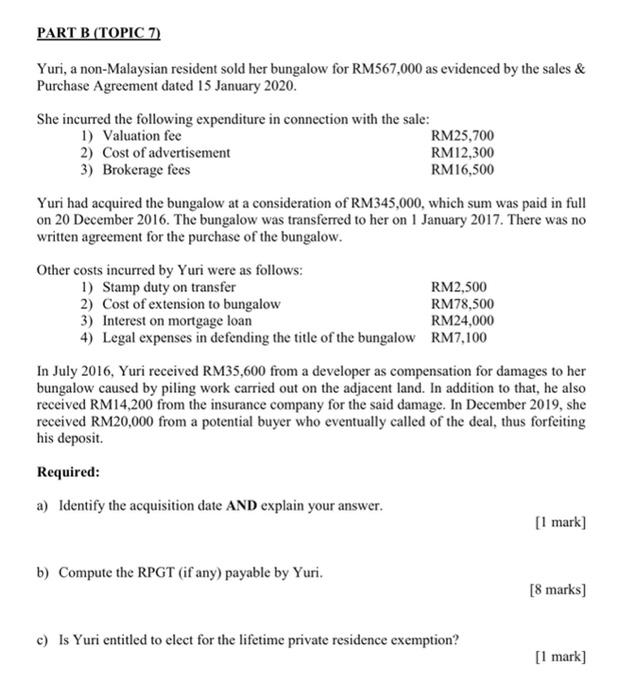

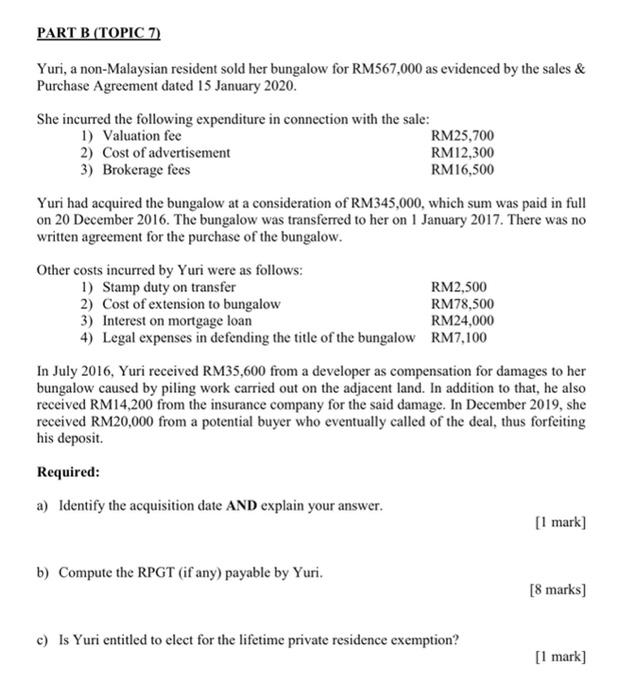

PART B (TOPIC 7) Yuri, a non-Malaysian resident sold her bungalow for RM567,000 as evidenced by the sales & Purchase Agreement dated 15 January 2020. She incurred the following expenditure in connection with the sale: 1) Valuation fee RM25,700 2) Cost of advertisement RM12,300 3) Brokerage fees RM16,500 Yuri had acquired the bungalow at a consideration of RM345,000, which sum was paid in full on 20 December 2016. The bungalow was transferred to her on 1 January 2017. There was no written agreement for the purchase of the bungalow. Other costs incurred by Yuri were as follows: 1) Stamp duty on transfer RM2,500 2) Cost of extension to bungalow RM78,500 3) Interest on mortgage loan RM24,000 4) Legal expenses in defending the title of the bungalow RM7,100 In July 2016, Yuri received RM35,600 from a developer as compensation for damages to her bungalow caused by piling work carried out on the adjacent land. In addition to that, he also received RM14.200 from the insurance company for the said damage. In December 2019, she received RM20,000 from a potential buyer who eventually called of the deal, thus forfeiting his deposit. Required: a) Identify the acquisition date AND explain your answer. [1 mark] b) Compute the RPGT (if any) payable by Yuri. [8 marks) c) Is Yuri entitled to elect for the lifetime private residence exemption? [1 mark] Citizens Permanent Residents a) If an asset is transferred as a gift by a donor who is a Malaysian citizen and the acquirers are either husband and wife, parent and children or grandparents and grandchildren. This exemption is not applicable for transfers between siblings. b) Once in a lifetime exemption on the chargeable gain on disposal of private residence by a Malaysian citizen or Permanent Resident (PR). Non-Citizens & Foreigners c) If an asset is transferred between spouses, then the asset to be disposed of must be owned by the husband or wife who is a Malaysian citizen d) If an asset is transferred to a company, then the asset owner or owner's spouse must be a Malaysian citizen. If the asset is jointly owned by 2 individuals, both need to be Malaysian citizens to make the transfer 2) Homeowners who own low or medium cost housing priced below RM200.000 are exempted from RPGT when disposing of their property For Individuals The following formulas are the same for Citizens PRE. Non-Citizens & Foreigners. Their RPGT rates will vary depending on their holding period and residential status (refer to the table above) RPGT is charged on Net Chargeable Gains. Gross Chargeable Gain: Acquisition price - Disposal price Net Chargeable Gain: Gross Chargeable Gain - Allowable Expense - RPGT Exemption - Allowable Loss TAX PAYABLE - RPGT Rate (based on the number of years of property ownership Net Chargeable Gains Example: For instance, let's say Adam and Hanis (both Malaysian citizens) bought a condominium in Hartamas on 4th January 2013 for RM 300.000 with plans to start a family, they decided to upgrade to a bigger place and on 20 January 2019 they sold off the condominium for RM500.000 Gross Chargeable Gain: RM 500.000 - RM 300,000 - RM 200.000 Asuing campus an doble perse of RN 30.000 and 20.000 TL of tot otrote (200.000 x Net Chargeable Gain: RM 200.000 - RM 30.000 - RM 20.000 = RM 150.000 TAX PAYABLE - 5% RPGT XRM 150.000 RM 7.500 (RPGT rate is based on Budget 2019 for individual Citizens disposal in sth years as the property holding period is 5 years) What is the consequence of late payment of RPGT? Any payment after 60 days may attract a penalty payable by the seller. The penalty is 10% of the amount payable as RPGT PART B (TOPIC 7) Yuri, a non-Malaysian resident sold her bungalow for RM567,000 as evidenced by the sales & Purchase Agreement dated 15 January 2020. She incurred the following expenditure in connection with the sale: 1) Valuation fee RM25,700 2) Cost of advertisement RM12,300 3) Brokerage fees RM16,500 Yuri had acquired the bungalow at a consideration of RM345,000, which sum was paid in full on 20 December 2016. The bungalow was transferred to her on 1 January 2017. There was no written agreement for the purchase of the bungalow. Other costs incurred by Yuri were as follows: 1) Stamp duty on transfer RM2,500 2) Cost of extension to bungalow RM78,500 3) Interest on mortgage loan RM24,000 4) Legal expenses in defending the title of the bungalow RM7,100 In July 2016, Yuri received RM35,600 from a developer as compensation for damages to her bungalow caused by piling work carried out on the adjacent land. In addition to that, he also received RM14.200 from the insurance company for the said damage. In December 2019, she received RM20,000 from a potential buyer who eventually called of the deal, thus forfeiting his deposit. Required: a) Identify the acquisition date AND explain your answer. [1 mark] b) Compute the RPGT (if any) payable by Yuri. [8 marks) c) Is Yuri entitled to elect for the lifetime private residence exemption? [1 mark] Citizens Permanent Residents a) If an asset is transferred as a gift by a donor who is a Malaysian citizen and the acquirers are either husband and wife, parent and children or grandparents and grandchildren. This exemption is not applicable for transfers between siblings. b) Once in a lifetime exemption on the chargeable gain on disposal of private residence by a Malaysian citizen or Permanent Resident (PR). Non-Citizens & Foreigners c) If an asset is transferred between spouses, then the asset to be disposed of must be owned by the husband or wife who is a Malaysian citizen d) If an asset is transferred to a company, then the asset owner or owner's spouse must be a Malaysian citizen. If the asset is jointly owned by 2 individuals, both need to be Malaysian citizens to make the transfer 2) Homeowners who own low or medium cost housing priced below RM200.000 are exempted from RPGT when disposing of their property For Individuals The following formulas are the same for Citizens PRE. Non-Citizens & Foreigners. Their RPGT rates will vary depending on their holding period and residential status (refer to the table above) RPGT is charged on Net Chargeable Gains. Gross Chargeable Gain: Acquisition price - Disposal price Net Chargeable Gain: Gross Chargeable Gain - Allowable Expense - RPGT Exemption - Allowable Loss TAX PAYABLE - RPGT Rate (based on the number of years of property ownership Net Chargeable Gains Example: For instance, let's say Adam and Hanis (both Malaysian citizens) bought a condominium in Hartamas on 4th January 2013 for RM 300.000 with plans to start a family, they decided to upgrade to a bigger place and on 20 January 2019 they sold off the condominium for RM500.000 Gross Chargeable Gain: RM 500.000 - RM 300,000 - RM 200.000 Asuing campus an doble perse of RN 30.000 and 20.000 TL of tot otrote (200.000 x Net Chargeable Gain: RM 200.000 - RM 30.000 - RM 20.000 = RM 150.000 TAX PAYABLE - 5% RPGT XRM 150.000 RM 7.500 (RPGT rate is based on Budget 2019 for individual Citizens disposal in sth years as the property holding period is 5 years) What is the consequence of late payment of RPGT? Any payment after 60 days may attract a penalty payable by the seller. The penalty is 10% of the amount payable as RPGT