b only

b only

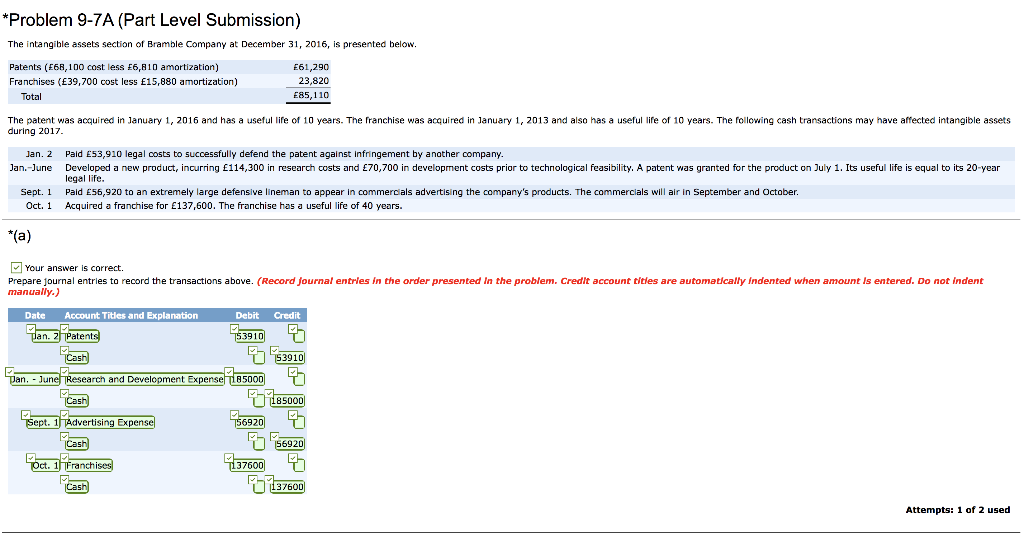

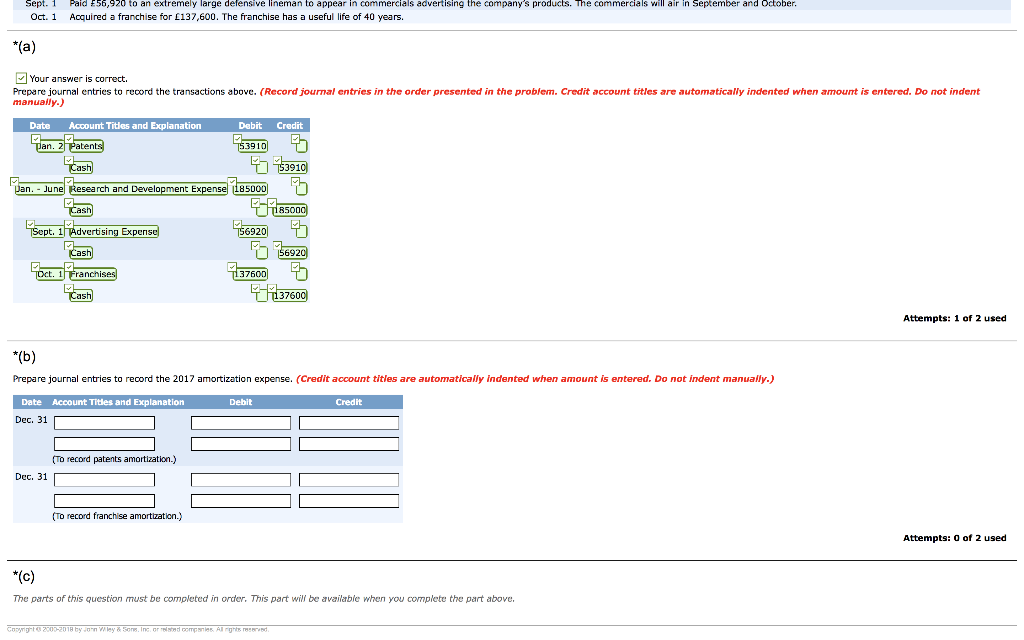

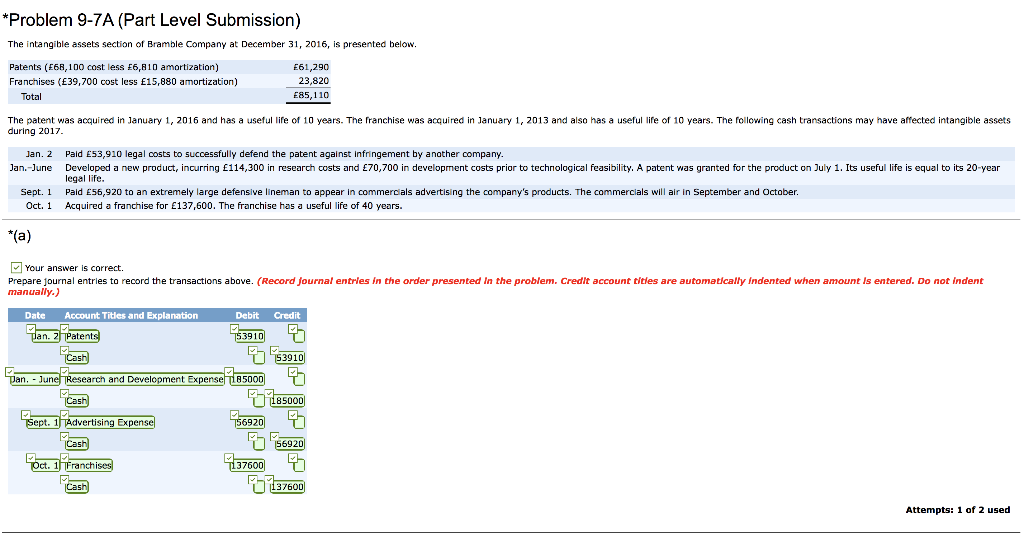

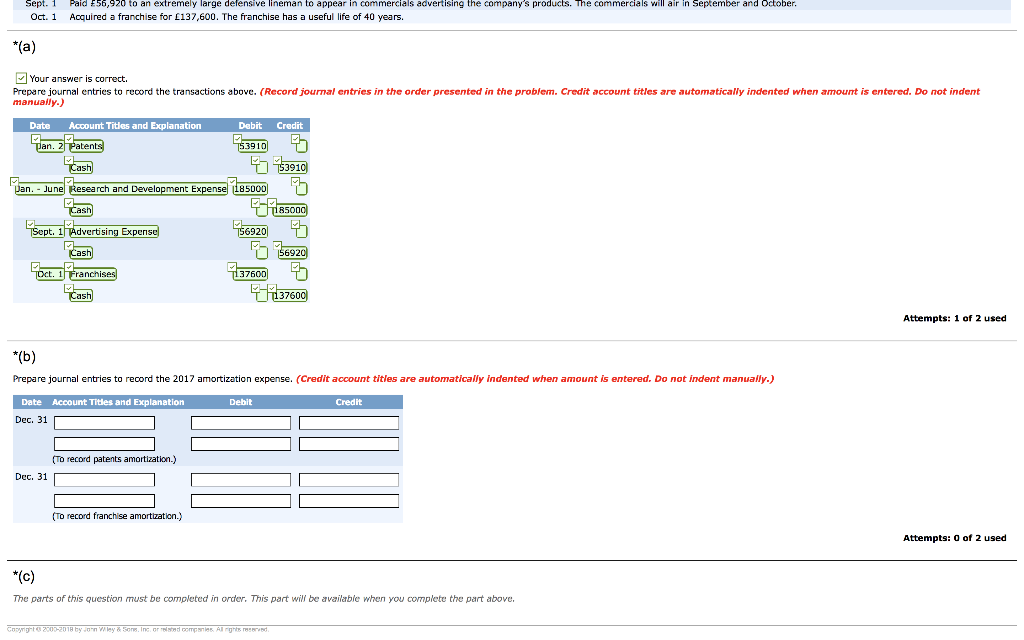

*Problem 9-7A (Part Level Submission) The intangible assets section of Bramble Company at December 31, 2016, is presented below. Patents (E68,100 cost less E6,810 amortization) E61,290 ranchises (E39,700 cost less E15,880 amortization) tal F Fas 110 The patent was acquired in January 1, 2016 and has a useful life of 10 years. The franchise was acquired in January 1, 2013 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2017 Jan. 2 Paid 53,910 legal costs t successfully defend the patent against infringement by another company. Jan.-lune Developed a new product, incurring 114,300 in research costs and 70,700 development costs prior to technological feasibility. patent was granted for the product on July 1. Its useful life is equal to its 20-year September and October 0 to an extremely large defensive lineman to appear in commercials advertising the company's products. The commercials will air Sept. 1 Oct. 1 Acquired a franchise for 137.600. The frzanchise has a Useful life 40 years. *(a) Your answer s correct Prepare journal entries manually.) record the transactions above. (Record journal entries in the order presented In the problem. Credit account titles are automatically indented when amount Is entered. Do not indent Account Titles and Explanation Date Debit Credit an. 2Patents 53910 53910 Cash June TResearch and Development Expense na5000 Jan R5000 Cash 6920 iSept. 1Advertising Expense Cash 56920 37600 Oct 1Franchises 137600 Cash Attempts: 1 of 2 used September and October commercials advertising the company's products. The commercials will air mely lar man to appear . Acquired a franchise for 137,600. The franchise has a useful life of 40 years. Oct. 1 *(a) Your answer is correct. Prepare journal entries to record the transactions above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount manually.) entered. Do not indent Date Account Titles and Explanation Debit Credit 53910 pan. . Patents 53910 Cash Dan. June Research and Development Expense 185000 R500 Cash 56920 TSept. 1Advertising Expense Cash 56920 37600 Oct.: Franchises 37600 Cash Attempts: 1 of 2 used *(b) Prepare journal entries to record the 2017 amortization expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 (To record patents amortization.) Dec. 31 (TO record franchise amortization.) Attempts: 0 of 2 used *(c) The parts of this question must be completed in order. This part will be available when you complete the part above. Cayngt2003-2018 by Jon Wley & Sons. Inc. or relted oompsnles All rghts reserved

b only

b only