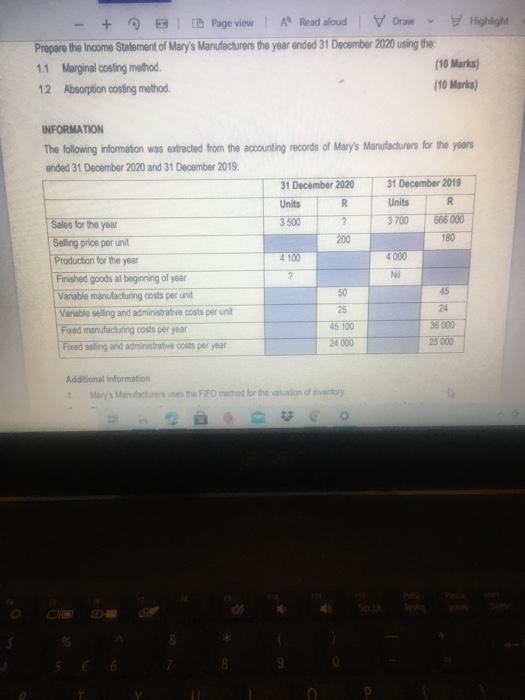

+ B Pageview A Read foud V Draw Highlight Prepare the Income Statement of Mary's Manufacturers the year ended 31 December 2020 using the 11 Marginal costing method (10 Marks) 1.2 Absorption costing method (10 Marks) INFORMATION The following information was extracted from the accounting records of Mary's Manufacturers for the years ended 31 December 2020 and 31 December 2019. 31 December 2020 31 December 2019 Units R Units R Sales for the year 3500 3700 666 000 Selling price per unit 200 180 Production for the year 4000 Finished goods at beginning of year 2 NI Varable manufactuning costs per unit 50 45 Variable selling and administrative costs per unit 25 24 Food Manufacturing costs peryan 45 100 38000 Friend Stiling and nominal costs per year 20000 25000 4700 Additional information Mary Food for honom B Mary commenced business in January 2019, manufacturing a single product. At the end of 2019 she calculated her profit using the absorption costing method and was pleased with the profits that were realised. However, she recently read that preparation of the income statement according to the marginal costing method would be more beneficial to her. She also learnt that if there are opening or closing inventories, then the profits calculated using the two methods would be different She forecasted her sales and costs for July to December 2021 and wanted to undertake cost-volume-profit (CVP) analysis since it made use of the marginal costing approach with which she was impressed. QUESTION 1 (20 Marks) REQUIRED Prepare the Income Statement of Mary's Manufacturers the year ended 31 December 2020 using the 8 U + B Pageview A Read foud V Draw Highlight Prepare the Income Statement of Mary's Manufacturers the year ended 31 December 2020 using the 11 Marginal costing method (10 Marks) 1.2 Absorption costing method (10 Marks) INFORMATION The following information was extracted from the accounting records of Mary's Manufacturers for the years ended 31 December 2020 and 31 December 2019. 31 December 2020 31 December 2019 Units R Units R Sales for the year 3500 3700 666 000 Selling price per unit 200 180 Production for the year 4000 Finished goods at beginning of year 2 NI Varable manufactuning costs per unit 50 45 Variable selling and administrative costs per unit 25 24 Food Manufacturing costs peryan 45 100 38000 Friend Stiling and nominal costs per year 20000 25000 4700 Additional information Mary Food for honom B Mary commenced business in January 2019, manufacturing a single product. At the end of 2019 she calculated her profit using the absorption costing method and was pleased with the profits that were realised. However, she recently read that preparation of the income statement according to the marginal costing method would be more beneficial to her. She also learnt that if there are opening or closing inventories, then the profits calculated using the two methods would be different She forecasted her sales and costs for July to December 2021 and wanted to undertake cost-volume-profit (CVP) analysis since it made use of the marginal costing approach with which she was impressed. QUESTION 1 (20 Marks) REQUIRED Prepare the Income Statement of Mary's Manufacturers the year ended 31 December 2020 using the 8 U