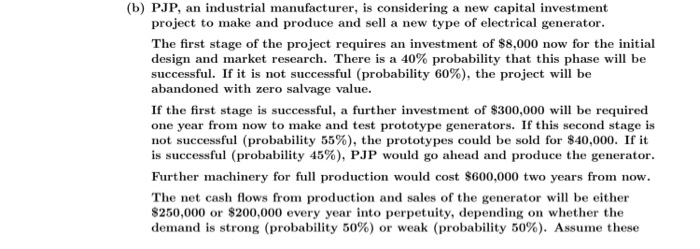

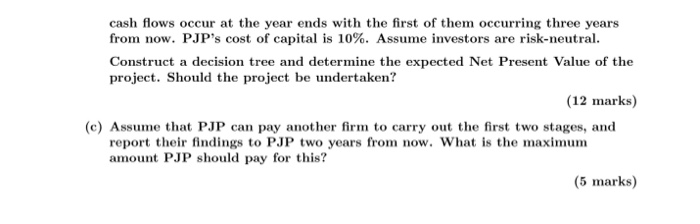

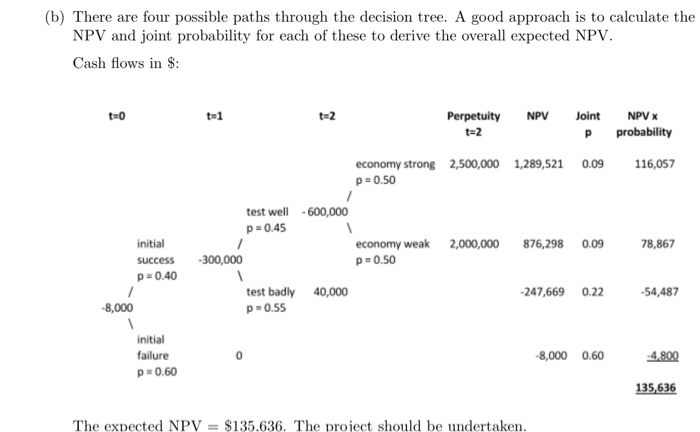

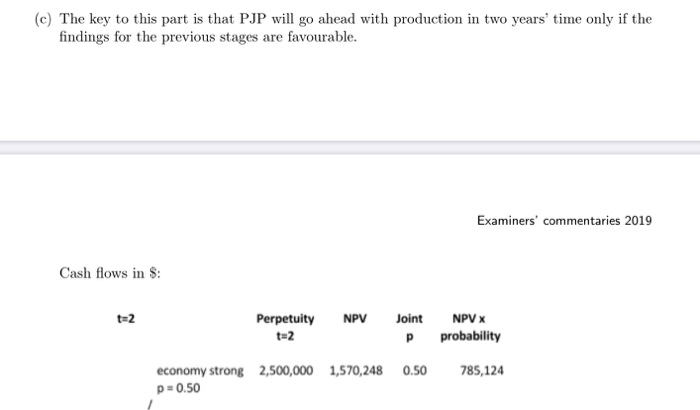

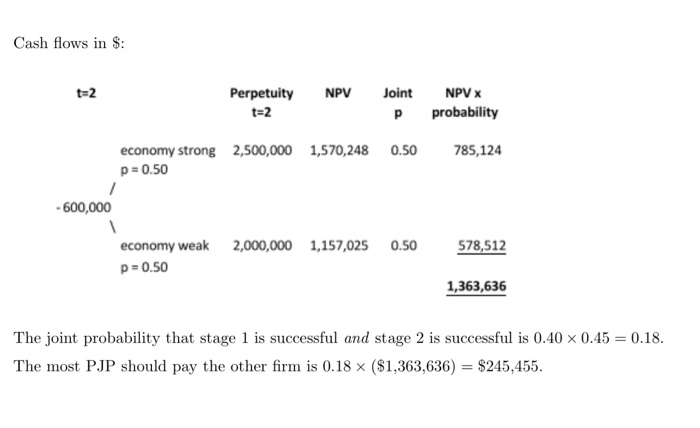

(b) PJP, an industrial manufacturer, is considering a new capital investment project to make and produce and sell a new type of electrical generator. The first stage of the project requires an investment of $8,000 now for the initial design and market research. There is a 40% probability that this phase will be successful. If it is not successful (probability 60%), the project will be abandoned with zero salvage value. If the first stage is successful, a further investment of $300,000 will be required one year from now to make and test prototype generators. If this second stage is not successful (probability 55%), the prototypes could be sold for $40,000. If it is successful (probability 45%), PJP would go ahead and produce the generator. Further machinery for full production would cost $600,000 two years from now. The net cash flows from production and sales of the generator will be either $250,000 or $200,000 every year into perpetuity, depending on whether the demand is strong (probability 50%) or weak (probability 50%). Assume these cash flows occur at the year ends with the first of them occurring three years from now. PJP's cost of capital is 10%. Assume investors are risk-neutral. Construct a decision tree and determine the expected Net Present Value of the project. Should the project be undertaken? (12 marks) (c) Assume that PJP can pay another firm to carry out the first two stages, and report their findings to PJP two years from now. What is the maximum amount PJP should pay for this? (5 marks) (b) There are four possible paths through the decision tree. A good approach is to calculate the NPV and joint probability for each of these to derive the overall expected NPV. Cash flows in $: Perpetuity t=2 NPV Joint P NPV X probability economy strong p=0.50 2,500,000 1,289,521 0.09 116,057 test well -600,000 p=0.45 economy weak p=0.50 2,000,000 876,298 initial success p=0.40 0.09 - 300,000 40,000 -247,669 0.22 -54,487 test badly p=0.55 8,000 initial failure p=0.60 -8,000 0.60 -4.800 135,636 The expected NPV = $135.636. The project should be undertaken. (c) The key to this part is that PJP will go ahead with production in two years' time only if the findings for the previous stages are favourable. Examiners' commentaries 2019 Cash flows in $: t=2 NPV Perpetuity t=2 Joint P NPV X probability economy strong 2,500,000 p=0.50 1,570,248 0.50 785,124 Cash flows in $: Perpetuity t=2 NPV Joint P NPV X probability economy strong 2,500,000 p = 0.50 1,570,248 0.50 785,124 - 600,000 2,000,000 1,157,025 0.50 578,512 economy weak p=0.50 1,363,636 The joint probability that stage 1 is successful and stage 2 is successful is 0.40 x 0.45 = 0.18. The most PJP should pay the other firm is 0.18 x ($1,363,636) = $245,455. I do not know how to compiere Part (b) & (C): - I have attached the answers / commentaries in but I do understand how to get the NPV answers in both part (6) & (C). (As the answer/commentaries did not provide wonings)