Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B please Bodbowl plans to sell 180,000 of their product at a price of R110 each during the coming year. There will be 15,000 units

B please

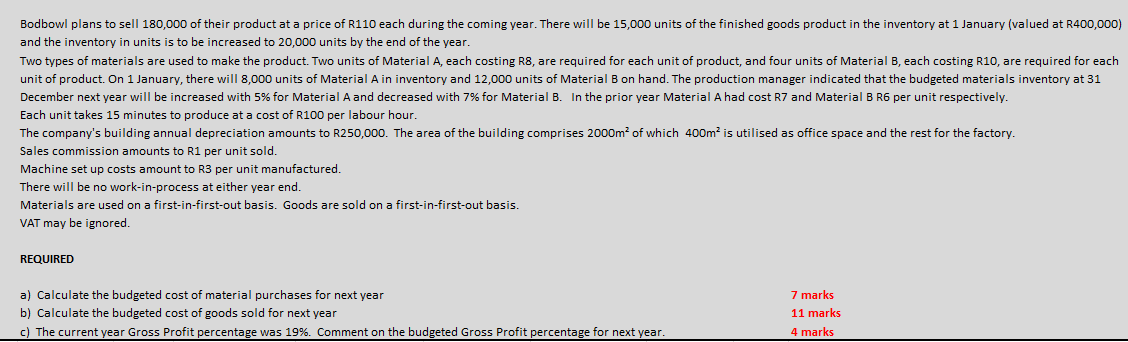

Bodbowl plans to sell 180,000 of their product at a price of R110 each during the coming year. There will be 15,000 units of the finished goods product in the inventory at 1 January (valued at R400,000) and the inventory in units is to be increased to 20,000 units by the end of the year. Two types of materials are used to make the product. Two units of Material A, each costing R8, are required for each unit of product, and four units of Material B, each costing R10, are required for each unit of product. On 1 January, there will 8,000 units of Material A in inventory and 12,000 units of Material B on hand. The production manager indicated that the budgeted materials inventory at 31 December next year will be increased with 5% for Material A and decreased with 7% for Material B. In the prior year Material A had cost R7 and Material B R6 per unit respectively. Each unit takes 15 minutes to produce at a cost of R100 per labour hour. The company's building annual depreciation amounts to R250,000. The area of the building comprises 2000m of which 400m2 is utilised as office space and the rest for the factory. Sales commission amounts to R1 per unit sold. Machine set up costs amount to R3 per unit manufactured. There will be no work-in-process at either year end. Materials are used on a first-in-first-out basis. Goods are sold on a first-in-first-out basis. VAT may be ignored. REQUIRED a) Calculate the budgeted cost of material purchases for next year b) Calculate the budgeted cost of goods sold for next year c) The current year Gross Profit percentage was 19%. Comment on the budgeted Gross Profit percentage for next year. 7 marks 11 marks 4 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started