Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B.) Prepare the required tax journal entries for 2020. C.) (c) Prepare the check/proof of the tax expenses for 2020. In 2020 , its 1st

B.) Prepare the required tax journal entries for 2020.

C.) (c) Prepare the check/proof of the tax expenses for 2020.

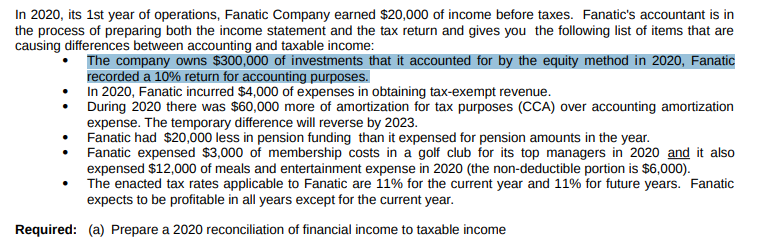

In 2020 , its 1st year of operations, Fanatic Company earned $20,000 of income before taxes. Fanatic's accountant is in the process of preparing both the income statement and the tax return and gives you the following list of items that are causing differences between accounting and taxable income: - The company owns $300,000 of investments that it accounted for by the equity method in 2020, Fanatic recorded a 10% return for accounting purposes. - In 2020, Fanatic incurred $4,000 of expenses in obtaining tax-exempt revenue. - During 2020 there was $60,000 more of amortization for tax purposes (CCA) over accounting amortization expense. The temporary difference will reverse by 2023. - Fanatic had $20,000 less in pension funding than it expensed for pension amounts in the year. - Fanatic expensed $3,000 of membership costs in a golf club for its top managers in 2020 and it also expensed $12,000 of meals and entertainment expense in 2020 (the non-deductible portion is $6,000 ). - The enacted tax rates applicable to Fanatic are 11% for the current year and 11% for future years. Fanatic expects to be profitable in all years except for the current year. Required: (a) Prepare a 2020 reconciliation of financial income to taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started